Silicon Motion (SIMO) Preliminary Q3 Results Show Higher Revenues

Silicon Motion Technology Corporation SIMO recently issued preliminary third-quarter 2023 results. The selective preliminary metrics offer clarity regarding its business operations as it aims to navigate through a challenging macroeconomic environment.

In concurrence with the second-quarter 2023 results, Silicon Motion offered guidance for the third quarter. The company had then expected third-quarter revenues to be up 15-20% sequentially as end-market demand stabilized with the reduction in customer inventory levels. Management currently expects the soon-to-be-reported quarter’s revenues to exceed the higher end of its guided range. However, non-GAAP gross margin is likely to be relatively flat on a sequential basis — in line with the original guidance.

Silicon Motion is bullish about a more robust market recovery in the second half of 2023. It is taking several measures to enhance its gross margins, including reducing manufacturing costs, minimizing compensation-related expenses, discontinuing unprofitable product lines and streamlining research and development expenditures. Despite facing challenging market conditions, the company's management remains committed to providing cost-effective, high-quality, and unique solutions to its customers while maintaining a strong presence in the storage controller market.

The company appears to be well-equipped to adapt to industry changes. It has collaborated with flash vendors to develop proprietary controller technology to overcome the existing weakness of 3D NAND and outshine peers. It has commenced initial sales of 3D SSD controllers to flash partners. The company expects this controller to be a significant SSD controller growth driver for the next year, as NAND Flash partners’ 3D capacity expands. Also, the company commenced mass production of PCIe NVMe client SSD controller for flash partners. We believe accelerated product sales and favorable industry trends signal bright prospects for Silicon Motion.

Silicon Motion has expanded its SSD controller program engagements with PC OEMs and eMMC/UFS controllers for smartphones, automotive applications and IoT/smart devices. The company is adding to this momentum with the upcoming launch of its next-generation enterprise-class SSD controllers. Silicon Motion’s eMMC is showing strong signals of rebound, thereby adding to the strength of its overall embedded storage market that comprises both SSD controllers and eMMC embedded memory.

As market trends suggest the tilting of balance from eMMC 4.5 toward eMMC 5.0, the company foresees lucrative prospects for eMMC 5.1 controller sales. We believe an expanding customer base and innovative products will likely act as tailwinds for the company’s top-line growth, going forward. Notably, over the last 10 years, Silicon Motion has shipped more than five billion controllers cumulatively – more than any other company in the world. On a yearly basis, Silicon Motion ships more than 750 million NAND controllers.

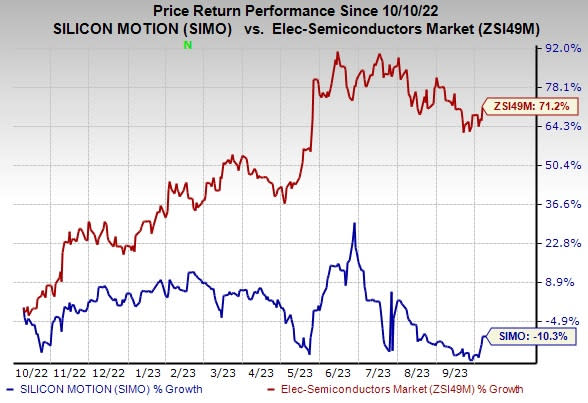

Shares of the company have lost 10.3% in the past year against the industry’s growth of 71.2%.

Image Source: Zacks Investment Research

Silicon Motion presently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 18.7% and delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Ubiquiti Inc. UI, carrying a Zacks Rank #2, is another key pick in the broader industry. Headquartered in New York, it offers a comprehensive portfolio of networking products and solutions for service providers and enterprises at disruptive prices.

Ubiquiti boasts a proprietary network communication platform that is well-equipped to meet end-market customer needs. In addition, it is committed to reducing operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2, delivered an earnings surprise of 5.62%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 5.58%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services analog and digital two-way radio, voice and data communications products and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report