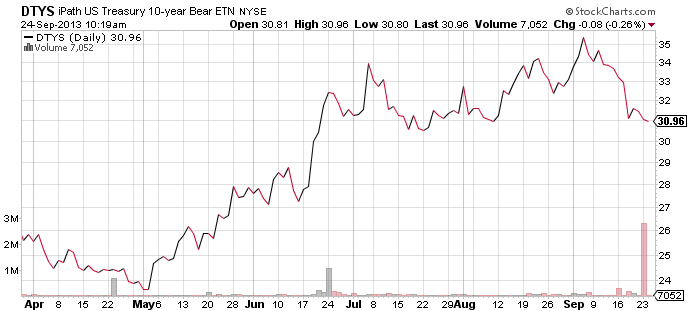

Short ETFs for Rising Interest Rates

Inverse exchange traded funds designed to short U.S. Treasuries have been getting more attention lately as yields rise and bond prices pull back.

These bearish ETFs, some of which use leverage, include ProShares UltraShort 20+ Year Treasury (NYSEArca: TBT), ProShares UltraShort 7-10 Year Treasury (NYSEArca: PST), ProShares Short 20+ Year Treasury (NYSEArca: TBF) and Direxion Daily 30-Year Treasury Bear 3X (TMV).

Yields on the 10-year note have jumped from around 2% to about 2.4% this month. Bond prices and yields move in opposite directions. [Rising Yields Punish Treasury ETFs]

Interest rates are still extremely low with many investors seeking safety in U.S. Treasuries, and also on the Federal Reserve’s bond-buying programs. An improving economy and inflation concerns could be driving the recent move higher in yields.

The decline in Treasury prices follows a quiet period of “volatility contraction” in the bond market, according to Waverly Advisors.

“Speaking generally, one of the characteristics of these moves is that they are more prone to continue than to reverse,” the firm said in a strategy note Tuesday. “A typical trading pattern might be a sharp breakdown (end of last week), followed by a period of consolidation (possibly underway), which would then be followed by another sharp selloff. Note that Treasurys are also set up for a more extended sell-off.”

In options markets, call buyers have resurfaced this week in ProShares UltraShort 20+ Year Treasury (TBT). These traders are “continuing to play higher yields and thus lower prices in Treasuries,” said Street One Financial. [ETF Chart of the Day: U.S. Treasury Bonds]

Marc Prosser at Forbes notes that inverse Treasury ETFs have relatively higher expense ratios.

ProShares UltraShort 20+ Year Treasury