Shay Capital LLC Acquires Significant Stake in Groupon Inc

On July 24, 2023, Shay Capital LLC (Trades, Portfolio), a New York-based investment firm, significantly increased its stake in Groupon Inc (NASDAQ:GRPN), a leading e-commerce marketplace. The firm added 1,872,100 shares to its portfolio, representing a 2.37% impact on its equity portfolio and a 6.06% stake in Groupon's outstanding shares. The shares were purchased at an average price of $6.61, bringing Shay Capital's total holdings in Groupon to 1,892,100 shares. This article provides an in-depth analysis of this transaction, the profiles of Shay Capital and Groupon, and the potential implications for value investors.

Transaction Details

The transaction took place on July 24, 2023, with Shay Capital adding 1,872,100 shares of Groupon to its portfolio. This acquisition represents a significant increase of 9360.50% in the firm's holdings of Groupon's stock. The shares were purchased at an average price of $6.61 per share, bringing the firm's total holdings in Groupon to 1,892,100 shares. This transaction had a 2.37% impact on Shay Capital's portfolio and increased its stake in Groupon to 6.06%. These details are significant to value investors as they provide insights into the investment strategies and confidence levels of prominent investment firms.

Profile of Shay Capital LLC (Trades, Portfolio)

Shay Capital LLC (Trades, Portfolio) is a New York-based investment firm with a portfolio of 434 stocks, primarily in the Financial Services and Consumer Cyclical sectors. The firm's top holdings include BGC Group Inc (NASDAQ:BGC), Corcept Therapeutics Inc (NASDAQ:CORT), FTAI Aviation Ltd (NASDAQ:FTAI), Tilly's Inc (NYSE:TLYS), and L Catterton Asia Acquisition Corp (NASDAQ:LCAA). Shay Capital manages an equity portfolio valued at $510 million. The firm's investment philosophy is centered on identifying undervalued companies with strong growth potential. The recent acquisition of Groupon shares aligns with this philosophy, as Groupon is currently considered modestly undervalued according to GuruFocus's GF Valuation.

Overview of Groupon Inc

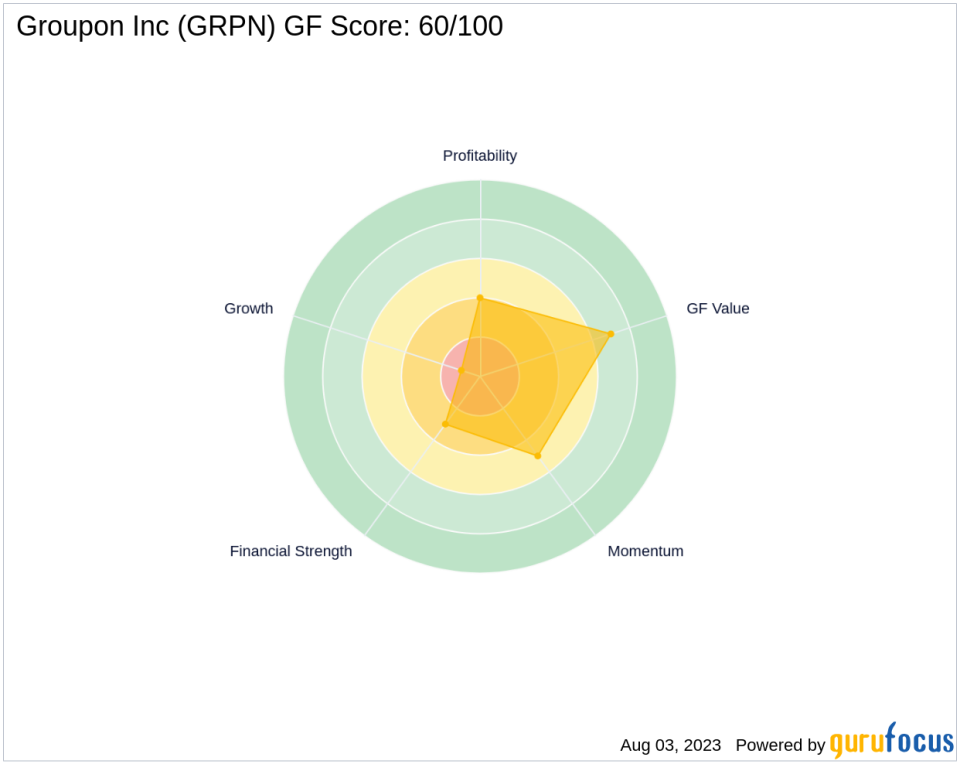

Groupon Inc (NASDAQ:GRPN), headquartered in the USA, is a leading e-commerce marketplace that connects consumers with local merchants. The company, which went public on November 4, 2011, operates in three segments: Goods, Local, and Travel. As of August 4, 2023, Groupon has a market capitalization of $243.305 million and a share price of $7.79. Despite operating at a loss, Groupon's GF Valuation is $9.53, suggesting the stock is modestly undervalued based on its price-to-GF-Value ratio of 0.83. The company's GF Score is 60/100, indicating a moderately-poor future performance potential. Groupon's financial strength and profitability ranks are 3/10 and 4/10, respectively, while its growth rank is 1/10. The company's cash to debt ratio is 0.54, and its Altman Z score is -3.16, indicating potential financial distress.

Stock Performance and Predictability

Groupon operates in the Interactive Media industry and has shown a gross margin growth of 12.90%. However, its operating margin growth, EBITDA growth, and earnings growth over the past three years have been stagnant. The company's revenue growth over the same period has declined by 36.70%. Groupon's RSI 14 Day is 57.81, and its momentum index for the past six months is -29.38. These figures suggest a mixed performance and predictability outlook for the stock.

Largest Guru Holding the Traded Stock

The largest guru holding Groupon's stock is Barrow, Hanley, Mewhinney & Strauss. The percentage of Groupon's shares held by this guru is not specified. This information is significant to value investors as it provides insights into the investment strategies and confidence levels of prominent investment firms.

Conclusion

In conclusion, Shay Capital's significant acquisition of Groupon shares is a noteworthy development for value investors. The transaction aligns with the firm's investment philosophy of identifying undervalued companies with strong growth potential. Despite Groupon's current financial challenges, the company's modest undervaluation and potential for future performance make it an attractive investment opportunity. However, investors should carefully consider the company's financial strength, profitability, and growth prospects before making investment decisions.

This article first appeared on GuruFocus.