Shares of Brooks Automation Decline Despite Topping Estimates

What happened

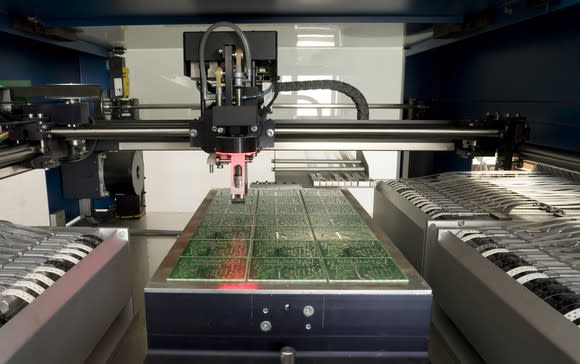

Shares of Brooks Automation (NASDAQ: BRKS), a worldwide provider of automation and cryogenic solutions for multiple markets including semiconductor manufacturing and life sciences, are down 10% as of 11:00 a.m. EST after the company released first-quarter results.

So what

Despite the stock price drop, the first quarter wasn't anything to shame. Revenue during the first quarter jumped 18.4% to $189.33 million, up from the prior year's $159.96 million. Its bottom line also moved higher from the year-ago $17.30 million, or $0.25 per share, to $22.50 million, or $0.32 per share -- that result was also higher than the $0.31 per share that analysts called for.

Image source: Getty Images.

As CEO Steve Schwartz said in a press release:

Our Semiconductor Solutions Group delivered at the high end of our expectations in both revenue and gross margin, producing 19% margin at the segment operating income line. And the Life Sciences segment provided another quarter of exceptional year-over-year revenue growth of 42%, including 22% organic growth plus the benefits of our recent strategic acquisitions. Even amid the strong semiconductor business results, Life Sciences has now grown to be 25% of total revenue.

Now what

Looking ahead, Brooks Automation estimates second-quarter revenue to check in between $195 million to $205 million and earnings per share between $0.33 and $0.41, which are solid figures. The reaction from investors seems a bit harsh, and even over the course of writing this article, the original 10% loss in share price has softened to a 6% decline.

More From The Motley Fool

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.