Shenandoah Telecommunications Co (SHEN) Reports Growth in 2023 Earnings

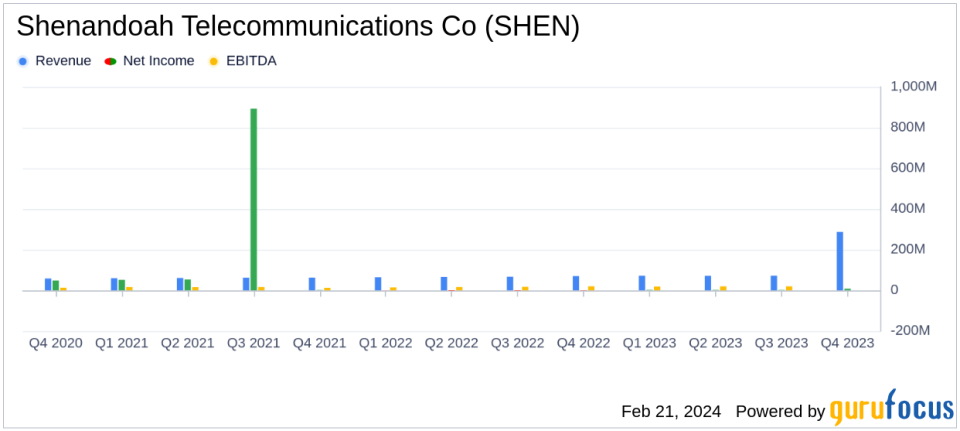

Consolidated Revenue: Increased by 7.5% to $287.4 million in 2023.

Net Income: Improved to $8.0 million in 2023, compared to a net loss of $8.4 million in 2022.

Adjusted EBITDA: Grew by 19.3% to $90.6 million in 2023.

Glo Fiber Expansion: Data customers surged by 71.7% and Glo Fiber passings increased by 58.6%.

Capital Expenditures: Rose to $256.6 million, driven by the expansion of Glo Fiber Markets.

Liquidity Position: Total available liquidity stood at $239.3 million as of December 31, 2023.

Horizon Acquisition: Announced agreement to acquire Horizon Acquisition Parent LLC for $385 million.

On February 21, 2024, Shenandoah Telecommunications Co (NASDAQ:SHEN) released its 8-K filing, detailing a year of significant growth and financial turnaround. The company, which operates through two business unitstower and broadbandsaw its broadband segment, particularly the Glo Fiber service, drive substantial revenue and customer growth.

Performance Highlights and Strategic Moves

Shenandoah Telecommunications Co (NASDAQ:SHEN) reported a robust increase in Glo Fiber data customers, which grew by 71.7% year-over-year to approximately 42,000. This growth was supported by an expansion of Glo Fiber passings by 58.6%, reaching approximately 234,000. The Glo Fiber revenue itself soared by 91.9% to $35.1 million, reflecting the strong demand for high-speed broadband services.

Christopher E. French, President and CEO, highlighted the potential for Glo Fiber, stating,

We believe we have the potential to more than double our Glo Fiber data customer penetration rate over the next five years, creating an excellent opportunity to continue to drive strong consolidated CAGR results."

Financial Achievements and Challenges

The company's consolidated revenue grew by 7.5% to $287.4 million in 2023, with net income reversing from a consolidated net loss of $8.4 million in 2022 to a net gain of $8.0 million in 2023. Adjusted EBITDA also saw a significant increase of 19.3% to $90.6 million. These achievements underscore the company's successful expansion and operational efficiency in a competitive telecommunications landscape.

However, challenges remain, including the expected churn of approximately $1 million in annual revenue as part of network rationalization by T-Mobile, which disconnected 338 backhaul circuits during the year. Additionally, the Rural Local Exchange Carrier (RLEC) & Other revenue segment experienced a decline due to a decrease in residential DSL subscribers.

Balance Sheet and Cash Flow Insights

Shenandoah Telecommunications Co (NASDAQ:SHEN) ended the year with a strong liquidity position, with cash and cash equivalents totaling $139.3 million and an available revolving line of credit of $100.0 million. The company's capital expenditures increased significantly to $256.6 million, primarily due to the expansion of Glo Fiber Markets. Total indebtedness stood at $300 million as of December 31, 2023.

The company's strategic move to acquire Horizon Acquisition Parent LLC for $385 million, consisting of $305 million in cash and $80 million in SHEN common stock, is expected to close in the first half of 2024. This acquisition aligns with SHEN's growth strategy and may enhance its market position in the broadband sector.

Value investors and potential GuruFocus.com members should consider the growth trajectory and strategic initiatives of Shenandoah Telecommunications Co (NASDAQ:SHEN) as indicative of its potential for long-term value creation in the dynamic telecommunications industry.

Explore the complete 8-K earnings release (here) from Shenandoah Telecommunications Co for further details.

This article first appeared on GuruFocus.