Sight Sciences Inc (SGHT) Navigates Challenges to Maintain Revenue Growth and Reduce Expenses

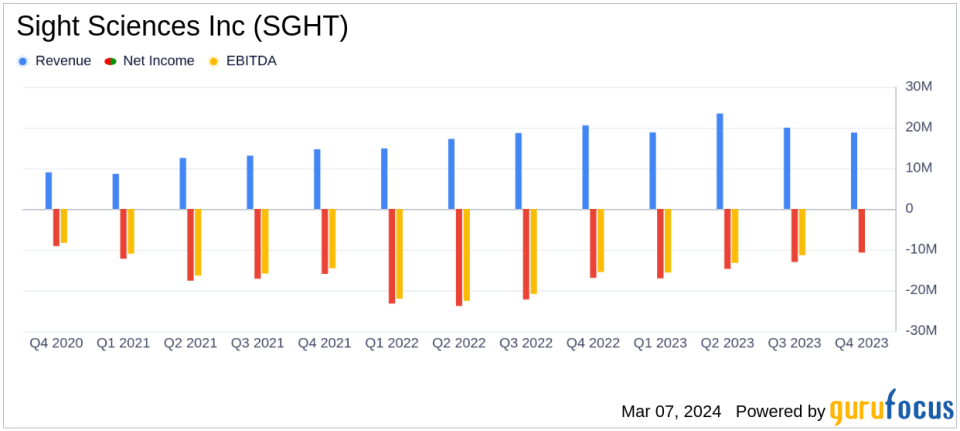

Full Year Revenue Growth: SGHT reported a 14% increase in full year 2023 revenue, reaching $81.1 million.

Q4 Revenue Dip: Despite a 9% decrease in fourth quarter revenue, SGHT demonstrated cost control measures.

Operating Expense Reduction: SGHT reduced Q4 operating expenses by 20%, showcasing improved operational efficiency.

Net Loss Improvement: The company reduced its net loss to $10.7 million in Q4, down from $16.9 million in the same period last year.

Cash Burn Reduction: SGHT significantly lowered its cash burn, using $46.9 million in 2023, improving from $75.7 million in 2022.

2024 Revenue Outlook: SGHT projects a 0% to 5% revenue growth for 2024, with expectations of double-digit growth in the second half.

On March 7, 2024, Sight Sciences Inc (NASDAQ:SGHT) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023, and providing financial guidance for the full year 2024. SGHT, an ophthalmic medical device company, is known for its innovative surgical and nonsurgical technologies designed to treat prevalent eye diseases. The company's flagship products include the OMNI Surgical System for glaucoma treatment and the TearCare System for dry eye disease.

Financial Performance and Challenges

SGHT's financial performance in 2023 reflects a company navigating through market challenges with resilience. The full year revenue saw a 14% increase to $81.1 million, despite a 9% decrease in fourth quarter revenue to $18.8 million. This decline was attributed to uncertainties arising from the Medicare coverage determination process, which have since been resolved favorably for the company. The ability to maintain revenue growth despite these challenges is significant as it demonstrates the underlying demand for SGHT's products and the company's adaptability in a dynamic healthcare reimbursement landscape.

SGHT's financial achievements in 2023 also include a substantial reduction in operating expenses and cash burn. The company's strategic cost control measures resulted in a 20% reduction in fourth quarter operating expenses and a 36% decrease in cash used in the fourth quarter compared to the third quarter of 2023. These improvements in financial discipline are crucial for SGHT's sustainability and future growth, particularly within the competitive Medical Devices & Instruments industry where efficient capital management is key to success.

Income Statement and Balance Sheet Highlights

Key details from SGHT's financial statements reveal a company focused on efficiency and growth:

Gross profit for the fourth quarter was $16.0 million with a gross margin of 85%, an improvement from 82% in the prior year's quarter.

Net loss improved to $10.7 million in Q4 2023, down from a net loss of $16.9 million in Q4 2022.

Cash and cash equivalents stood at $138.1 million as of December 31, 2023, with a total long-term debt of $35.0 million.

Management's Outlook and Commentary

Paul Badawi, co-founder and CEO of SGHT, expressed pride in the company's achievements and the team's resilience during a challenging period. He highlighted the addition of experienced leadership and restructuring efforts that have positioned the company for predictable long-term results. Badawi's commentary underscores the importance of strategic leadership and organizational efficiency in navigating industry challenges.

"We are extremely proud of our achievements in 2023 and our teams remarkable resilience, focus, and determination throughout a challenging LCD process in the back half of the year that ultimately resulted in the LCDs being withdrawn. We added highly experienced medtech growth leadership to our team, restructured our commercial organization for both increased efficiency and effectiveness, and meaningfully reduced our cash burn during a transient period of uncertainty, which I believe will lead to predictable long-term results as we enter our next exciting phase of transformative growth, said Paul Badawi.

2024 Financial Guidance and Future Prospects

Looking ahead, SGHT has initiated financial guidance for 2024 with projected revenue ranging from $81.0 million to $85.0 million. The company anticipates a return to double-digit revenue growth in the second half of the year, driven by an expanded clinical data library, progress towards meaningful reimbursement for TearCare, and a productive start to the year. SGHT's forward-looking guidance reflects management's confidence in the company's strategic direction and commercial prospects.

For value investors and potential GuruFocus.com members, SGHT's latest earnings report and future guidance offer a picture of a company that is successfully managing its resources while laying the groundwork for future growth. The company's focus on innovation, operational efficiency, and market expansion aligns with the interests of investors seeking long-term value creation.

For more detailed information and analysis on Sight Sciences Inc (NASDAQ:SGHT)'s financial performance, visit GuruFocus.com.

Investors and media interested in learning more about SGHT's financial results and future plans can access the conference call hosted by the management team or visit the company's website at www.sightsciences.com.

Explore the complete 8-K earnings release (here) from Sight Sciences Inc for further details.

This article first appeared on GuruFocus.