Silicon Motion (SIMO) Q4 Earnings & Revenues Beat Estimates

Silicon Motion Technology Corporation SIMO reported healthy fourth-quarter 2023 results, with the bottom and the top line beating the Zacks Consensus Estimate. The leading developer of microcontroller ICs for NAND flash storage devices witnessed top-line growth driven by healthy demand trends. In addition, the company has executed some management changes to better navigate the volatile market conditions.

Net Income

On a GAAP basis, net income in the reported quarter was $21.1 million or 63 cents per American depositary share (ADS) compared with $23.5 million or 71 cents per ADS in the prior-year quarter. The year-over-year decline was attributable to higher operating expenses.

Non-GAAP net income was $31.3 million or 93 cents per ADS, down from $41.1 million or $1.22 per ADS in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 17 cents.

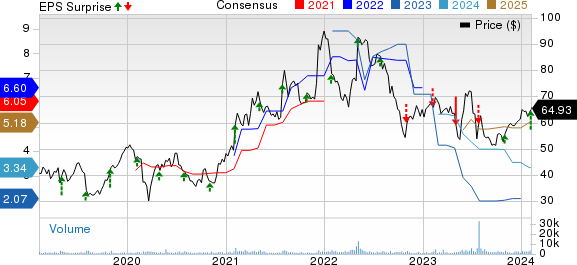

Silicon Motion Technology Corporation Price, Consensus and EPS Surprise

Silicon Motion Technology Corporation price-consensus-eps-surprise-chart | Silicon Motion Technology Corporation Quote

For 2023, GAAP net income was $52.8 million or $1.58 per ADS compared with $172.6 million or $5.17 per ADS in 2022. Non-GAAP net income for 2023 declined 64.4% to $76.1 million ($2.27 per ADS) from $213.9 million ($6.36 per ADS) in 2022.

Revenues

Quarterly revenues increased to $202.4 million from the year-ago quarter’s tally of $200.8 million. The top line marginally surpassed the Zack Consensus Estimate of $202 million.

Despite inventory corrections, increasing competition and soft demand trends in China, the company posted revenue growth in the quarter, focusing on developing the most advanced controller technology and delivering industry-leading solutions to tap new market segments. The core focus on controller technology was primarily driven by the increasing adoption of NAND in consumer, industrial, commercial and enterprise applications.

Silicon Motion has expanded its SSD controller program engagements with PC OEMs and eMMC/UFS controllers for smartphones, automotive applications and IoT/smart devices.

For 2023, net sales decreased to $639.1 million from $945.9 million in 2022.

Other Details

Non-GAAP gross profit aggregated $89.3 million compared with $95.1 million in the year-ago quarter, with respective margins of 44.1% and 47.4%. Non-GAAP operating expenses increased to $61.5 million from $48.5 million. Non-GAAP operating income fell from $46.6 million to $27.8 million, with margins of 23.2% and 13.8%, respectively.

Cash Flow & Liquidity

For full-year 2023, Silicon Motion generated $148.7 million of cash from operating activities compared with $83.8 million a year ago. As of Dec 31, 2023, the company had $314.3 million in cash and cash equivalents with $60.4 million of other liabilities compared with $232.2 million in cash and cash equivalents with $44.7 million of other liabilities.

In the fourth quarter, the company’s capital expenditure totaled $9.5 million. This includes $3.5 million for the routine procurement of testing equipment, software, design tools and other goods and another $6 million for building construction in Hsinchu.

Outlook

For first-quarter 2024, management estimates non-GAAP revenues in the range of $172-$182 million. Non-GAAP gross margin is expected to be 44-45%. Operating margin is anticipated in the band of 10.5-11.5%. The company expects sustainability in growth driven by strong demand for eMMC+UFS and SSD Controllers among flash maker partners.

Zacks Rank & Other Stocks to Consider

Silicon Motion currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

InterDigital, Inc. IDCC is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks.

This Zacks Rank #2 stock has a long-term earnings growth expectation of 17.4% and has surged 75.3% in the past year. A well-established global footprint, diversified product portfolio and ability to penetrate different markets are key growth drivers for InterDigital. The addition of technologies related to sensors, user interface and video to its already strong portfolio of wireless technology solutions is likely to drive considerable value, given the massive size of the market it offers licensing technologies to.

Arista Networks, Inc. ANET, carrying a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance cloud experience. Arista delivered an average earnings surprise of 12% in the trailing four quarters.

The company holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. It is increasingly gaining market traction in 200 and 400-gig high-performance switching products. It remains well-positioned for healthy growth in the data-driven cloud networking business with proactive platforms and predictive operations.

NVIDIA Corporation NVDA, currently carrying a Zacks Rank #2, delivered a trailing four-quarter average earnings surprise of 18.99%. In the last reported quarter, it delivered an earnings surprise of 19.64%.

NVIDIA is the world leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus evolved from PC graphics to AI-based solutions that support high-performance computing, gaming and virtual reality platforms.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report