Simcoe Capital Management, LLC Reduces Stake in Donnelley Financial Solutions Inc

On August 14, 2023, Simcoe Capital Management, LLC (Trades, Portfolio), a New York-based investment firm, reduced its holdings in Donnelley Financial Solutions Inc (NYSE:DFIN). This article provides an in-depth analysis of the transaction, the guru's profile, and the traded stock company's profile. The data and rankings are accurate as of August 15, 2023.

Profile of Simcoe Capital Management, LLC (Trades, Portfolio)

Simcoe Capital Management, LLC (Trades, Portfolio), located at 6 East 43rd Street, 23rd Floor, New York, NY 10017, is an investment firm with a portfolio of 11 stocks, primarily in the Consumer Cyclical and Financial Services sectors. The firm's top holdings include Warner Bros. Discovery Inc (NASDAQ:WBD), Asbury Automotive Group Inc (NYSE:ABG), Donnelley Financial Solutions Inc (NYSE:DFIN), Jabil Inc (NYSE:JBL), and SeaWorld Entertainment Inc (NYSE:SEAS). The firm's equity stands at $764 million.

Transaction Details

The transaction involved a reduction of 178,926 shares in Donnelley Financial Solutions Inc, representing a change of -5.21%. The shares were traded at a price of $47.81 each. Following the transaction, Simcoe Capital Management, LLC (Trades, Portfolio) holds 3,254,867 shares in the company, accounting for 20.59% of their portfolio and 11.10% of the company's total shares.

Profile of Donnelley Financial Solutions Inc

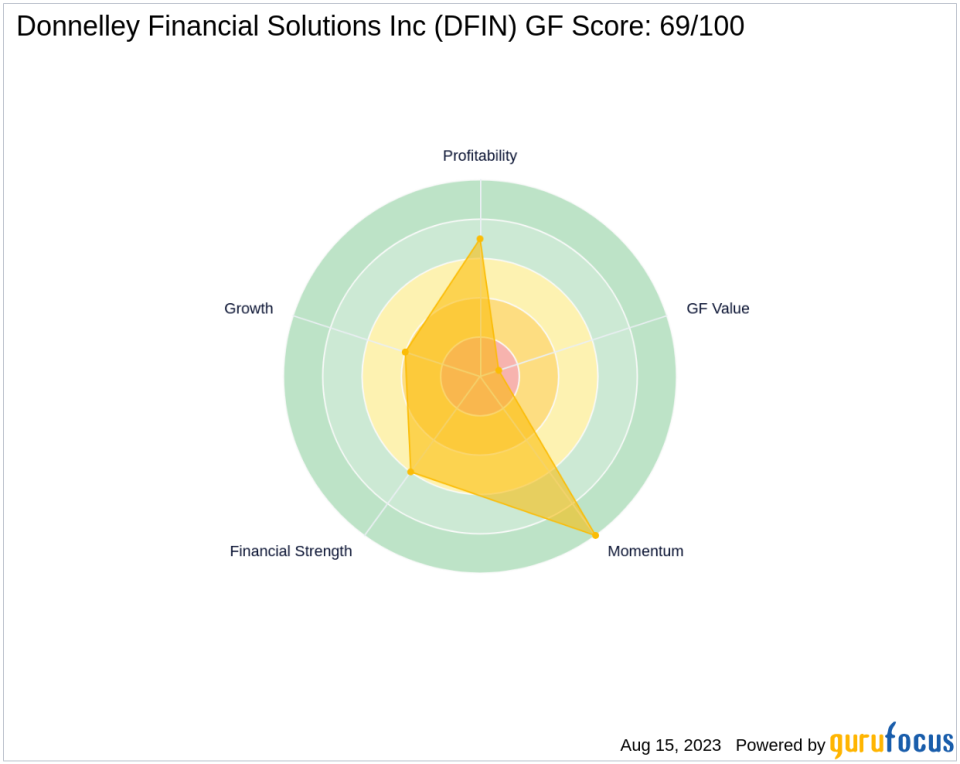

Donnelley Financial Solutions Inc (NYSE:DFIN), a company based in the USA, operates in the Capital Markets industry. The company provides regulatory filing and deal solutions via its software-as-a-service, technology-enabled services, and print and distribution solutions to public and private companies, mutual funds, and other regulated investment firms. The company's market cap stands at $1.38 billion. The company's stock is currently priced at $47.12, with a PE percentage of 17.20. The GF Value of the stock is 32.27, indicating that the stock is significantly overvalued. The stock has gained 109.42% since its IPO on September 21, 2016, and 19.81% year-to-date. The GF Score of the stock is 69/100, suggesting a poor future performance potential. GF-Score

Financial Health and Performance of the Stock

The stock's Financial Strength is ranked 6/10, with a Profitability Rank of 7/10 and a Growth Rank of 4/10. The GF Value Rank is 1/10, indicating that the stock is significantly overvalued. The stock's momentum is strong, with a Momentum Rank of 10/10. The stock's Piotroski F-Score is 6, and its Altman Z score is 3.70, suggesting a low risk of financial distress. The stock's cash to debt ratio is 0.08.

Industry Performance and Growth of the Stock

The stock's industry performance is strong, with an interest coverage of 8.52 and a ROE of 24.43. The stock's gross margin growth is 9.70%, and its operating margin growth is 19.50%. The stock's revenue growth over the past three years is 0.40%, and its EBITDA growth over the same period is 12.60%.

Other Gurus' Involvement

Other gurus who also hold the traded stock include Mario Gabelli (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio). The largest guru who holds the most shares of the traded stock is Fisher Asset Management, LLC.

Transaction Analysis

The reduction in Simcoe Capital Management, LLC (Trades, Portfolio)'s stake in Donnelley Financial Solutions Inc is likely to have a significant impact on the firm's portfolio, given that the stock accounts for 20.59% of their holdings. The transaction may also influence the stock's performance, considering that the firm holds 11.10% of the company's total shares. However, the stock's overvaluation and poor future performance potential, as indicated by its GF Score, suggest that the firm's decision to reduce its stake may be a strategic move to mitigate potential risks.

This article first appeared on GuruFocus.