Simcoe Capital Management, LLC Reduces Stake in Donnelley Financial Solutions Inc

Simcoe Capital Management, LLC (Trades, Portfolio), a New York-based investment firm, recently adjusted its portfolio by reducing its stake in Donnelley Financial Solutions Inc. This article provides an in-depth analysis of the transaction, the profiles of both the firm and the traded company, and the potential implications for value investors.

Details of the Transaction

On November 3, 2023, Simcoe Capital Management, LLC (Trades, Portfolio) reduced its holdings in Donnelley Financial Solutions Inc by 343,206 shares, representing a change of -11.30%. The transaction, which was executed at a price of $55.55 per share, had a -2.43% impact on the firm's portfolio. Following the transaction, the firm holds a total of 2,695,052 shares in Donnelley Financial Solutions Inc, accounting for 19.57% of its portfolio and 9.26% of the company's total shares.

Profile of Simcoe Capital Management, LLC (Trades, Portfolio)

Simcoe Capital Management, LLC (Trades, Portfolio) is an investment firm located at 6 East 43rd Street, 23rd Floor, New York, NY 10017. The firm's portfolio consists of 12 stocks, with a total equity of $784 million. Its top holdings include Warner Bros. Discovery Inc (NASDAQ:WBD), Asbury Automotive Group Inc (NYSE:ABG), Donnelley Financial Solutions Inc (NYSE:DFIN), Jabil Inc (NYSE:JBL), and SeaWorld Entertainment Inc (NYSE:SEAS). The firm's preferred sectors are Consumer Cyclical and Financial Services.

Overview of Donnelley Financial Solutions Inc

Donnelley Financial Solutions Inc (NYSE:DFIN) is a global risk and compliance solutions company based in the USA. The company, which went public on September 21, 2016, provides regulatory filing and deal solutions to public and private companies, mutual funds, and other regulated investment firms. Its operations are divided into four segments: Capital Markets - Software Solutions, Capital Markets - Compliance and Communications Management, Investment Companies - Software Solutions, and Investment Companies - Compliance and Communications Management. The company has a market capitalization of $1.61 billion and a current stock price of $55.16. Its PE percentage stands at 20.13.

GuruFocus Valuation of Donnelley Financial Solutions Inc

According to GuruFocus valuation, Donnelley Financial Solutions Inc is significantly overvalued, with a GF Value of 34.27 and a Price to GF Value ratio of 1.61. The GF Value represents the current intrinsic value of a stock derived from GuruFocus's exclusive method, which takes into account historical multiples, GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of the business performance.

Performance and Ranking of Donnelley Financial Solutions Inc

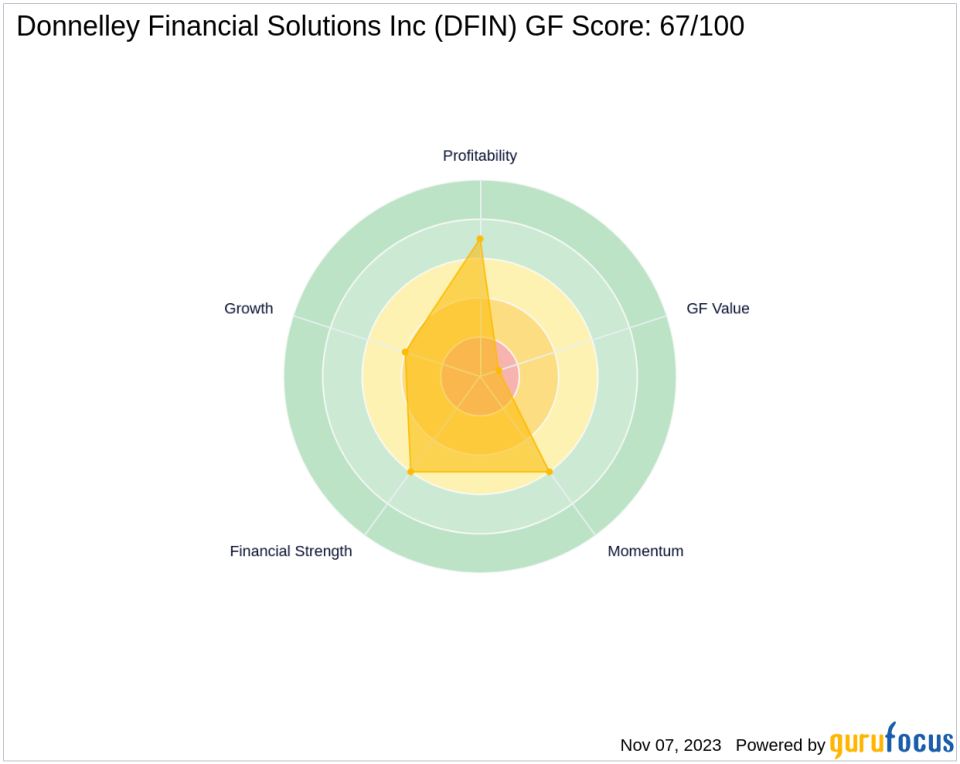

Donnelley Financial Solutions Inc has a Financial Strength rank of 6/10, a Profitability Rank of 7/10, and a Growth Rank of 4/10. The company's GF Score is 67/100, indicating poor future performance potential. Its Piotroski F-Score is 8, suggesting a healthy financial situation, and its Altman Z score is 4.31, indicating low bankruptcy risk. The company's cash to debt ratio is 0.06, and its interest coverage is 7.45.

Other Gurus' Investment in Donnelley Financial Solutions Inc

Other notable gurus who hold shares in Donnelley Financial Solutions Inc include Mario Gabelli (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio). The largest guru holding the traded stock is Fisher Asset Management, LLC.

Conclusion

In conclusion, the recent transaction by Simcoe Capital Management, LLC (Trades, Portfolio) has slightly reduced its exposure to Donnelley Financial Solutions Inc. Despite the company's overvaluation according to GuruFocus, it maintains a healthy financial situation and low bankruptcy risk. This transaction and its potential implications should be of interest to value investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.