Siemens (ETR:SIE) Seems To Use Debt Quite Sensibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Siemens Aktiengesellschaft (ETR:SIE) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Siemens

What Is Siemens's Debt?

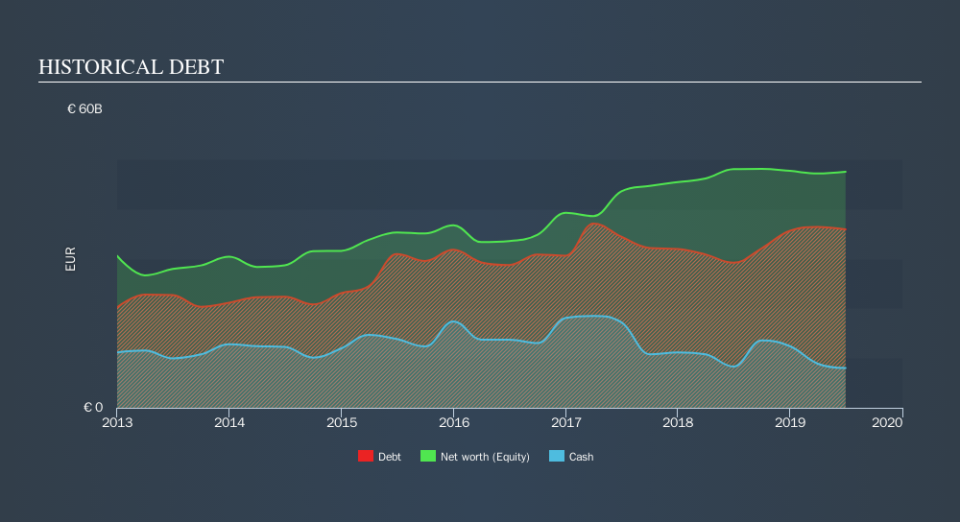

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Siemens had €35.8b of debt, an increase on €29.2b, over one year. On the flip side, it has €8.02b in cash leading to net debt of about €27.7b.

How Healthy Is Siemens's Balance Sheet?

According to the last reported balance sheet, Siemens had liabilities of €52.6b due within 12 months, and liabilities of €43.5b due beyond 12 months. On the other hand, it had cash of €8.02b and €40.2b worth of receivables due within a year. So its liabilities total €47.9b more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Siemens has a huge market capitalization of €82.9b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Siemens has a debt to EBITDA ratio of 3.0, which signals significant debt, but is still pretty reasonable for most types of business. However, its interest coverage of 1k is very high, suggesting that the interest expense may well rise in the future, even if there hasn't yet been a major cost attached to that debt. Importantly Siemens's EBIT was essentially flat over the last twelve months. We would prefer to see some earnings growth, because that always helps diminish debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Siemens's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Siemens produced sturdy free cash flow equating to 76% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Siemens's interest cover was a real positive on this analysis, as was its conversion of EBIT to free cash flow. Having said that, its net debt to EBITDA somewhat sensitizes us to potential future risks to the balance sheet. When we consider all the elements mentioned above, it seems to us that Siemens is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Siemens's dividend history, without delay!

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.