SIGA Technologies Inc Reports Robust Financial Growth in 2023

Product Sales: Increased to $131 million in 2023, a 51% rise from 2022.

Pre-Tax Operating Income: Grew to $84 million, a 96% increase compared to the previous year.

Special Cash Dividend: Declared a special cash dividend of $0.60 per share.

Net Income: Rose to $68.1 million, up from $33.9 million in 2022.

Earnings Per Share: Diluted income per share reached $0.95, more than doubling from $0.46 in 2022.

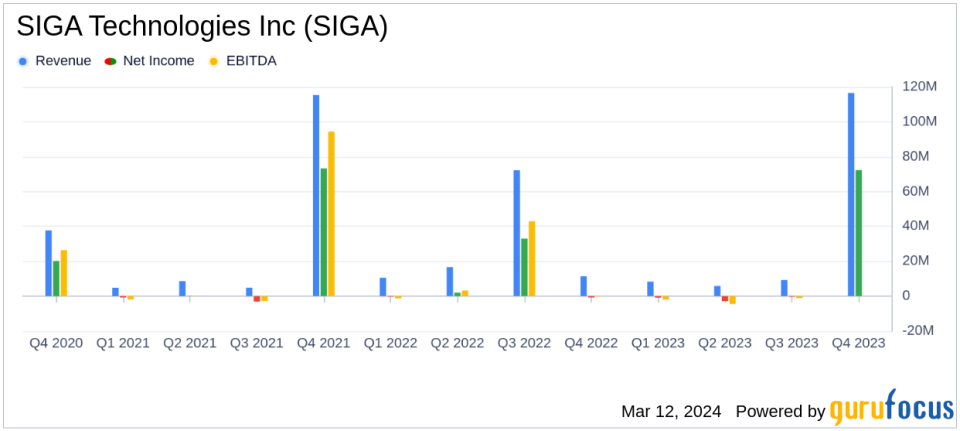

On March 12, 2024, SIGA Technologies Inc (NASDAQ:SIGA) released its 8-K filing, announcing financial results for the fiscal year ended December 31, 2023. The company, a leader in the pharmaceutical industry specializing in health security, reported a substantial increase in product sales to $131 million, marking a 51% growth over the previous year. Pre-tax operating income also saw a significant rise, reaching $84 million, nearly doubling from 2022's figures.

SIGA Technologies Inc is a commercial-stage pharmaceutical company that focuses on the health security market. Its flagship product, TPOXX, is an oral antiviral drug designed for the treatment of human smallpox disease caused by the variola virus. The company's financial performance in 2023 underscores the strength and potential of its business model within the public health sector.

Financial Highlights and Corporate Updates

Chief Executive Officer Diem Nguyen expressed confidence in the company's financial trajectory, stating, "These financial results represent a significant increase over the 2022 financial results; product revenues increased 51% over the corresponding 2022 amount, and pre-tax operating income year increased 96% over the corresponding 2022 amount." Nguyen also emphasized SIGA's commitment to maintaining its sector leadership in 2024.

The overall financial performance, and growth over prior-year financial results, highlight the strength, resilience and growth potential of SIGAs business model and are a testament to SIGAs long-standing leadership within the public health sector. We look forward to continuing our strong performance and sector leadership in 2024."

In addition to the impressive revenue and income figures, SIGA's Board of Directors declared a special cash dividend of $0.60 per share, reflecting a $0.15 increase from the previous year's dividend. The company also repurchased approximately 1.7 million shares of its common stock in 2023.

Comprehensive Financial Review

The company's balance sheet as of December 31, 2023, shows a healthy financial position with $150.1 million in cash and cash equivalents, an increase from $98.8 million the previous year. Total assets rose to $254.4 million from $195.0 million in 2022. The company's diligent capital management is evident in its ability to pay dividends and buy back shares while maintaining a robust balance sheet.

Net income for the year stood at $68.1 million, a significant improvement from $33.9 million in 2022. Earnings per share (EPS) also saw a notable increase, with diluted EPS at $0.95 compared to $0.46 in the previous year. This growth in net income and EPS is a clear indicator of SIGA's profitability and operational efficiency.

The company's commitment to its shareholders and the market is further demonstrated by its proactive approach to capital management, including the declaration of a special dividend and share repurchases. These actions not only reward shareholders but also reflect confidence in the company's financial health and future prospects.

As SIGA Technologies Inc continues to navigate the pharmaceutical industry with a focus on health security, its financial results from 2023 serve as a strong foundation for future growth and stability. The company's ability to increase product sales and operating income significantly, coupled with strategic capital management, positions it well for continued success in the coming years.

For more detailed information on SIGA's financial performance and future corporate updates, interested parties are encouraged to join the conference call and webcast scheduled for today at 4:30 PM ET.

Value investors and potential GuruFocus.com members seeking investment opportunities in the pharmaceutical sector may find SIGA Technologies Inc's robust financial performance and strategic market position to be of particular interest.

For further details on SIGA's financials, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from SIGA Technologies Inc for further details.

This article first appeared on GuruFocus.