Shift4 Payments Inc CFO Nancy Disman Sells 18,000 Shares

In a notable insider transaction, CFO Nancy Disman of Shift4 Payments Inc (NYSE:FOUR) sold 18,000 shares of the company's stock on November 14, 2023. This sale is part of a series of transactions by the insider over the past year, which has seen a total of 23,000 shares sold and no shares purchased.

Who is Nancy Disman?

Nancy Disman serves as the Chief Financial Officer of Shift4 Payments Inc, a role that places her at the helm of the company's financial strategies and operations. Her position grants her deep insights into the company's financial health and growth prospects, making her trading activities a point of interest for investors and market analysts.

About Shift4 Payments Inc

Shift4 Payments Inc is a leading provider of integrated payment processing and technology solutions. The company offers a comprehensive suite of products and services that streamline the payment process for businesses across various industries. With a focus on innovation and security, Shift4 Payments Inc has established itself as a key player in the payment processing space.

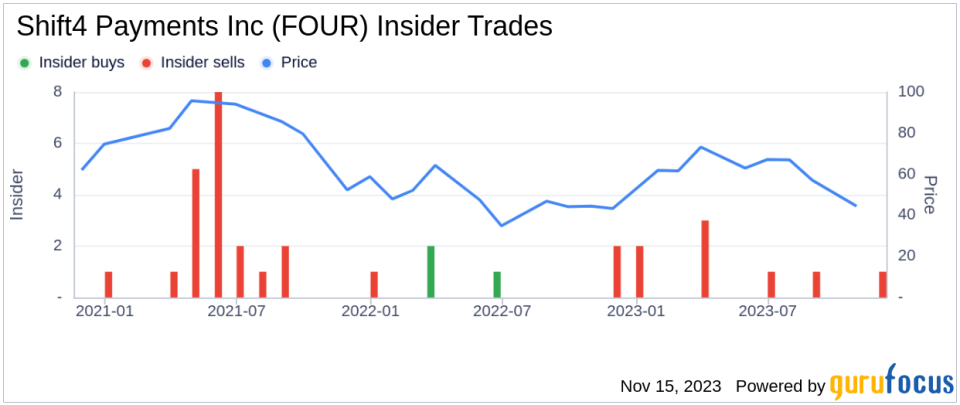

Analysis of Insider Buy/Sell and Stock Price Relationship

The insider trading history for Shift4 Payments Inc reveals a pattern of more sales than purchases over the past year, with 12 insider sells and no insider buys. This could suggest that insiders, including Nancy Disman, may perceive the stock's current price as favorable for taking profits or reallocating their investment portfolios.

The relationship between insider trading activity and stock price can be complex. While insider sales do not always indicate a lack of confidence in the company's future, they can sometimes lead to negative market sentiment, especially when they occur in large volumes or are conducted by high-ranking executives like CFOs.

Shift4 Payments Inc's Market Valuation

On the day of Nancy Disman's recent sale, shares of Shift4 Payments Inc were trading at $59.63, giving the company a market cap of $3.715 billion. The price-earnings ratio stood at 37.74, which is above the industry median of 26.58 but below the company's historical median price-earnings ratio. This suggests that, while the stock may be trading at a premium compared to the industry, it is not at its historical peak valuation.

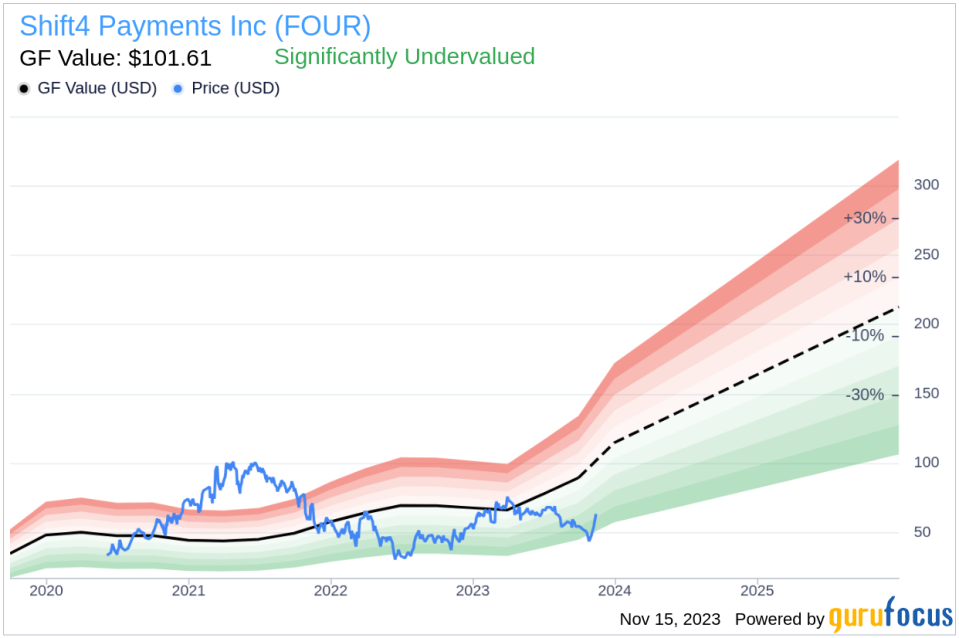

GF Value and Stock Valuation

Considering the stock's price of $59.63 against a GuruFocus Value (GF Value) of $101.61, Shift4 Payments Inc appears to be Significantly Undervalued with a price-to-GF-Value ratio of 0.59.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The significant undervaluation based on GF Value could indicate that the stock has room for growth or that the market has not fully recognized the company's potential.

Conclusion

The recent insider sale by CFO Nancy Disman may raise questions among investors about the timing and rationale behind the transaction, especially given the stock's current undervaluation based on GF Value. While insider sales can be motivated by various personal and financial considerations, they are always worth noting as part of a broader investment analysis.Investors should consider the insider trading trends, the company's valuation metrics, and the broader market conditions when evaluating Shift4 Payments Inc as a potential investment. While the insider's actions may provide some insight, they should not be the sole factor in making investment decisions. It is essential to conduct thorough research and consider a multitude of factors, including company performance, industry trends, and economic indicators, before making any financial commitments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.