The Shyft Group Inc (SHYF) Reports Mixed 2023 Financial Results Amid Market Challenges

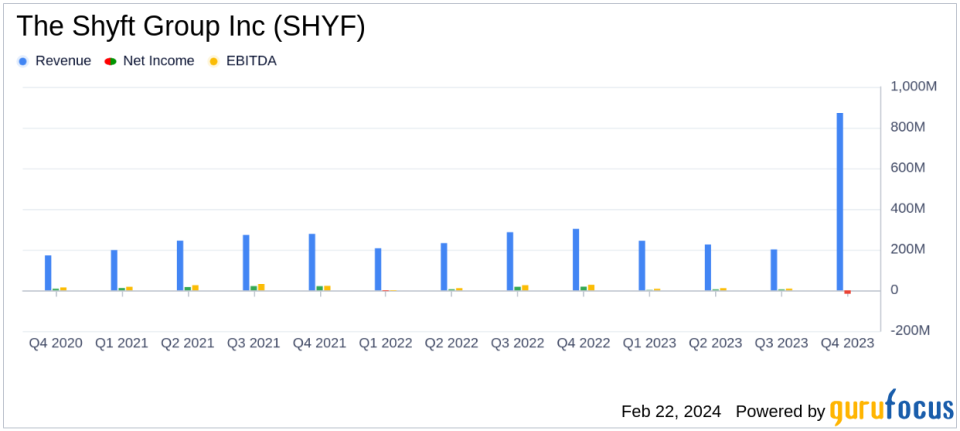

Revenue: The Shyft Group Inc (NASDAQ:SHYF) reported a decrease in annual sales from $1.03 billion in 2022 to $872 million in 2023.

Net Income: Net income for the year dropped to $6.5 million in 2023 from $36.6 million in 2022.

Earnings Per Share (EPS): Diluted EPS fell to $0.19 in 2023, down from $1.03 in the previous year.

Operational Challenges: The company faced underwhelming performance in its Fleet Vehicles and Services segment due to lower customer demand.

Financial Outlook: The Shyft Group anticipates continued challenges in the demand environment for parcel and motorhome segments in the first half of 2024.

The Shyft Group Inc (NASDAQ:SHYF) released its 8-K filing on February 22, 2024, detailing its financial performance for the fourth quarter and full-year ending December 31, 2023. The company, a leader in specialty vehicle manufacturing and assembly, faced a challenging year with a significant decrease in annual sales and net income. Despite these challenges, The Shyft Group remained focused on operational efficiency and cash generation.

Company Overview

The Shyft Group Inc is engaged in specialty vehicle manufacturing and assembly for various industries, including commercial vehicle and recreational vehicle markets. Its diverse product portfolio includes walk-in vans, truck bodies, cargo van and pick-up truck upfits, and luxury Class A diesel motorhome custom chassis. The company also provides replacement parts and maintenance services, catering to e-commerce/parcel delivery, mobile retail, utility trades, and more.

Financial Performance and Challenges

For the fourth quarter of 2023, The Shyft Group reported sales of $202.3 million, a significant decline from $302 million in the same quarter of the previous year. The full-year sales also saw a decrease from $1.03 billion in 2022 to $872 million in 2023. The net income for the year dropped to $6.5 million, down from $36.6 million in 2022, with diluted earnings per share (EPS) falling to $0.19 from $1.03.

President and CEO John Dunn commented on the results, stating,

We drove positive cash generation by remaining focused on the operational levers within our control. Our Specialty Vehicles business delivered strong overall profitability driven by robust demand for our vocational work trucks. While Fleet Vehicles and Services performance was underwhelming due to lower customer demand, the leadership team is responding with decisive commercial and operational actions to improve profitability."

Financial Achievements and Industry Impact

The Shyft Group's ability to generate positive cash flow despite a decrease in sales highlights the company's operational resilience. The Specialty Vehicles segment's strong profitability underscores the sustained demand for vocational work trucks, an essential component of the commercial vehicle market. However, the underperformance in the Fleet Vehicles and Services segment reflects broader market challenges that may impact the industry's growth trajectory.

Financial Metrics and Importance

Key financial metrics from the income statement, balance sheet, and cash flow statement reveal the company's financial health and operational efficiency. The Shyft Group's total current assets decreased from $345.8 million in 2022 to $286.9 million in 2023, while total liabilities decreased from $311.8 million to $277.9 million. The company's cash and cash equivalents also saw a slight decrease from $11.5 million to $9.9 million.

These metrics are crucial for understanding the company's liquidity, solvency, and ability to manage its debt. For investors, these indicators are essential for assessing the company's financial stability and potential for long-term growth.

2024 Financial Outlook

Looking ahead, Chief Financial Officer Jon Douyard provided guidance for 2024, indicating that the company expects the challenging demand environment to persist in the first half of the year. Despite this, The Shyft Group remains committed to improving financial performance and generating cash flow while investing in future growth initiatives, such as the Blue Arc EV program.

Conclusion and Analysis

The Shyft Group Inc (NASDAQ:SHYF) faces a pivotal year ahead as it navigates market headwinds and works to return to historic profitability levels. With a strong core business and a focus on operational execution, the company is poised to manage the dynamic demand environment and capitalize on long-term shareholder value. Investors and stakeholders will be watching closely as The Shyft Group advances its strategic initiatives and responds to industry challenges.

For more detailed insights and financial analysis, visit GuruFocus.com to explore The Shyft Group's performance and future prospects.

Explore the complete 8-K earnings release (here) from The Shyft Group Inc for further details.

This article first appeared on GuruFocus.