Silver Lake Group, L.L.C. Reduces Stake in First Advantage Corp

On September 15, 2023, Silver Lake Group, L.L.C. (Trades, Portfolio), a prominent technology-focused investment firm, executed a significant transaction involving First Advantage Corp. This article provides an in-depth analysis of the transaction, the profiles of both Silver Lake Group and First Advantage Corp, and the potential implications for value investors.

Details of the Transaction

Silver Lake Group, L.L.C. (Trades, Portfolio) reduced its holdings in First Advantage Corp by 206,903 shares, representing a change of -0.23%. The transaction, which took place at a trade price of $14.29 per share, had a -0.02% impact on the firm's portfolio. Following the transaction, Silver Lake Group holds a total of 89,673,776 shares in First Advantage Corp, accounting for 8.66% of its portfolio and 61.76% of the traded company's stock.

Profile of Silver Lake Group, L.L.C. (Trades, Portfolio)

Established in 1989, Silver Lake Group, L.L.C. (Trades, Portfolio) is a software-focused investment firm based in Menlo Park, California. The firm has grown significantly over the years, employing over 1,200 people worldwide. Silver Lake Group is recognized as one of the most significant Banking and Financial solutions and services providers in the Asia Pacific region. The firm primarily invests in the consumer discretionary group, with its top holdings in Alibaba Group Holding Limited and Sabre Corporation making up 49% and 47% of its total holdings, respectively. Other significant holdings include VMware Inc, Endeavor Group Holdings Inc, Unity Software Inc, First Advantage Corp, and N-able Inc. The firm's equity stands at $14.81 billion, with a strong focus on the Technology and Communication Services sectors.

Overview of First Advantage Corp

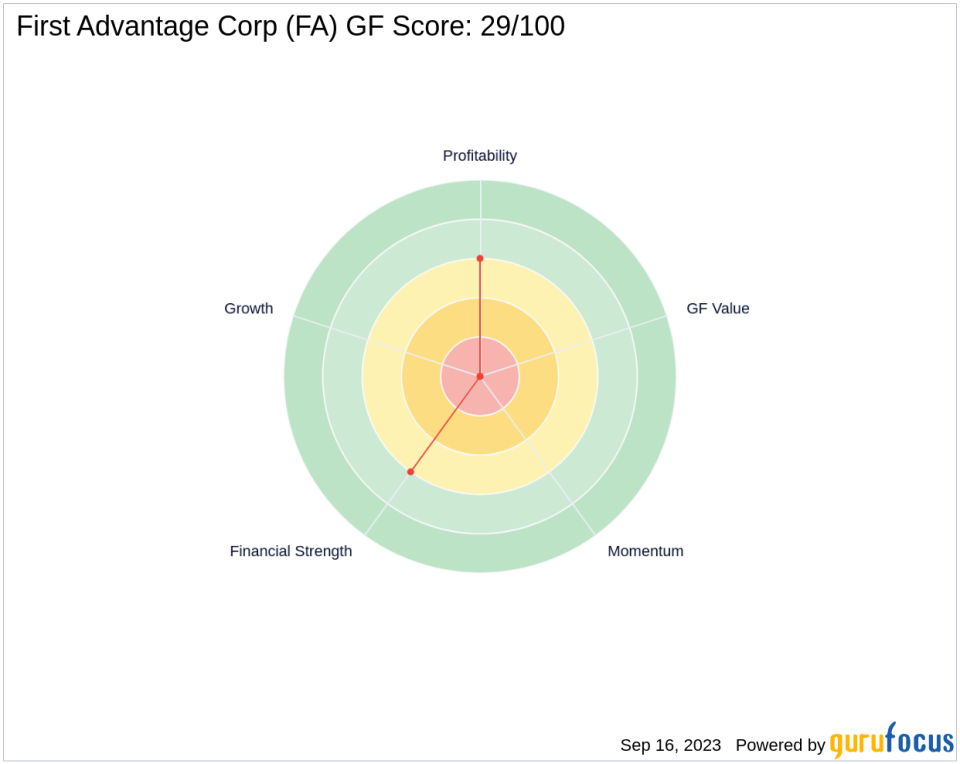

First Advantage Corp is a leading global provider of employment background screening and verification solutions. The company, which went public on June 23, 2021, operates in the Americas and International markets. As of September 16, 2023, the company has a market capitalization of $2.06 billion and a PE ratio of 44.31. The company's GF-Score stands at 29/100, indicating a poor future performance potential. The company's Financial Strength and Profitability Rank are both 6/10, while its Growth Rank is not applicable due to insufficient data.

Analysis of the Transaction

The reduction of Silver Lake Group's stake in First Advantage Corp could be attributed to various factors, including the firm's investment strategy and the traded company's performance. The transaction has slightly decreased the firm's portfolio concentration in First Advantage Corp, but the firm still holds a significant stake in the company. The transaction could potentially influence the traded company's stock, given the firm's substantial holdings.

Comparison with Other Gurus

Other notable gurus, such as Joel Greenblatt (Trades, Portfolio), also hold shares in First Advantage Corp. However, Silver Lake Group, L.L.C. (Trades, Portfolio) remains the largest holder of the traded company's stock, with Baron Funds being the second largest.

Conclusion

In conclusion, Silver Lake Group, L.L.C. (Trades, Portfolio)'s recent transaction involving First Advantage Corp represents a noteworthy development for value investors. The transaction not only reflects the firm's investment strategy but also potentially influences the traded company's stock. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.