Signal Says Avoid This Sector in September

The real estate sector has been on shaky footing all 2023. As mortgage rates rise in lockstep with home prices, exchange traded funds (ETF) like iShares U.S. Real Estate ETF (NYSEARCA:IYR) and Charles Schwab US REIT ETF (NYSEARCA:SCHH) have lagged around the year-to-date breakeven level. Entering September, real estate investment trusts (REIT) in particular could be in for a choppy month, if past is precedent.

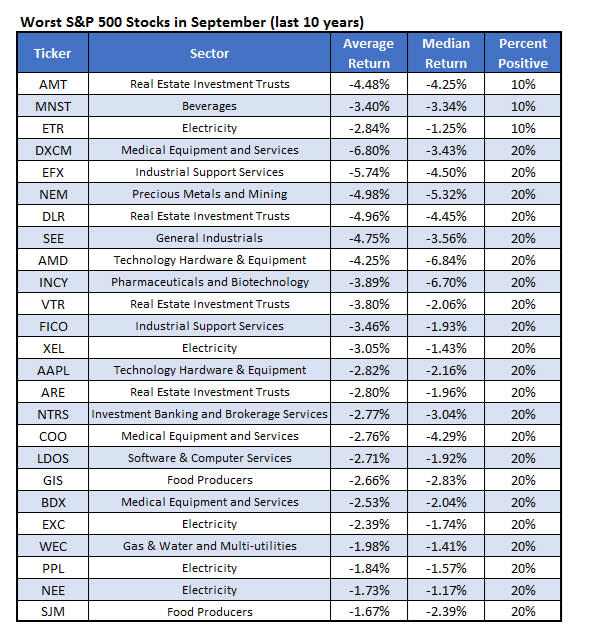

Below are the worst S&P 500 Index (SPX) stocks to own in the month of September, looking back 10 years. The list -- cultivated by Schaeffer's Senior Quantitative Analyst Rocky White -- considers only SPX stocks with at least 10 years' worth of historical returns. Four REIT’s land on the list, with Digital Reality Trust Inc (NYSE:DLR) the worst of the bunch, averaging a roughly 5% loss in the last 10 years, with only 20% of the monthly returns positive. Or consider American Tower Corp's (NYSE:AMT) rough win rate of only 10%, with a 4.5% average loss in the last decade.

DLR sports a 30.6% lead and scored an annual high of $131.97 on Aug. 30, while AMT is off by 15% for the year and was at an annual low of $172.55 on Aug. 21. The case is particularly bleak for American Tower, considering the downgrade risk; 13 of the 15 brokerages covering the REIT rate it a “buy” or better, with zero “sells” on the books.

If put options on these REIT’s seems appealing, consider their discounted premium. Their respective Schaeffer's Volatility Index (SVI) readings of 21% and 22% sit in the bottom percentile all other readings in their annual range, implying that options players are pricing in relatively low volatility expectations at the moment.