Signet (SIG) Q4 Earnings Surpass Estimates, Sales Dip Y/Y

Signet Jewelers Limited SIG has posted its fourth-quarter fiscal 2024 results, wherein the bottom line beat the Zacks Consensus Estimate and increased year over year. However, the top line missed the same and declined from the year-ago quarter’s readings. Also, same-store sales dropped 9.6% from the year-ago period.

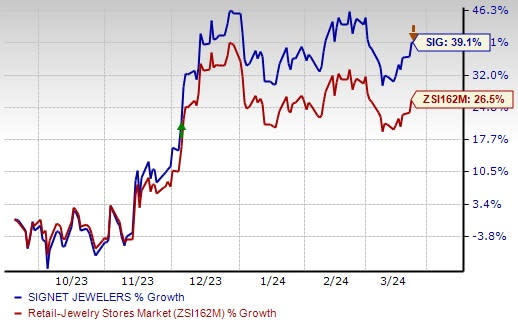

This Zacks Rank #2 (Buy) player’s shares have gained 39.1% in the past six months compared with the industry’s 26.5% growth.

Signet Jewelers Limited Price, Consensus and EPS Surprise

Signet Jewelers Limited price-consensus-eps-surprise-chart | Signet Jewelers Limited Quote

Quarterly Details

Signet has reported adjusted earnings of $6.73 per share, beating the Zacks Consensus Estimate of earnings of $6.33. The bottom line increased 21.9% from $5.52 in the year-ago quarter.

This jewelry retailer generated total sales of $2,497.6 million, lagging the consensus estimate of $2,562 million. The top line dipped 6.3% from the prior-year quarter. The metric declined 6.6% at constant currency.

A Sneak Peek Into Margins

The gross profit in the fiscal fourth quarter amounted to $1,081.3 million, down 2.7% from $1,111.1 million in the year-ago quarter. We note that the gross margin increased 160 basis points (bps) year over year to 43.3% in the quarter under review. This enhancement was primarily due to an expansion of the merchandise margin by 130 bps.

Selling, general and administrative (SG&A) expenses were $671.9 million, down from $702.5 million in the prior-year quarter. Meanwhile, SG&A expenses, as a percentage of sales, stood at 26.9%, which were 60 bps higher year over year. This change was mainly due to fixed cost deleverage, slightly mitigated by actions taken to save costs.

SIG reported an adjusted operating income of $409.7 million, up from $404.7 million in the year-ago quarter. As a rate of sales, the adjusted operating margin increased 120 basis points to 16.4%.

Segmental Discussion

Sales in the North American segment fell 6.1% from the year-ago quarter to $2,350.4 million. This decline was driven by a 0.6% year-over-year drop in the average transaction value (ATV), alongside a reduction in transaction volume. Same-store sales tumbled 10% from the year-ago quarter, which was impacted by a 1% decline from integration challenges with the company's digital platforms. Notably, the consensus estimate for the North American segment’s sales was pegged at $2,436 million for the fiscal fourth quarter.

Sales in the International segment dropped 7.5% from the year-earlier quarter to $141.7 million due to a 10.4% reduction in ATV, influenced by the sale of prestige watch stores, coupled with fewer transactions. Same-store sales slipped 1% from the year-ago quarter. Sales fell 11.4% on a constant-currency basis. Notably, the consensus estimate for the International segment’s fiscal fourth-quarter sales was pegged at $116 million.

Image Source: Zacks Investment Research

Financial Details

Signet ended the fiscal fourth quarter with cash and cash equivalents of $1,378.7 million, accounts receivable of $9.4 million, and inventories of $1,936.6 million. Total shareholders’ equity was $2,166.5 million at the end of the fiscal fourth quarter.

As of Feb 3, 2024, Signet had a cash flow of $546.9 million from operating activities.

In fiscal 2024, Signet bought back 1.9 million shares at an average price of $73.06 per share, totaling $139.3 million, with $21.8 million of that amount spent in the fiscal fourth quarter. We note that the company had 2,698 stores as of Feb 3, 2024.

Guidance

For the first quarter of fiscal 2025, Signet anticipates total sales of $1.47-$1.53 billion, with same-store sales expected to decline 7-11%. Operating income is forecast between $40 million and $60 million, whereas the adjusted EBITDA is projected between $87 million and $107 million.

The company's guidance for the fiscal first quarter indicates a slow start, with improving trends observed since mid-February of 2024. U.S. engagement incidents are expected to decrease in the low to mid-single digits from that reported in the first quarter of fiscal 2024.

For fiscal 2025, Signet expects total sales of $6.66-$7.02 billion, with same-store sales between a decline of 4.5% and an increase of 0.5%. Operating income is projected between $590 million and $675 million, with an adjusted EBITDA between $780 million and $865 million. Earnings per share (EPS) are anticipated between $9.08 and $10.48.

The full-year outlook includes an expected 1.5-2% negative impact on sales due to integration issues with its Digital banners, which are anticipated to be resolved in the second half of fiscal 2025. The company expects about $225 million in sales headwinds from non-comparable events, including over $100 million due to an extra week in fiscal 2024, around $75 million in the UK from selling high-end watch locations and closing up to 30 Ernest Jones stores, and about $50 million from store closures in North America across fiscal 2024 and 2025.

Despite these challenges, engagement incidents in the United States are expected to increase 5-10% from that reported in fiscal 2024, with the company planning $150-$180 million in cost savings. These savings will be achieved by leveraging technology, such as artificial intelligence, improving sourcing efficiencies and maintaining strict discipline on spending.

Planned capital expenditure is estimated between $160 million and $180 million, focusing on store openings, renovations, and digital and technology advancements.

Key Picks

Some other top-ranked stocks in the same space are American Eagle Outfitters Inc. AEO, Abercrombie & Fitch Co. ANF and Crocs, Inc. CROX.

American Eagle Outfitters is a specialty retailer of casual apparel, accessories and footwear. It sports a Zacks Rank of 1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year earnings and sales indicates growth of 12.5% and 3.3%, respectively, from the year-ago period’s reported figures. AEO has a trailing four-quarter average earnings surprise of 22.7%.

Abercrombie & Fitch is a specialty retailer of premium, high-quality casual apparel. The company currently carries a Zacks Rank #2. ANF has a trailing four-quarter average earnings surprise of 715.6%.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year earnings and sales indicates growth of 16.4% and 5.7%, respectively, from the year-ago period’s reported figures.

Crocs is one of the leading footwear brands, with its focus on comfort and style. CROX carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Crocs’ current financial-year sales and EPS suggests growth of 3.9% and 2.9%, respectively, from the year-ago reported figures. CROX has a trailing four-quarter earnings surprise of 14.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Signet Jewelers Limited (SIG) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report