Shareholders in ZoomInfo Technologies (NASDAQ:ZI) have lost 60%, as stock drops 28% this past week

Investing in stocks inevitably means buying into some companies that perform poorly. But the long term shareholders of ZoomInfo Technologies Inc. (NASDAQ:ZI) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 60% drop in the share price over that period. And the ride hasn't got any smoother in recent times over the last year, with the price 59% lower in that time. Unfortunately the share price momentum is still quite negative, with prices down 30% in thirty days. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

After losing 28% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for ZoomInfo Technologies

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

ZoomInfo Technologies became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

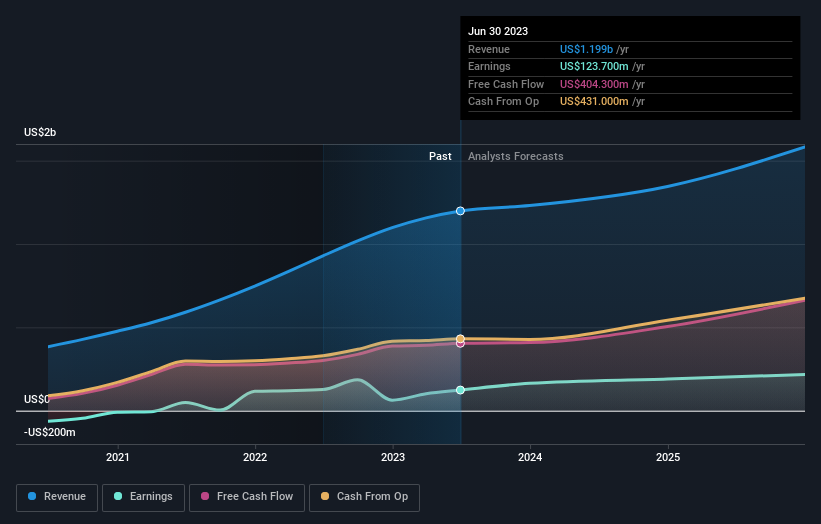

We note that, in three years, revenue has actually grown at a 38% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating ZoomInfo Technologies further; while we may be missing something on this analysis, there might also be an opportunity.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

The last twelve months weren't great for ZoomInfo Technologies shares, which cost holders 59%, while the market was up about 8.8%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 17% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for ZoomInfo Technologies you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.