Shareholders Will Probably Be Cautious Of Increasing Forward Industries, Inc.'s (NASDAQ:FORD) CEO Compensation At The Moment

The underwhelming performance at Forward Industries, Inc. (NASDAQ:FORD) recently has probably not pleased shareholders. The next AGM coming up on 16 February 2022 will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. The data we gathered below shows that CEO compensation looks acceptable for now.

Check out our latest analysis for Forward Industries

Comparing Forward Industries, Inc.'s CEO Compensation With the industry

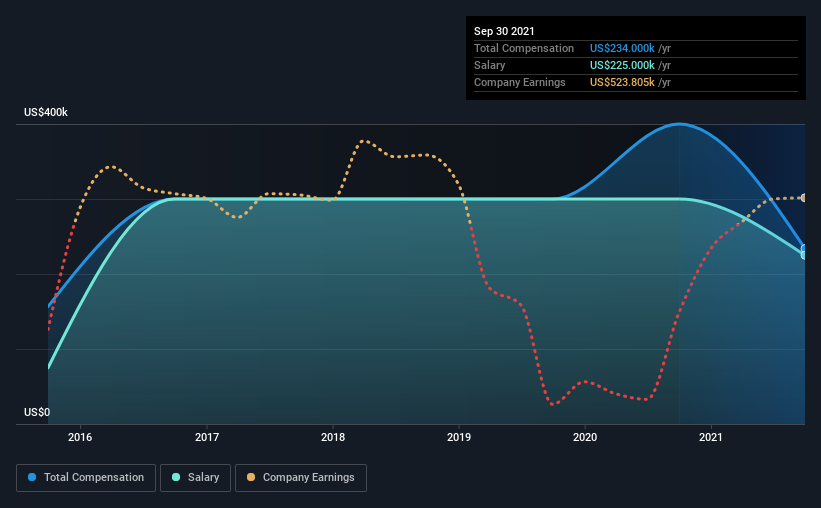

At the time of writing, our data shows that Forward Industries, Inc. has a market capitalization of US$16m, and reported total annual CEO compensation of US$234k for the year to September 2021. That's a notable decrease of 42% on last year. We note that the salary portion, which stands at US$225.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$463k. This suggests that Terry Wise is paid below the industry median. What's more, Terry Wise holds US$2.6m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2021 | 2020 | Proportion (2021) |

Salary | US$225k | US$300k | 96% |

Other | US$9.0k | US$100k | 4% |

Total Compensation | US$234k | US$400k | 100% |

Speaking on an industry level, nearly 23% of total compensation represents salary, while the remainder of 77% is other remuneration. Forward Industries pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Forward Industries, Inc.'s Growth Numbers

Forward Industries, Inc. has reduced its earnings per share by 30% a year over the last three years. It achieved revenue growth of 13% over the last year.

Few shareholders would be pleased to read that EPS have declined. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Forward Industries, Inc. Been A Good Investment?

Since shareholders would have lost about 3.0% over three years, some Forward Industries, Inc. investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Forward Industries pays its CEO a majority of compensation through a salary. Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Forward Industries that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.