Silk Road Medical Inc (SILK) Reports Growth Amidst Increased Adoption of TCAR

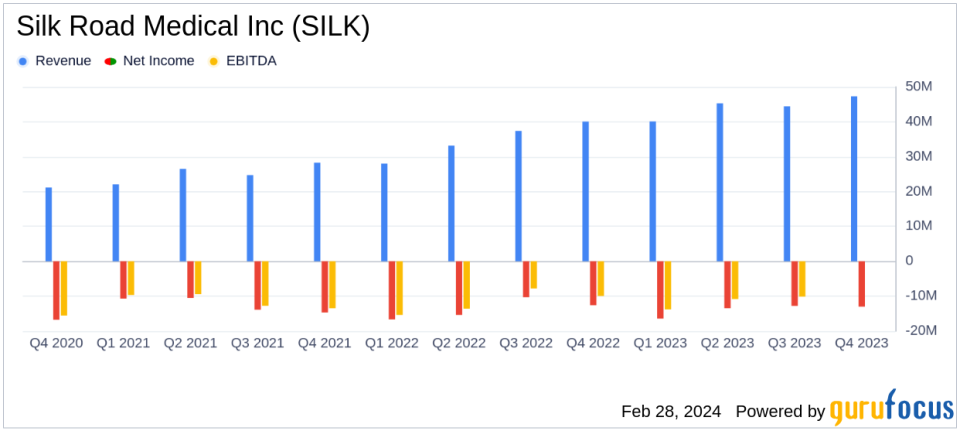

Revenue Growth: Fourth quarter revenue increased by 18% year-over-year, and full year revenue grew by 28%.

Gross Profit and Margin: Gross profit improved in Q4, with a slight increase in gross margin; however, full year gross margin slightly decreased.

Operating Expenses: Operating expenses rose by 18% in Q4 and 22% for the full year, largely due to increased headcount.

Net Loss: Net loss was $13.0 million for Q4 and $55.7 million for the full year, with losses per share slightly improving.

Adjusted EBITDA: Adjusted EBITDA showed a reduced loss in both Q4 and the full year compared to the previous year.

2024 Financial Outlook: Silk Road Medical projects full year 2024 revenue to be between $194 million and $198 million.

Liquidity Position: Cash, cash equivalents, and investments totaled $190.9 million as of December 31, 2023.

On February 28, 2024, Silk Road Medical Inc (NASDAQ:SILK) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, known for its innovative TransCarotid Artery Revascularization (TCAR) procedure aimed at reducing the risk of stroke, reported significant revenue growth driven by increased adoption of its medical technology.

Financial Performance and Challenges

Silk Road Medical's revenue for the fourth quarter of 2023 was $47.3 million, marking an 18% increase from the same period in the previous year. The full year revenue reached $177.1 million, a substantial 28% rise compared to 2022. This growth was primarily attributed to the broader adoption of TCAR. Despite the revenue increase, the company faced a net loss of $13.0 million in Q4 and $55.7 million for the full year. The net loss per share showed a slight improvement from the previous year, indicating a reduction in losses relative to the number of shares outstanding.

Operating expenses for Q4 2023 were $49.2 million, an 18% increase year-over-year, mainly due to an expansion in workforce. For the full year, operating expenses climbed by 22% to $186.4 million. The company's gross profit for the fourth quarter was $34.8 million with a gross margin of 74%, a slight improvement from the previous year's 73%. However, the full year gross margin saw a minor decrease to 72% from 73% in 2022, driven by unfavorable production variances.

Financial Achievements and Industry Significance

The financial achievements of Silk Road Medical are particularly significant in the Medical Devices & Instruments industry, where innovation and adoption rates directly influence revenue growth. The company's ability to increase its gross profit amidst a challenging economic environment underscores the value and demand for its TCAR procedure. Additionally, maintaining a strong liquidity position with $190.9 million in cash, cash equivalents, and investments as of December 31, 2023, provides the company with the financial flexibility to navigate future growth and development strategies.

Management Commentary

With the right team in place, broad reimbursement, and extensive evidence in support of TCAR, we are laser focused on deepening adoption in physicians who perform TCAR, said Chas McKhann, CEO of Silk Road Medical. My experience thus far at Silk Road has only served to further validate the vast opportunity that we see for TCAR to benefit many more patients with carotid artery disease, and Im excited by the underlying progress we are already making towards that end.

Looking Ahead

For 2024, Silk Road Medical has set a revenue projection ranging from $194 million to $198 million, indicating a positive outlook and continued growth expectations. The company's focus remains on expanding the use of TCAR and leveraging its commercial infrastructure to enhance market penetration.

Value investors and potential GuruFocus.com members interested in the medical device sector may find Silk Road Medical's growth trajectory and strategic focus on TCAR adoption to be of particular interest. The company's commitment to innovation and improving patient outcomes positions it as a noteworthy player in the industry.

For further details on Silk Road Medical's financial performance and future outlook, interested parties are encouraged to join the company's conference call or access the webcast available on their investor relations website.

For a comprehensive analysis of Silk Road Medical Inc's financials and strategic direction, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Silk Road Medical Inc for further details.

This article first appeared on GuruFocus.