Shoe Carnival Inc (SCVL) Reports Mixed Q4 and Fiscal 2023 Results; Sets Growth Outlook for 2024

Net Sales: Q4 net sales reached $280.2 million, with fiscal year sales totaling $1.176 billion.

Earnings Per Share (EPS): Q4 GAAP EPS was $0.57, adjusted EPS $0.59; Fiscal year GAAP EPS $2.68, adjusted EPS $2.70.

Dividend Increase: Announced a 12.5% dividend increase to an annualized rate of $0.54.

Rogan's Acquisition: Integration expected to be accretive to 2024 earnings, with full synergies of $2.5 million anticipated by 2025.

Inventory Optimization: Year-end inventory down 11.3% from the previous year, with further reductions expected.

Fiscal 2024 Outlook: Net sales growth projected at 4.0% to 6.0%, with comparable store sales ranging from down 3.0% to up 1.0%.

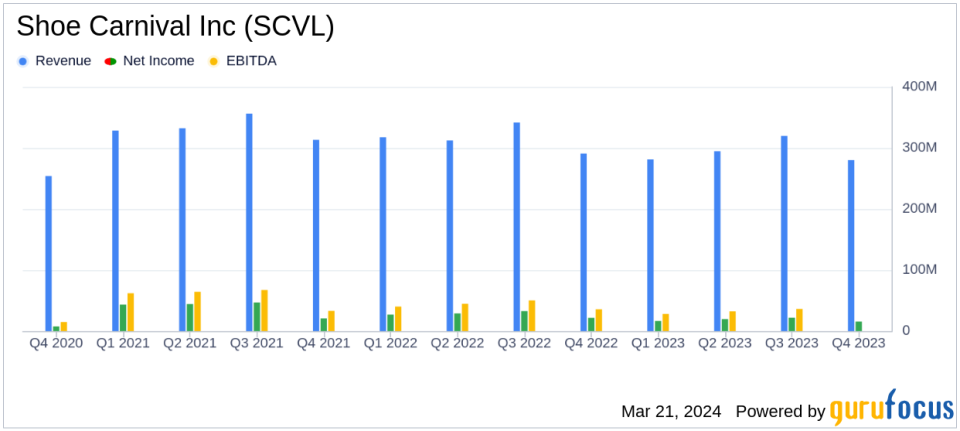

On March 21, 2024, Shoe Carnival Inc (NASDAQ:SCVL) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full fiscal year of 2023. The company, a prominent family footwear retailer, reported net sales of $280.2 million for the fourth quarter and $1.176 billion for the fiscal year, achieving the high end of its expectations. The earnings per share (EPS) for the fourth quarter were reported at $0.57 on a GAAP basis and $0.59 on an adjusted basis, while the full-year EPS stood at $2.68 and $2.70, respectively.

Performance and Challenges

Shoe Carnival Inc faced a decline in net sales by 3.6% compared to the fourth quarter of the previous year, primarily due to soft trends prior to the December holiday period and weather disruptions in January. Despite this, the company maintained a gross profit margin above 35% for the twelfth consecutive quarter, although it experienced a slight decrease to 35.6% in the fourth quarter due to lower merchandise margins and deleveraging effects.

The company's net income for the fourth quarter was $15.5 million, a decrease from $21.6 million in the same period last year. The EPS results were consistent with the company's expectations, driven by net sales performance and sustained gross profit margin. Shoe Carnival Inc also continued its inventory optimization plan, ending the fiscal year with inventory levels 11.3% lower than the previous year.

Financial Achievements and Industry Significance

Shoe Carnival Inc's financial achievements, particularly its sustained dividend growth, underscore the company's commitment to shareholder returns even amidst market challenges. The 12.5% dividend increase reflects confidence in the company's cash flow and future earnings potential. Additionally, the acquisition of Rogan's is set to be immediately accretive to the company's 2024 earnings, with full synergies expected to be realized by 2025, signaling strategic growth in the retail-cyclical sector.

Acquisition and Outlook

The acquisition of Rogan's, a family footwear company, for $45 million, is a strategic move that positions Shoe Carnival Inc as a market leader in Wisconsin and opens up new expansion opportunities. The company's store count has reached an all-time high of 429, with plans to operate between 430 to 432 stores by the end of Fiscal 2024. The integration of Rogan's is progressing well, with synergy expectations raised to approximately $2.5 million annually.

For Fiscal 2024, Shoe Carnival Inc anticipates net sales growth of approximately 5.0% at the mid-point of guidance. The company's long-term profit transformation strategy includes investments in CRM capabilities, e-commerce infrastructure, store modernization, and acquisitions, which have contributed to an 84% increase in EPS since 2019.

Shoe Carnival Inc has demonstrated a strong balance sheet, ending the fiscal year with no debt for the 19th consecutive year and approximately $111 million in cash, cash equivalents, and marketable securities. The company's capital management strategy remains robust, with $50 million available for future share repurchases and a consistent track record of paying quarterly dividends.

Conclusion

Shoe Carnival Inc's mixed fourth-quarter and fiscal 2023 results reflect the resilience of its business model in the face of market headwinds. The company's strategic initiatives, including the Rogan's acquisition and inventory optimization, are expected to drive growth and profitability in the coming year. Value investors may find Shoe Carnival Inc's commitment to shareholder returns and strategic growth initiatives appealing as the company navigates the retail-cyclical landscape.

For more detailed information and analysis on Shoe Carnival Inc's financial performance and future outlook, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Shoe Carnival Inc for further details.

This article first appeared on GuruFocus.