Shutterstock (NYSE:SSTK) Surprises With Q3 Sales, Stock Jumps 13.8%

Stock photography and footage provider Shutterstock (NYSE:SSTK) reported Q3 FY2023 results exceeding Wall Street analysts' expectations , with revenue up 14.3% year on year to $233.2 million. Turning to EPS, Shutterstock made a non-GAAP profit of $1.26 per share, improving from its profit of $0.64 per share in the same quarter last year.

Is now the time to buy Shutterstock? Find out by accessing our full research report, it's free.

Shutterstock (SSTK) Q3 FY2023 Highlights:

Revenue: $233.2 million vs analyst estimates of $214.5 million (8.76% beat)

EPS (non-GAAP): $1.26 vs analyst estimates of $0.81 (55.6% beat)

The company lifted its revenue guidance for the full year from $860.5 million to $877.5 million at the midpoint, a 1.98% increase

Free Cash Flow of $12.7 million, down 62.1% from the previous quarter

Gross Margin (GAAP): 59.6%, down from 60.8% in the same quarter last year

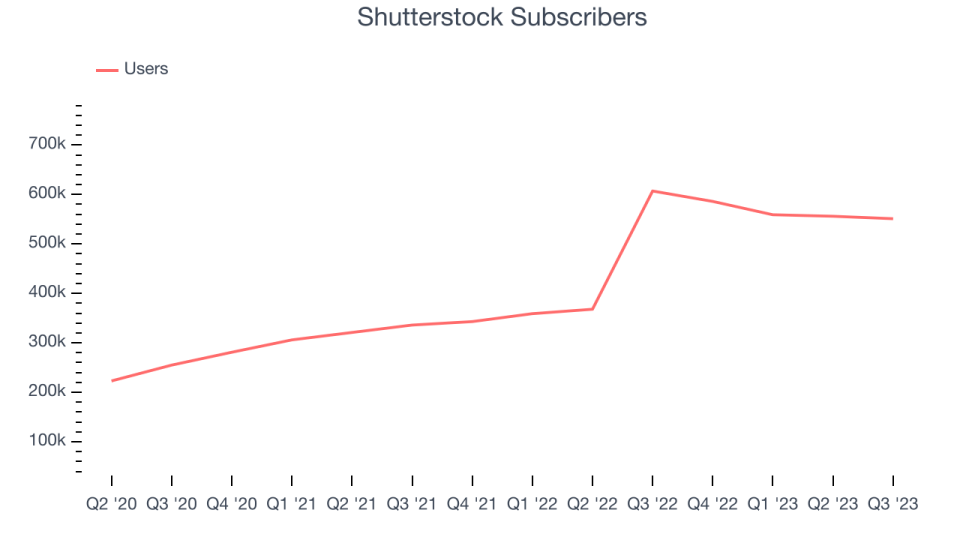

Subscribers: 0.55 million, down 56 thousand year on year

Commenting on the Company's performance, Paul Hennessy, the Company's Chief Executive Officer, said, "In the third quarter, Shutterstock's data and creative engines fueled faster growth and furthered the transformation of our business. Enterprise demand picked up, and we expect a further acceleration in the fourth quarter. We are seeing stabilization and expect a recovery in E-commerce over the next several quarters supported by marketing and product innovation. Based on our strong year to date performance, and improved confidence and visibility in our business, we are again raising both revenue and EBITDA guidance for 2023."

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE:SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Sales Growth

Shutterstock's revenue growth over the last three years has been unremarkable, averaging 10.4% annually. This quarter, Shutterstock beat analysts' estimates but reported mediocre 14.3% year-on-year revenue growth.

Ahead of the earnings results, analysts covering the company were projecting sales to grow 1.29% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Usage Growth

As an online marketplace, Shutterstock generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Shutterstock's users, a key performance metric for the company, grew 37.9% annually to 0.55 million. This is among the fastest growth rates of any consumer internet company, indicating that users are excited about its offerings.

Unfortunately, Shutterstock's users decreased by 56 thousand in Q3, a 9.23% drop since last year.

Key Takeaways from Shutterstock's Q3 Results

Sporting a market capitalization of $1.24 billion, Shutterstock is among smaller companies, but its more than $75.2 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

This was a classic beat and raise quarter. We were impressed by how significantly Shutterstock blew past analysts' revenue expectations this quarter. We were also glad its full-year revenue and adjusted EBITDA guidance both came in higher than Wall Street's estimates and were raised from the previous outlook. On the other hand, its user base fell. Zooming out, we think this was a very strong quarter, showing that the company is staying on track, especially in light of some choppy earnings results and pockets of macro pressures. The stock is up 13.8% after reporting and currently trades at $39 per share.

So should you invest in Shutterstock right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.