Sherwin-Williams (SHW) Gains on Strong Demand and Cost Actions

The Sherwin-Williams Company SHW is well-positioned to benefit from rising domestic demand, a growing retail business, and the effective implementation of cost-saving initiatives.

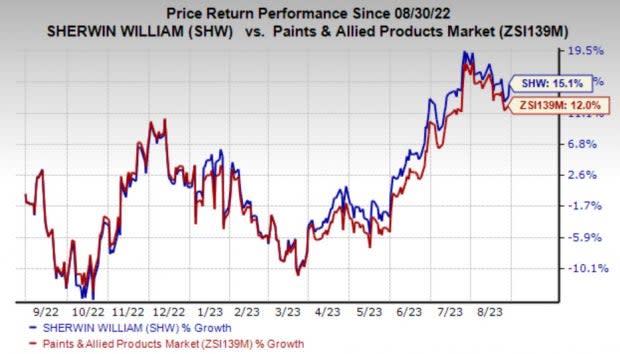

The stock has gained 15.1% in the past year compared with the industry’s rise of 12% in the same period.

Image Source: Zacks Investment Research

Demand Strength, Growing Retail Footprint Drive Sales

Sherwin-Williams is experiencing strong demand within its domestic markets and remains dedicated to expanding its retail footprint. The company now has greater visibility into third-quarter demand than the second quarter. it is seeing robust demand in the auto refinishing sector across various regions. The installation of systems in North America has displayed an impressive double-digit increase throughout the current year, which is expected to influence the company's future sales performance positively.

Sherwin-Williams has consistently expanded its retail presence by demonstrating a clear commitment to capturing a larger market share. This expansion is exemplified by the 10% growth in sales for the Paint Stores Group during the second quarter. This growth is attributed to a combination of effective pricing strategies and an increase in volume, resulting in a 280 basis point rise in the segment's margin, reaching 24.3%.

Cost Management Strategies Boost Margins

Sherwin-Williams' proactive approach to cost management and consistent efforts in optimizing the supply chain and enhancing overall productivity is expected to maintain its favorable impact on margins. The company's diligent cost-saving measures have significantly contributed to robust net cash flows, totaling approximately $1.9 billion in 2022. This strong cash generation has also facilitated the return of $848.7 million to shareholders through dividends and repurchases in the first half of 2023.

Restructuring Actions to Provide Benefits

Sherwin-Williams is actively executing restructuring initiatives to optimize the Consumer Brands Group, Performance Coatings Group, and corporate operations. These endeavors are poised to generate annual savings of $50-$70 million. Anticipated benefits of these efforts are expected to be realized to the extent of 75% by the end of 2023, with full implementation anticipated by the conclusion of 2024.

The Sherwin-Williams Company Price and Consensus

The Sherwin-Williams Company price-consensus-chart | The Sherwin-Williams Company Quote

Zacks Rank & Other Key Picks

Sherwin-Williams currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the Construction space are Century Communities, Inc. CCS and EMCOR Group, Inc. EME, both sporting a Zacks Rank #1, and Lennar Corporation LEN, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for Century Communities’ current year is pegged at $6.43, which has been revised upwards by 32.6% in the last 60 days. CCS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 31.1%. The company’s shares have rallied 55.2% in the past year.

The Zacks Consensus Estimate for EMCOR’s current-year earnings has been revised 13% upward in the past 60 days. The earnings estimate for the current year is pegged at $11.01, indicating a year-over-year growth of 36%. EME beat the Zacks Consensus Estimate in the last four quarters. It delivered a trailing four-quarter earnings surprise of 17.3% on average. The company’s shares have risen roughly 89.5% in the past year.

The Zacks Consensus Estimate for Lennar’s current-year earnings has been revised 29.6% upward in the past 90 days. LEN beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 18.4%. The company’s shares have risen roughly 47.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Sherwin-Williams Company (SHW) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

Century Communities, Inc. (CCS) : Free Stock Analysis Report