Silgan Holdings Inc. Reports Full Year 2023 Earnings, Anticipates Growth in 2024

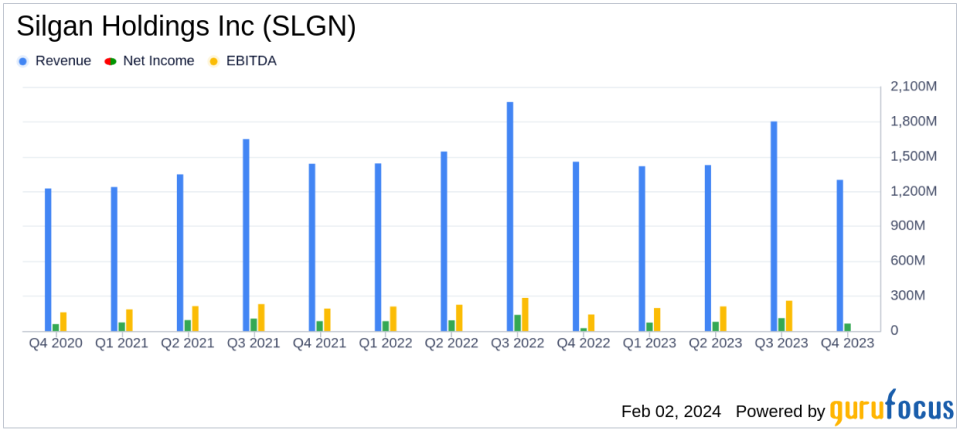

Net Sales: Reported $6.0 billion for full year 2023, a decrease from $6.4 billion in 2022.

Net Income: Achieved $326.0 million, or $2.98 per diluted share, compared to $340.8 million, or $3.07 per diluted share in the previous year.

Adjusted Net Income: Adjusted net income per diluted share was $3.40 for 2023 after certain adjustments.

Dividends and Share Repurchases: Returned over $250 million to shareholders through share repurchases and dividends.

Cost Reduction Program: Announced a multi-year $50 million cost reduction program to enhance profitability.

Free Cash Flow: Reported $356.7 million in 2023, with expectations of growth in 2024.

2024 Outlook: Estimates adjusted net income per diluted share for 2024 to be in the range of $3.55 to $3.75.

On January 31, 2024, Silgan Holdings Inc (NYSE:SLGN), a leader in sustainable rigid packaging solutions for consumer goods, released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. Despite a challenging economic environment and unprecedented volume fluctuations, Silgan reported a robust financial performance, with net sales of $6.0 billion and net income of $326.0 million, or $2.98 per diluted share. This performance reflects a slight decline from the previous year's net sales of $6.4 billion and net income of $340.8 million, or $3.07 per diluted share.

Silgan Holdings manufactures approximately half of North America's metal food containers, serving major customers like Campbell Soup, Nestle, and Del Monte. The company also produces plastic dispensers and containers for personal and healthcare products, as well as metal and plastic lids and caps through its closures business.

The company's financial achievements, including a record annual adjusted EBIT in its Metal Containers segment, underscore its resilience and strategic focus on high-value dispensing products. These achievements are particularly significant in the Packaging & Containers industry, where innovation, cost efficiency, and sustainable practices are increasingly important.

Financial Performance Highlights

For the full year of 2023, Silgan's adjusted net income per diluted share was $3.40, reflecting adjustments that increased net income per diluted share by $0.42. The company's 10-year CAGR for adjusted EPS stands at 10 percent, demonstrating consistent growth and shareholder value creation. The fourth quarter results showed net sales of $1.3 billion, a decrease of 8% compared to the same period in the prior year, predominantly due to lower volumes. However, net income for the fourth quarter was $64.4 million, or $0.60 per diluted share, an increase from $24.6 million, or $0.22 per diluted share, in the fourth quarter of 2022.

Adam Greenlee, President and CEO of Silgan, commented on the company's performance, stating:

"The Silgan team navigated yet another year of unprecedented volume fluctuations and volatile market conditions, and delivered strong performance in a challenging economic environment. We are pleased to have achieved the second highest annual adjusted earnings in the Companys history, and our robust and reliable cash generation allowed us to return over $250 million to shareholders during the year."

Looking ahead, Silgan anticipates earnings and free cash flow growth in 2024, with a multi-year $50 million cost reduction program underway. The company has also seen early signs of recovery from customer destocking activities that impacted 2023, with favorable trends expected to continue improving in the first half of the year.

Financial Statements and Outlook

From the income statement, Silgan reported a gross profit of $992.6 million for 2023, with selling, general, and administrative expenses amounting to $384.4 million. The balance sheet shows a strong position with total assets of $7.6 billion, including cash and cash equivalents of $642.9 million. The company's total liabilities and stockholders' equity also stand at $7.6 billion.

The cash flow statement reveals net cash provided by operating activities of $482.6 million for 2023, with free cash flow of $356.7 million. Capital expenditures were reported at $226.8 million for the year.

For 2024, Silgan expects adjusted net income per diluted share to range between $3.55 and $3.75, marking a 7% increase at the midpoint over 2023. The company also anticipates higher volumes in the Dispensing and Specialty Closures and Metal Containers segments, with comparable volumes in the Custom Containers segment to the prior year. Free cash flow for 2024 is estimated to be approximately $375 million.

Investors and interested parties can access the webcast of Silgan's conference call discussing the 2023 results and the outlook for 2024 on the company's website.

For a detailed analysis of Silgan Holdings Inc's financial performance and future prospects, visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from Silgan Holdings Inc for further details.

This article first appeared on GuruFocus.