Would Shareholders Who Purchased Adamas Pharmaceuticals' (NASDAQ:ADMS) Stock Three Years Be Happy With The Share price Today?

It's nice to see the Adamas Pharmaceuticals, Inc. (NASDAQ:ADMS) share price up 12% in a week. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 86% in that time. So it sure is nice to see a bit of an improvement. The thing to think about is whether the business has really turned around.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Adamas Pharmaceuticals

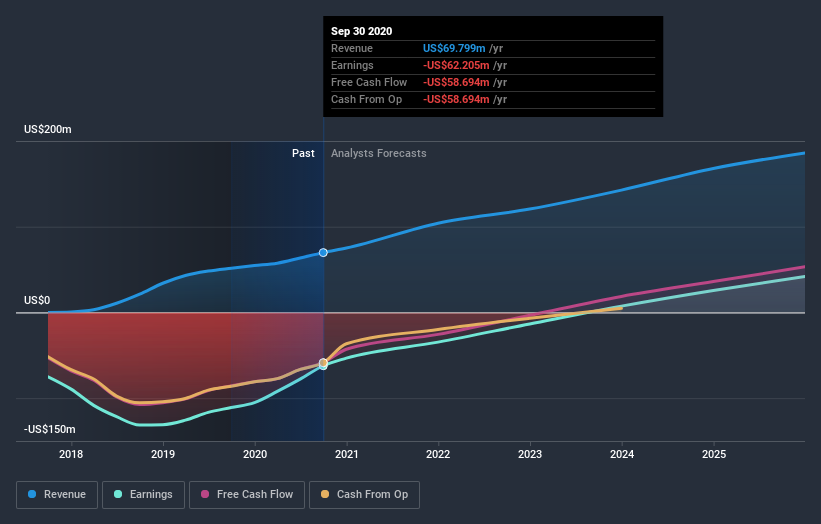

Given that Adamas Pharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Adamas Pharmaceuticals saw its revenue grow by 72% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 23% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Adamas Pharmaceuticals is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Adamas Pharmaceuticals shareholders are up 11% for the year. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 13% endured over half a decade. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Adamas Pharmaceuticals , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.