Signet's (SIG) Omnichannel Endeavors Appear Encouraging

Signet Jewelers Limited SIG has been doing well on the bourses, thanks to its sturdy omnichannel efforts to enrich customers’ experience. The company is focused on making digital endeavors and smooth progress in its Inspiring Brilliance strategy. We note that Signet is consistently integrating its physical stores with advanced virtual experiences through data-driven in-store consultations and services like buy online pickup in-store and curbside options.

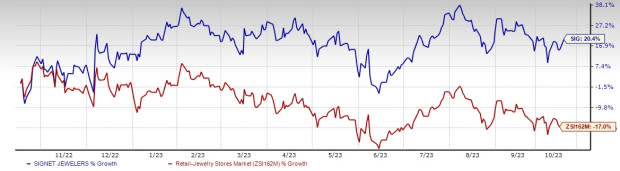

Driven by such catalysts, shares of this jewelry retailer have increased 20.4% in the past year against the industry’s 17% decline.

Let’s Delve Deep

Digital business is the key growth driver. The company remains focused on enhancing the data- analytics capabilities with higher precision. It is leveraging the analytics capability to optimize the process of adding product assortments. Management has been building on the trade area data with customer e-commerce trends, location data such as GPS tracking and macro level data with traffic draw.

Markedly, the company has added several features and capabilities across its digital platform to offer a seamless customer experience. It has rolled out Google Business Messages and Apple Business Chat features, which allow customers to engage with virtual jewelry consultants in real-time or offline from search results or maps. Signet’s connected commerce strategy helps in combining customer experiences, leveraging in store and online as well as mobile and ubiquitous delivery.

Image Source: Zacks Investment Research

As part of the company’s fleet-optimization endeavors, management expects to close up to 150 stores in the next few months. Management expects capital investments of up to $200 million along with investments in banner differentiation with stores, connected-commerce capabilities, and digital and technology upgrades.

Further, the company’s loyalty program is progressing well. It has introduced the option to enroll in the loyalty program when first making an account on one of its banner sites, thus creating a frictionless point of entry for the customers. Also, the company has implemented more than a dozen new priority feature launches.

These features consist enhancements to the online merchandise presentation, messaging, appointment booking and services. All such efforts indicate that Signet has been focusing on evolving its channel-agnostic retailer capabilities. This is helping the company to cater to customers’ needs more aptly.

Markedly, the company is on track to generate cost savings in the band of $225-$250 million. Major drivers of the savings include non-customer impact initiatives like product-sourcing efforts, cloud integration, enhanced credit agreements and advertising efficiencies.

The company is focused on four growth drivers, which include winning the engagement recovery, expanding accessible luxury, improving services, and building unassailable competitive advantages in digital and data-driven marketing. Altogether, these drivers will lead to $9-$10 billion in revenues with 11-12% annual non-GAAP EBIT. Management remains confident in delivering the company’s mid-term goals in the next three to five years.

This current Zacks Rank #3 (Hold) company has a VGM Score of A, which further demonstrates strength. Analysts seem optimistic about the company. The Zacks Consensus Estimate for fiscal 2025 sales and earnings per share (EPS) is currently pegged at $7.37 billion and $10.38, respectively. These estimates show corresponding increases of 1.9% and 5% year over year.

Key Picks

We have highlighted three better-ranked stocks, namely Abercrombie & Fitch ANF, American Eagle Outfitters AEO and The Children's Place PLCE.

Abercrombie & Fitch, a leading casual apparel retailer, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales suggests growth of 10% from the year-ago reported figure. ANF delivered a trailing four-quarter earnings surprise of 724.8%, on average.

American Eagle Outfitters, a retailer of casual apparel, accessories and footwear, currently sports a Zacks Rank of 1. AEO delivered an average earnings surprise of 43.2% in the trailing four quarters.

The Zacks Consensus Estimate for American Eagle Outfitters’ current financial-year EPS suggests growth of 33% from the year-ago reported figure.

The Children's Place, the children’s specialty apparel retailer, currently carries a Zacks Rank #2 (Buy). The company has a negative trailing four-quarter earnings surprise of 5%, on average.

The consensus estimate for The Children's Place’s current financial-year EPS suggests growth of 1,300% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Signet Jewelers Limited (SIG) : Free Stock Analysis Report

The Children's Place, Inc. (PLCE) : Free Stock Analysis Report