Shareholders Are Raving About How The Caesars Entertainment (NASDAQ:CZR) Share Price Increased 738%

Buying shares in the best businesses can build meaningful wealth for you and your family. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held Caesars Entertainment, Inc. (NASDAQ:CZR) shares for the last five years, while they gained 738%. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 31% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 15% in 90 days).

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Caesars Entertainment

Because Caesars Entertainment made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Caesars Entertainment saw its revenue grow at 27% per year. Even measured against other revenue-focussed companies, that's a good result. Arguably, this is well and truly reflected in the strong share price gain of 53%(per year) over the same period. It's never too late to start following a top notch stock like Caesars Entertainment, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

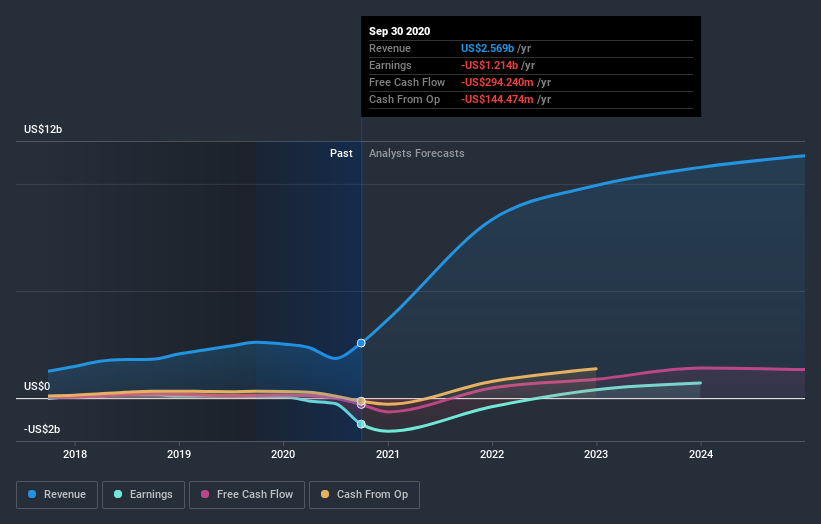

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Caesars Entertainment is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Caesars Entertainment in this interactive graph of future profit estimates.

A Different Perspective

Caesars Entertainment shareholders gained a total return of 16% during the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 53% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Caesars Entertainment (1 is significant!) that you should be aware of before investing here.

Of course Caesars Entertainment may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.