Shutterstock (NYSE:SSTK) Misses Q4 Revenue Estimates, Stock Drops

Stock photography and footage provider Shutterstock (NYSE:SSTK) fell short of analysts' expectations in Q4 FY2023, with revenue flat year on year at $217.2 million. The company's full-year revenue guidance of $875 million at the midpoint also came in 4.8% below analysts' estimates. It made a non-GAAP profit of $0.72 per share, down from its profit of $1.05 per share in the same quarter last year.

Is now the time to buy Shutterstock? Find out by accessing our full research report, it's free.

Shutterstock (SSTK) Q4 FY2023 Highlights:

Revenue: $217.2 million vs analyst estimates of $223.9 million (3% miss)

EPS (non-GAAP): $0.72 vs analyst estimates of $0.60 (19.5% beat)

Management's revenue guidance for the upcoming financial year 2024 is $875 million at the midpoint, missing analyst estimates by 4.8% and implying 0% growth (vs 5.8% in FY2023)

Free Cash Flow of $41.6 million is up from -$6.30 million in the previous quarter

Gross Margin (GAAP): 55.9%, down from 59.6% in the same quarter last year

Subscribers: 523,000, down 63,000 year on year

Market Capitalization: $1.59 billion

Commenting on the Company's performance, Paul Hennessy, the Company's Chief Executive Officer, said, "Shutterstock delivered record revenues and profitability in 2023 and significantly exceeded our targets set out at the beginning of the year".

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE:SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

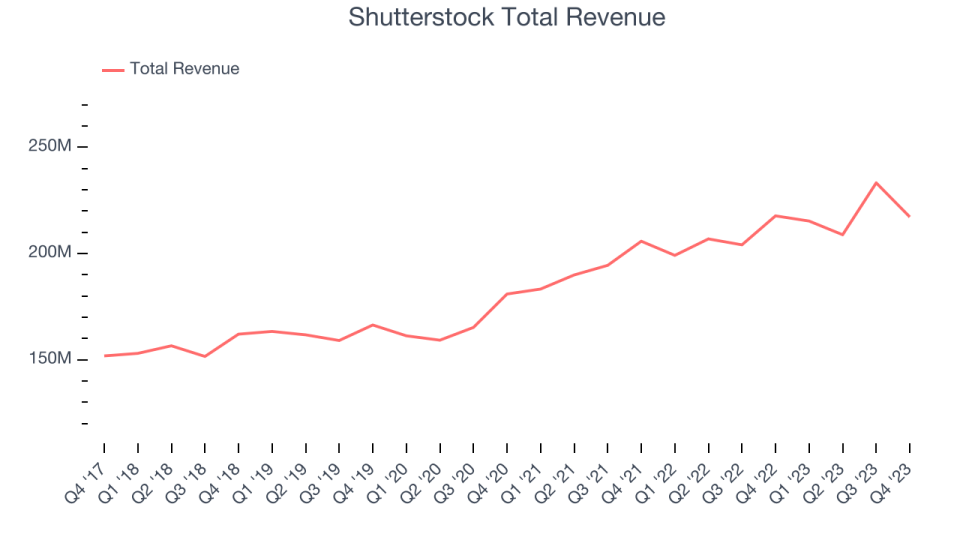

Sales Growth

Shutterstock's revenue growth over the last three years has been unremarkable, averaging 9.6% annually. This quarter, Shutterstock reported a year on year revenue decline of 0.2%, missing analysts' expectations.

For the upcoming financial year, management expects revenue to reach $875 million at the midpoint, representing 0% growth compared to the 5.8% increase in FY2023.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Usage Growth

As an online marketplace, Shutterstock generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Shutterstock's users, a key performance metric for the company, grew 33.8% annually to 523,000. This is among the fastest growth rates of any consumer internet company, indicating that users are excited about its offerings.

Unfortunately, Shutterstock's users decreased by 63,000 in Q4, a 10.8% drop since last year.

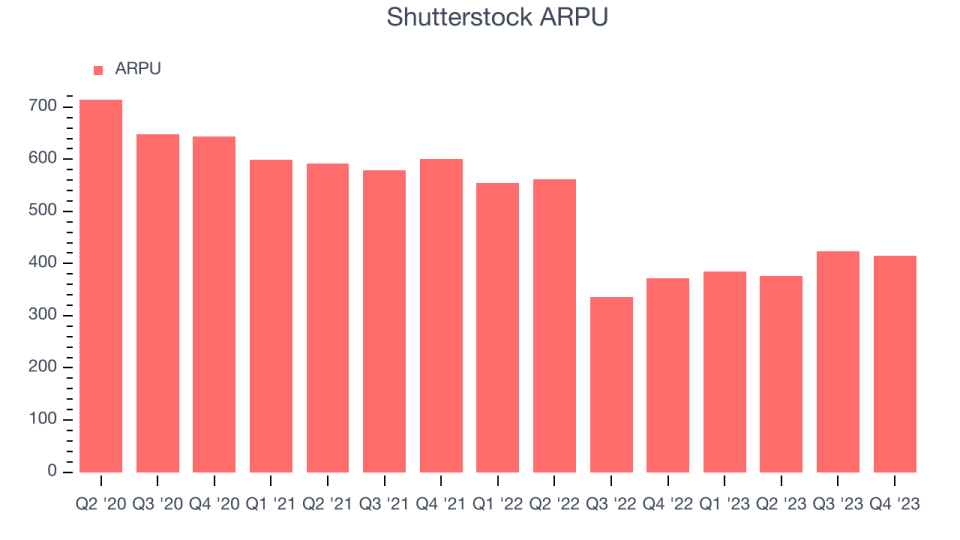

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Shutterstock because it measures how much the company earns in transaction fees from each user. Furthermore, ARPU gives us unique insights as it's a function of a user's average order size and Shutterstock's take rate, or "cut", on each order.

Shutterstock's ARPU has declined over the last two years, averaging 14.8%. Although it's unfortunate to see the company lose its pricing power, it was still able to achieve strong user growth. This quarter, ARPU grew 11.8% year on year to $415.33 per user.

Key Takeaways from Shutterstock's Q4 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and free cash flow missed estimates, driven by churn in its subscriber base and paid downloads that fell short of analysts' expectations. A lone bright spot was its revenue from its Data, Distribution, and Services product offering, which grew 256% in 2023 compared to 2022. That increase can be attributed to growth in its data offering and revenue generated from Giphy, a company Shutterstock bought in May 2023 from Meta as part of the UK regulator order (Giphy wasn't generating meaningful revenue at the time of acquisition).

The company will begin disclosing more granular information with investors; it plans to break down its revenue into two reportable segments - Content and Data, Distribution and Services. Looking ahead, the company's full-year 2024 revenue and EBITDA guidance came up short, but it did share its 2027 goals. The company expects to grow its revenue at a 10% CAGR with a long-term EBITDA margin of 28-30% (up from 21% this quarter).

The Board also declared a dividend of $0.30 per share payable on 3/14/24 to stockholders as of 2/29/24.

Overall, this was a mixed quarter for Shutterstock. The company is down 6.7% on the results and currently trades at $41.5 per share.

Shutterstock may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.