Siebert Financial (NASDAQ:SIEB) investors are sitting on a loss of 87% if they invested five years ago

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Anyone who held Siebert Financial Corp. (NASDAQ:SIEB) for five years would be nursing their metaphorical wounds since the share price dropped 87% in that time. The falls have accelerated recently, with the share price down 14% in the last three months. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Siebert Financial

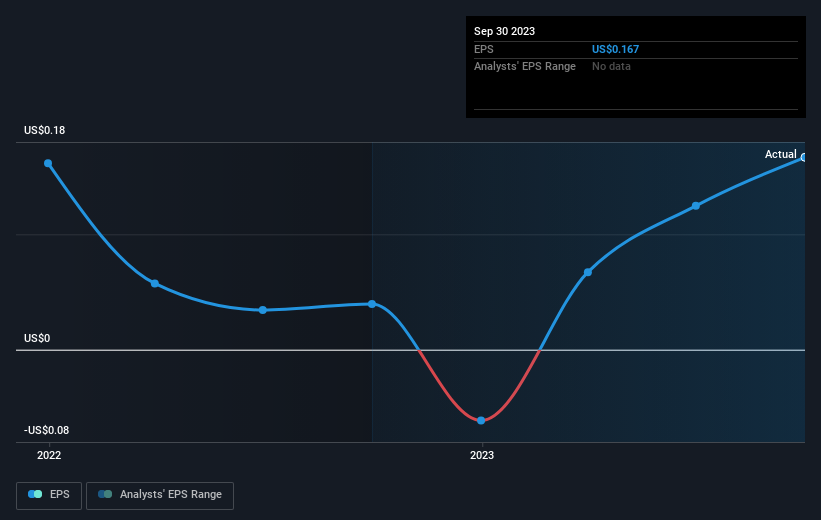

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Siebert Financial's share price and EPS declined; the latter at a rate of 12% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 34% per year, over the period. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 11.17.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Siebert Financial's key metrics by checking this interactive graph of Siebert Financial's earnings, revenue and cash flow.

A Different Perspective

Siebert Financial shareholders are up 22% for the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 13% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Siebert Financial is showing 4 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Of course Siebert Financial may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.