Silence Therapeutics plc's (NASDAQ:SLN) 65% Price Boost Is Out Of Tune With Revenues

Silence Therapeutics plc (NASDAQ:SLN) shares have had a really impressive month, gaining 65% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

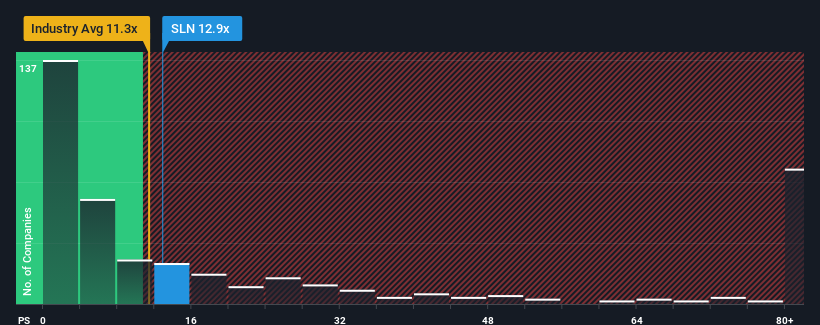

Even after such a large jump in price, there still wouldn't be many who think Silence Therapeutics' price-to-sales (or "P/S") ratio of 12.9x is worth a mention when the median P/S in the United States' Biotechs industry is similar at about 11.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Silence Therapeutics

How Silence Therapeutics Has Been Performing

With revenue growth that's superior to most other companies of late, Silence Therapeutics has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Silence Therapeutics will help you uncover what's on the horizon.

Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Silence Therapeutics' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 74% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 5.9% per year as estimated by the four analysts watching the company. Meanwhile, the broader industry is forecast to expand by 196% per annum, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Silence Therapeutics' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Silence Therapeutics appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that Silence Therapeutics currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

You should always think about risks. Case in point, we've spotted 4 warning signs for Silence Therapeutics you should be aware of, and 1 of them makes us a bit uncomfortable.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.