Shareholders in Tango Therapeutics (NASDAQ:TNGX) are in the red if they invested a year ago

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Tango Therapeutics, Inc. (NASDAQ:TNGX) have tasted that bitter downside in the last year, as the share price dropped 32%. That falls noticeably short of the market decline of around 0.6%. Tango Therapeutics may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 10% in the last three months. Of course, this share price action may well have been influenced by the 5.3% decline in the broader market, throughout the period.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Tango Therapeutics

Given that Tango Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Tango Therapeutics saw its revenue grow by 384%. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 32% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

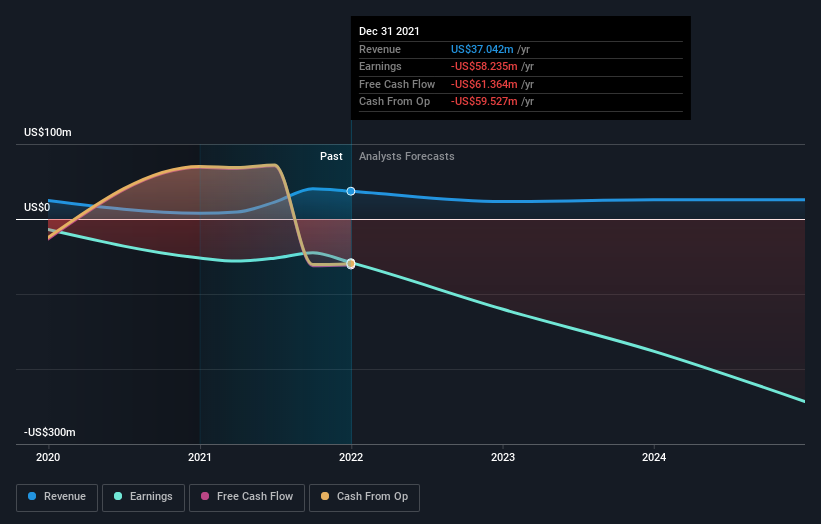

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Tango Therapeutics stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We doubt Tango Therapeutics shareholders are happy with the loss of 32% over twelve months. That falls short of the market, which lost 0.6%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 10% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Tango Therapeutics (1 is a bit unpleasant) that you should be aware of.

We will like Tango Therapeutics better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.