Shell (SHEL) Q2 Earnings Coming Up: Here's What to Expect

Shell plc SHEL is set to release second-quarter results on Jul 27. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of $1.68 per share.

Let’s delve into the factors that might have influenced the integrated energy behemoth’s results in the June quarter. But it’s worth taking a look at SHEL’s previous-quarter performance first.

Highlights of Q1 Earnings

In the last reported quarter, Europe’s largest oil company beat the consensus mark, backed by stronger marketing and product prices, to go with higher LNG volumes and lower operating expenses. SHEL had reported earnings per ADS (on a current cost of supplies basis, excluding items — the market’s preferred measure) — of $2.78, well above the Zacks Consensus Estimate of $2.30.

Trend in Estimate Revision & Surprise History

The Zacks Consensus Estimate for the second-quarter bottom line has remained unchanged in the past seven days. The estimated figure indicates a 44.7% decline year over year.

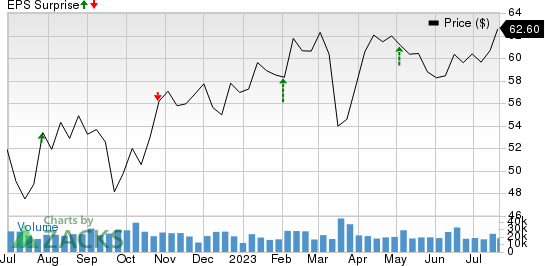

Shell beat the Zacks Consensus Estimate for earnings thrice in the last four quarters and missed in the other, resulting in an earnings surprise of 13.3%, on average. This is depicted in the graph below:

Shell PLC Unsponsored ADR Price and EPS Surprise

Shell PLC Unsponsored ADR price-eps-surprise | Shell PLC Unsponsored ADR Quote

Factors to Consider

Earlier this month, Shell released a preliminary report for the April-June period, which said that maintenance issues in the Gulf of Mexico, Norway, Malaysia and Brazil resulted in decreased output in the second quarter. The London-based supermajor further sees considerably lower contributions from liquid natural gas trading and loss in its chemicals segment. Shell also predicts writedowns of $3 billion for the second quarter, though this will not influence the period’s adjusted earnings.

Now, let’s dig into some other segment-wise selected items from that release.

Upstream

According to the latest update, Shell’s upstream production fell 9.4% on a sequential basis in the second quarter of 2023 at the midpoint of the guidance. The supermajor estimates its output in the range of 1,650-1,750 (thousand barrels of oil equivalent per day) MBOE/d compared to 1,877 MBOE/d in the first quarter of 2023, hampered by maintenance activity. Tax charges are expected to hurt earnings in the range of $1.5-2.3 billion.

Meanwhile, Shell expects the share of profit of joint ventures and associates to be around zero. The segment’s results are also likely to include well write-offs to the tune of $200 million. Finally, operating expense for the segment is projected at around $2.3 billion.

Integrated Gas

Shell’s LNG liquefaction volumes are expected in the range of 6.9-7.3 million tons, translating into a decrease of around 1.4% sequentially. Shell’s integrated gas production is expected in the range of 950,000-990,000 barrels of oil equivalent per day (BOE/d) or 970,000 BOE/d at the midpoint. It was 970,000 BOE/d in the January quarter as well.

Per the company, second-quarter trading and optimization results in its integrated gas unit will be well below the first quarter of 2023, primarily due to seasonal trends. However, the numbers will be essentially unchanged from the second quarters of 2021 and 2022. Segment operating cost is expected between $1.1 billion and $1.3 billion.

Marketing

The midpoint of management’s marketing sales volume guidance is 2.60 million barrels per day, higher than the 2.446 million barrels achieved in the first quarter of 2023. Overall, segment profits are expected to be in line with the quarter-ago levels, while operating expenses would be between $2 billion and $2.4 billion.

Chemicals & Products

The company expects a downward trajectory in its Trading & Optimisation results from the first-quarter levels. Also, as projected by Shell, the refining margin should weaken considerably in the second quarter, with the metric falling 40% sequentially. Meanwhile, despite chemical margins improving, realized numbers are expected to show losses. Shell also forecast refinery utilization of 85-89%, operating expense of $2.7-$3.1 billion and chemicals manufacturing plant utilization of 67-71%.

Renewables and Energy Solutions

The adjusted bottom line of this segment is expected to hover between a loss of $300 million and a profit of $300 million.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Shell is likely to beat estimates in the second quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company is -3.57%.

Zacks Rank: Shell currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for Shell, here are some firms from the energy space that you may want to consider on the basis of our model:

TC Energy Corporation TRP has an Earnings ESP of +11.77% and a Zacks Rank #2. The firm is scheduled to release earnings on Jul 28.

You can see the complete list of today’s Zacks #1 Rank stocks here.

TC Energy beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed in the other. It has a trailing four-quarter earnings surprise of 2.1%, on average. Valued at around $39.7 billion, TRP has lost 25.7% in a year.

Viper Energy Partners LP VNOM has an Earnings ESP of +47.14% and a Zacks Rank #3. The firm is scheduled to release earnings on Jul 31.

Viper Energy beat the Zacks Consensus Estimate for earnings in three of the last four quarters and met in the other. It has a trailing four-quarter earnings surprise of 63.1%, on average. Valued at around $4.2 billion, VNOM has lost 4.6% in a year.

California Resources Corporation CRC has an Earnings ESP of +18.05% and a Zacks Rank #3. The firm is scheduled to release earnings on Jul 31.

The 2023 Zacks Consensus Estimate for California Resources indicates 18% year-over-year earnings per share growth. Over the past 60 days, CRC saw the Zacks Consensus Estimate for 2023 move up 3.5%. Valued at around $3.4 billion, the company has gained 19% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TC Energy Corporation (TRP) : Free Stock Analysis Report

Viper Energy Partners LP (VNOM) : Free Stock Analysis Report

California Resources Corporation (CRC) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report