Shoe Carnival's (NASDAQ:SCVL) Q4 Earnings Results: Revenue In Line With Expectations

Footwear retailer Shoe Carnival (NASDAQ:SCVL) reported results in line with analysts' expectations in Q4 CY2023, with revenue down 3.6% year on year to $280.2 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $1.23 billion at the midpoint. It made a non-GAAP profit of $0.59 per share, down from its profit of $0.79 per share in the same quarter last year.

Is now the time to buy Shoe Carnival? Find out by accessing our full research report, it's free.

Shoe Carnival (SCVL) Q4 CY2023 Highlights:

Revenue: $280.2 million vs analyst estimates of $280.3 million (small miss)

EPS (non-GAAP): $0.59 vs analyst expectations of $0.59 (small miss)

Management's EPS guidance for the upcoming financial year 2024 is $2.65 billion at the midpoint, below analyst expectations of $2.84 (6.7% miss)

Gross Margin (GAAP): 35.6%, down from 38.3% in the same quarter last year

Free Cash Flow of $40.73 million, up 128% from the same quarter last year

Same-Store Sales were down 9.4% year on year (in line)

Store Locations: 429 at quarter end, increasing by 32 over the last 12 months

Market Capitalization: $894 million

“I would like to thank our dedicated team members and vendor partners for their support in driving growth during the key holiday period and setting us up for continued growth in 2024. With the acquisition of Rogan’s, we are now at an all-time high of 429 stores. Rogan’s will be immediately accretive to our results in 2024 and the level of accretion is expected to meaningfully increase in 2025. The integration progress to date has been encouraging and we are raising the full synergy expectation to $2.5 million and accelerating the integration schedule, with the expectation of now realizing full synergies in 2025. We are well positioned to advance our strategy to be the nation’s leading family footwear retailer by accelerating growth, as well as pursuing additional growth initiatives and M&A opportunities in the future,” said Mark Worden, President and Chief Executive Officer.

Known for its playful atmosphere that features carnival elements, Shoe Carnival (NASDAQ:SCVL) is a retailer that sells footwear from mainstream brands for the entire family.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Sales Growth

Shoe Carnival is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

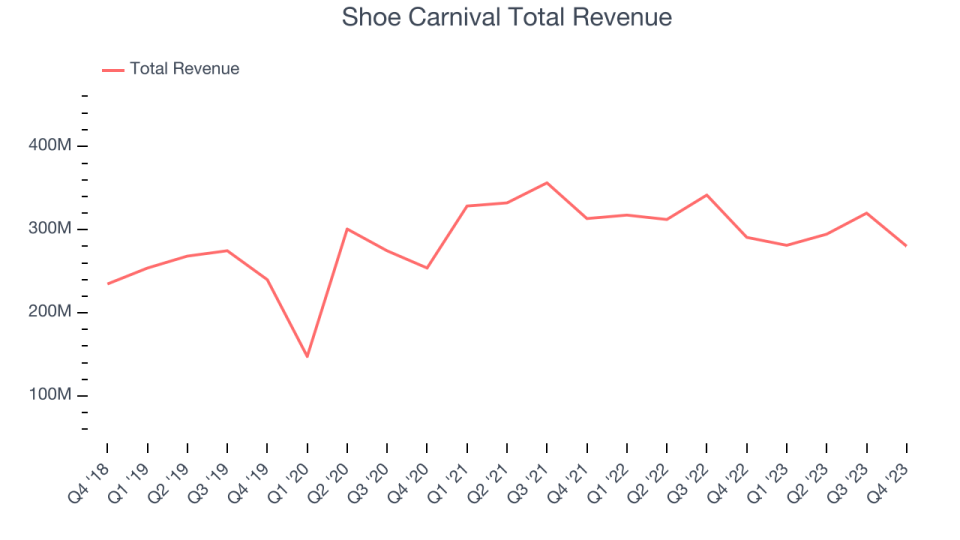

As you can see below, the company's annualized revenue growth rate of 3.2% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new stores and expanded its reach.

This quarter, Shoe Carnival missed Wall Street's estimates and reported a rather uninspiring 3.6% year-on-year revenue decline, generating $280.2 million in revenue. Looking ahead, Wall Street expects sales to grow 4.3% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Shoe Carnival's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 9.9% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Shoe Carnival's same-store sales fell 9.4% year on year. This performance was more or less in line with the same quarter last year.

Key Takeaways from Shoe Carnival's Q4 Results

We struggled to find many strong positives in these results. The key negative was that its full-year earnings forecast missed analysts' expectations by a meaningful amount. The stock is flat after reporting and currently trades at $32.95 per share.

So should you invest in Shoe Carnival right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.