Signet Jewelers (SIG): A Closer Look at Its Market Value

Signet Jewelers Ltd (NYSE:SIG) has been making waves in the finance world with a daily gain of 2.44% and a 3-month gain of 8.33%. With an Earnings Per Share (EPS) (EPS) of 8.79, the question arises: is the stock modestly overvalued? This article provides a comprehensive valuation analysis of Signet Jewelers (NYSE:SIG) to answer this question.

Company Introduction

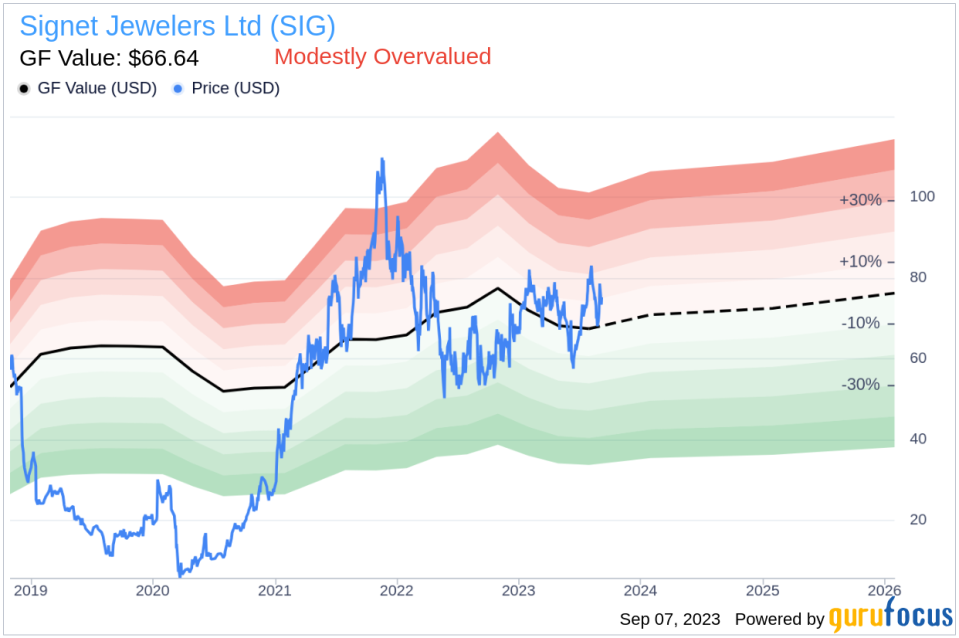

Signet Jewelers Ltd is a renowned retailer of diamond jewelry. The company's merchandise mix includes bridal, fashion, watches, and other items. The bridal category includes engagement, wedding, and anniversary purchases. The company operates through the North America segment, the International segment, and the Other segment, with the North America segment contributing to the majority of the revenue. The company's stock price is currently $75.23, and with a market cap of $3.40 billion, it appears to be modestly overvalued based on the GF Value of $66.64.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides a visual representation of the stock's fair trading value. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Given that Signet Jewelers (NYSE:SIG) is modestly overvalued, the long-term return of its stock is likely to be lower than its business growth.

Financial Strength

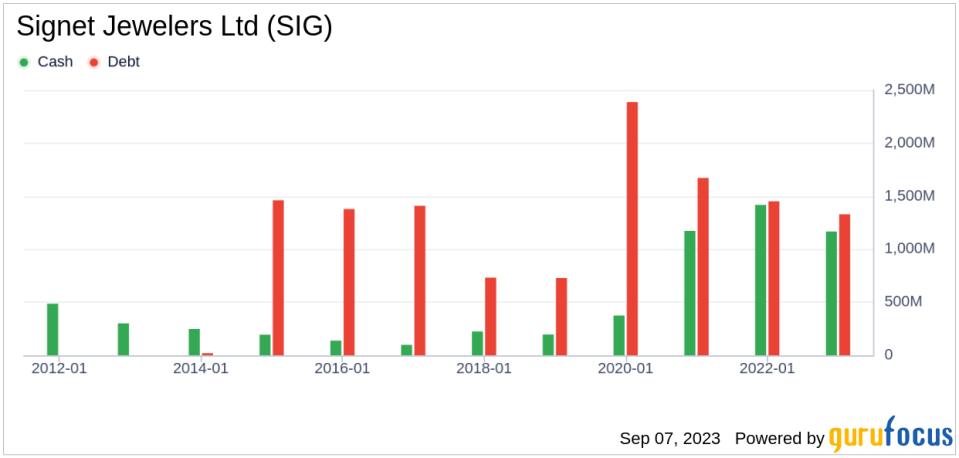

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to review a company's financial strength before deciding to buy shares. Signet Jewelers has a cash-to-debt ratio of 0.53, which ranks better than 51.96% of 1099 companies in the Retail - Cyclical industry. Based on this, GuruFocus ranks Signet Jewelers's financial strength as 7 out of 10, suggesting a fair balance sheet.

Profitability and Growth

Companies that have been consistently profitable over the long term offer less risk for investors. Signet Jewelers has been profitable 8 over the past 10 years. Over the past twelve months, the company had a revenue of $7.50 billion and Earnings Per Share (EPS) of $8.79. Its operating margin is 8.77%, which ranks better than 74.02% of 1097 companies in the Retail - Cyclical industry. Overall, the profitability of Signet Jewelers is ranked 7 out of 10, indicating fair profitability.

Growth is a crucial factor in the valuation of a company. The 3-year average annual revenue growth of Signet Jewelers is 5.3%, which ranks better than 54.12% of 1044 companies in the Retail - Cyclical industry. The 3-year average EBITDA growth rate is 18.7%, which ranks better than 69.04% of 898 companies in the Retail - Cyclical industry.

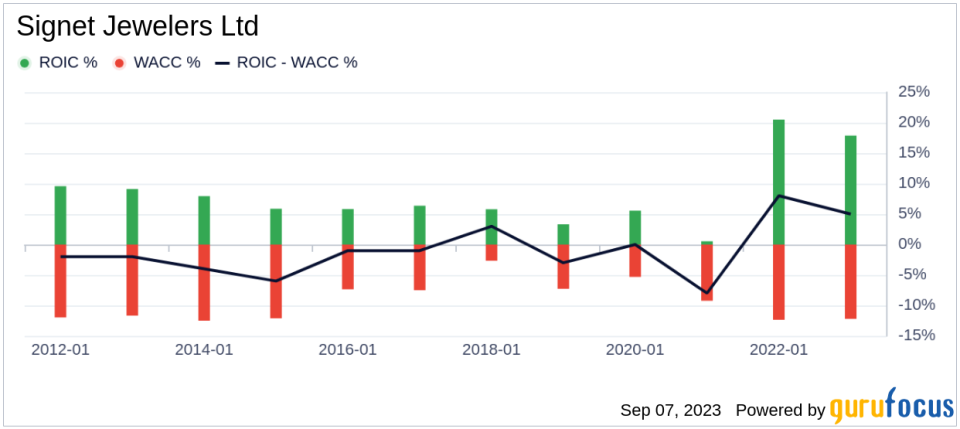

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) can also determine its profitability. The ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. The WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Signet Jewelers's ROIC is 12.41, and its cost of capital is 8.03.

Conclusion

In conclusion, the stock of Signet Jewelers appears to be modestly overvalued. The company's financial condition is fair, and its profitability is fair. Its growth ranks better than 69.04% of 898 companies in the Retail - Cyclical industry. To learn more about Signet Jewelers stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.