Sherri Luther, SVP, CFO of Lattice Semiconductor Corp, Sells 7,500 Shares

On September 14, 2023, Sherri Luther, the Senior Vice President and Chief Financial Officer of Lattice Semiconductor Corp (NASDAQ:LSCC), sold 7,500 shares of the company. This move is part of a trend observed in the insider's trading activity.

Lattice Semiconductor Corp is a developer of semiconductor technologies that it distributes across the globe. The company's main products include programmable logic devices, video connectivity application-specific standard products, and millimeter-wave devices. These products are used in a variety of industries, including communications, computing, industrial, automotive, and consumer.

Over the past year, the insider has sold a total of 67,455 shares and has not made any purchases. This trend is reflected in the company's overall insider transaction history, which shows zero insider buys and 48 insider sells over the past year.

The insider's recent sell occurred when the shares of Lattice Semiconductor Corp were trading at $90.74, giving the stock a market cap of $12.05 billion. The price-earnings ratio at this price was 59.90, higher than the industry median of 24.55 but lower than the companys historical median price-earnings ratio.

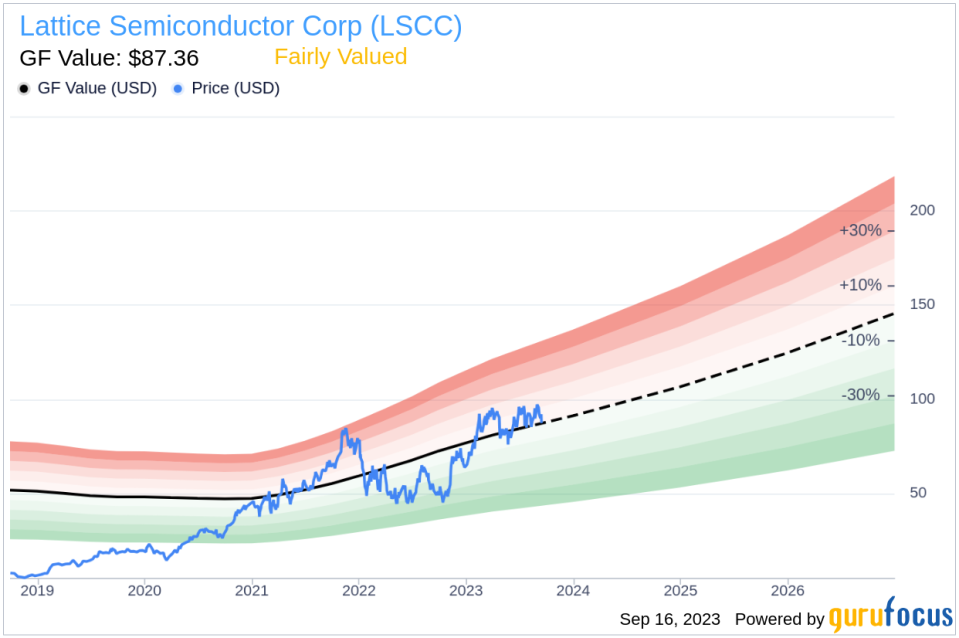

The GF Value of Lattice Semiconductor Corp at the time of the insider's sell was $87.36, resulting in a price-to-GF-Value ratio of 1.04. This suggests that the stock was fairly valued at the time of the sale.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's sell, along with the overall trend of insider sells over the past year, could be interpreted as a lack of confidence in the company's stock. However, it's important to note that the stock was fairly valued at the time of the insider's sell, according to the GF Value. Therefore, the insider's sell might not necessarily indicate a negative outlook for the company's stock.

Investors should always consider the reasons behind an insider's sell. While it could indicate a lack of confidence in the company's stock, it could also be due to personal reasons or portfolio rebalancing. Therefore, it's crucial to consider other factors, such as the company's financial health, market conditions, and industry trends, when making investment decisions.

This article first appeared on GuruFocus.