Shopify (SHOP) to Report Q2 Earnings: What's in the Cards?

Shopify Inc. SHOP is slated to report second-quarter 2019 results on Aug 1.

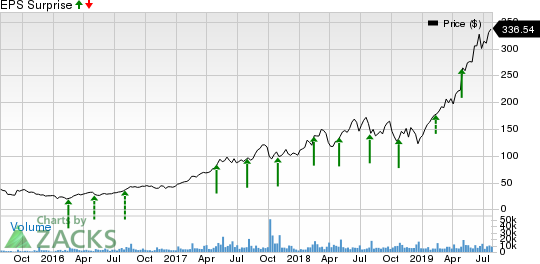

Notably, the company has surpassed the Zacks Consensus Estimate for earnings in the trailing four quarters, with an average positive surprise of 175.95%.

Q1 at a Glance

Shopify had delivered first-quarter 2019 adjusted earnings of 9 cents per share against the Zacks Consensus Estimate of a loss of 5 cents. Moreover, the figure improved 125% year over year.

Total revenues surged 49.5% from the year-ago quarter to $320.5 million, outpacing the Zacks Consensus Estimate of $310 million. The figure also fared better than management’s guided range of $305 million to $310 million.

Guidance & Estimates for Q2

For second-quarter 2019, Shopify projects revenues in the range of $345 million to $350 million. The Zacks Consensus Estimate for revenues is currently pegged at $350.58 million, suggesting growth of 43.1% from the year-ago quarter.

Further, the Zacks Consensus Estimate for the bottom line is pegged at 3 cents, unchanged over the past 30 days. The figure indicates an improvement of 50% from year-ago earnings of 2 cents.

Let’s see how things are shaping up prior to this announcement.

Shopify Inc. Price and EPS Surprise

Shopify Inc. price-eps-surprise | Shopify Inc. Quote

Factors at Play

Robust adoption of Shopify’s easy-to-use upgrades and new merchant-friendly applications is expected to drive top-line growth. An expanding merchant base is likely to bolster Gross Merchandise Volume (GMV), which in turn is likely to aid the upcoming quarterly results.

We expect the momentum witnessed by Shopify Payments, Shopify Ping, Shopify Capital and Shopify Shipping to aid the to-be-reported quarter as well. Moreover, increasing initiatives to strengthen presence in the international market remain a key catalyst.

For instance, Shopify has been developing various apps, including varied augmented reality (AR) and virtual reality (VR) based applications, in order to streamline customer experience, which is expected to bolster the company’s financials in the second quarter.

In fact, the company recently rolled out new store design experience to boost online shopping. Merchants can display their products in 3D and video models by leveraging the new design.

Additionally, Shopify is expected to reap benefits from incremental adoption of “all-new Shopify Plus,” Dynamic Checkout, Centralized Marketing Dashboard, Fraud Protect and Shopify AR solutions, in the to-be-reported quarter.

Further, Shopify recently introduced retail hardware offerings, which include Dock and Stand, and, Tap & Chip Reader, to help merchants provide enhanced retail experience to customers. The company also announced new integration with Snap SNAP, by which merchants on Shopify platform can utilize Snapchat’s Story ad campaigns for effective marketing.

We believe these latest merchant friendly initiatives will attract new merchants and drive top-line growth in the second quarter.

However, Shopify is increasing investments on development of innovative products to aid merchants enhance business processes. Moreover, stiff competition in the e-commerce market is a headwind. These are anticipated to weigh on the company’s second-quarter profitability.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The Sell-rated stocks (Zacks Rank #4 or 5) are best avoided.

Shopify has a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a couple of stocks you may consider, as our proven model shows that these have the right combination of elements to post an earnings beat this quarter.

Clearway Energy CWEN has an Earnings ESP of +15.00% and a Zacks Rank #1. The company is slated to report second-quarter 2019 results on Aug 6. You can see the complete list of today’s Zacks #1 Rank stocks here.

AmerisourceBergen Corporation ABC has an Earnings ESP of +0.82% and a Zacks Rank #3. The company is scheduled to report third-quarter fiscal 2019 results on Aug 1.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft stock in the early days of personal computers… or Motorola after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

Clearway Energy, Inc. (CWEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research