Shutterstock Inc (SSTK) Reports Mixed 2023 Results with Record Annual Revenues

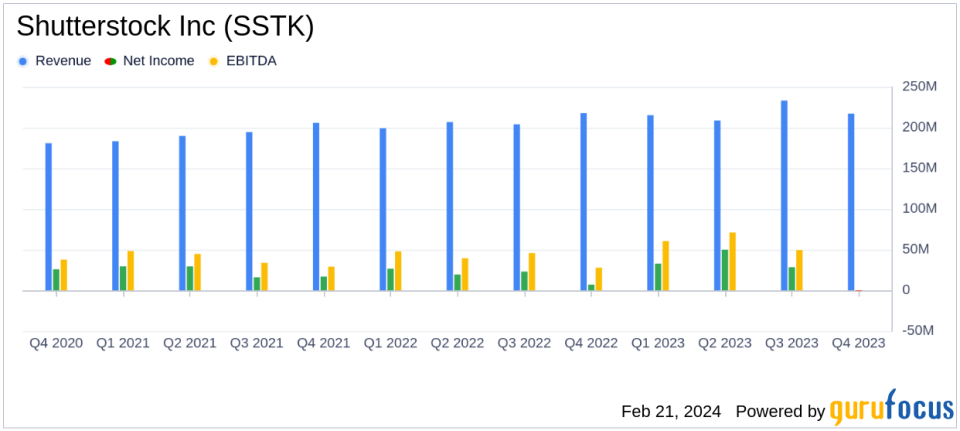

Annual Revenue: Increased by 6% to $874.6 million in 2023.

Net Income: Grew by 45% to $110.3 million for the full year.

Adjusted EBITDA: Rose by 10% to $240.8 million in 2023.

Q4 Performance: Slight revenue decrease and a net loss reported in Q4 2023.

2024 Guidance: Revenue and Adjusted EBITDA expected to remain steady; Adjusted net income per diluted share projected between $4.15 to $4.30.

On February 21, 2024, Shutterstock Inc (NYSE:SSTK), a leading global creative platform, announced its financial results for the full year and fourth quarter ended December 31, 2023. The company released its 8-K filing, revealing a year of record revenues and profitability, but with a slight revenue decrease in the fourth quarter.

Shutterstock Inc is a U.S.-based company that provides digital content, including photographs, illustrations, vector art, video clips, and music tracks. The company's digital content products are marketed under various brands, with the majority of sales derived from the shutterstock.com website. Shutterstock serves customers globally, with a significant portion of revenue coming from North America and Europe.

Financial Performance and Challenges

For the full year 2023, Shutterstock reported a 6% increase in revenue to $874.6 million, with net income surging by 45% to $110.3 million. Adjusted EBITDA also saw a 10% increase to $240.8 million. However, income from operations decreased by 27% to $68.4 million. The company's success was attributed to growth in its Data, Distribution, and Services product offering, which increased by 256% compared to 2022, and a $50.3 million bargain purchase gain from the Giphy acquisition.

Despite the annual growth, the fourth quarter of 2023 presented challenges, with revenues slightly decreasing by $0.5 million to $217.2 million and a net loss of $1.0 million, compared to a net income of $7.0 million in the same quarter of the previous year. This decline was primarily due to increased operating expenses associated with the Giphy acquisition and higher marketing expenses.

Key Financial Metrics

Shutterstock's financial achievements in 2023 are significant, particularly the growth in its Data, Distribution, and Services segment, which is crucial for diversifying revenue streams in the interactive media industry. The company's ability to generate increased free cash flow, which rose by $40.1 million to $138.5 million, is also notable as it provides flexibility for strategic investments and shareholder returns.

Key metrics from the income statement, balance sheet, and cash flow statement include:

Operating cash flows decreased by $17.9 million to $140.6 million for the full year.

Free cash flow increased by $40.1 million to $138.5 million in 2023.

Cash and cash equivalents stood at $100.5 million at the end of 2023, a decrease from $115.2 million at the end of 2022.

These metrics are important as they reflect the company's operational efficiency, liquidity, and ability to sustain growth and shareholder value.

Commentary from the CEO

"Shutterstock delivered record revenues and profitability in 2023 and significantly exceeded our targets set out at the beginning of the year. Our success in building a leading content platform has allowed us to make key investments in Data, Distribution and Services where we have an exciting growth opportunity supported by strong industry tailwinds and a large TAM," said Paul Hennessy, CEO of Shutterstock.

Analysis and Outlook

While Shutterstock's full-year performance was robust, the fourth-quarter results indicate potential headwinds. The decrease in operating cash flows and the net loss in Q4 highlight the need for careful management of operating expenses and investment strategies. The company's 2024 guidance suggests a cautious outlook, with revenue and Adjusted EBITDA expected to remain unchanged from 2023, and a slight decrease in adjusted net income per diluted share.

Shutterstock's long-term financial targets for 2027 include a revenue growth CAGR of 10%, EBITDA margin expansion from 28% to 30%, and cumulative free cash flow of $800 million allocated to strategic acquisitions, dividends, and share repurchases, indicating confidence in the company's growth trajectory.

For detailed financial tables and further information, please refer to the full 8-K filing.

Investors and potential GuruFocus.com members interested in Shutterstock Inc's financials and future prospects can find comprehensive analysis and updates on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Shutterstock Inc for further details.

This article first appeared on GuruFocus.