Simmons First National Corp (SFNC) Announces Q4 2023 Earnings and Strategic Initiatives

Net Income and EPS: Reported net income of $23.9 million and diluted EPS of $0.19 for Q4 2023, with adjusted figures showing $50.2 million and $0.40 respectively.

Net Interest Income and Margin: Net interest income increased by 1% with a net interest margin of 2.68%, up 7 basis points from the previous quarter.

Asset Quality: Net charge-offs (NCO) for the quarter were 11 basis points, and the allowance for credit losses to total loans ratio ended at 1.34%.

Capital Ratios: Equity to assets ratio stood at 12.53%, with tangible common equity (TCE) ratio improving to 7.69%.

Dividend Increase and Share Repurchase: Quarterly cash dividend increased by 5%, and a new $175 million share repurchase program was authorized.

Balance Sheet Growth: Total loans increased to $16.846 billion, up from $16.142 billion in Q4 2022.

Strategic Decisions: Sold $241 million of AFS securities to pay down higher rate wholesale funding, with an estimated earn back period of ~2.5 years.

Simmons First National Corp (NASDAQ:SFNC), a prominent financial holding company, released its 8-K filing on January 24, 2024, detailing its financial results for the fourth quarter of 2023. The company, through its subsidiaries, provides a comprehensive suite of banking services across the United States, including loans, deposits, and wealth management.

Financial Performance and Challenges

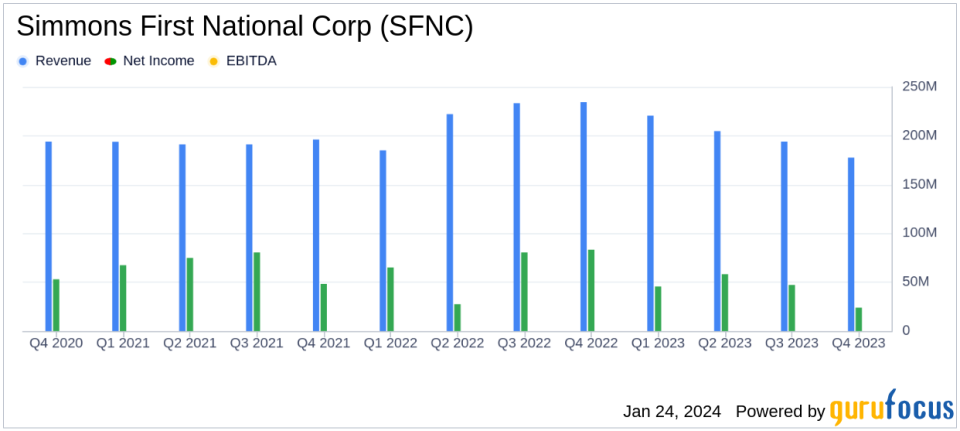

Simmons reported a net income of $23.9 million for Q4 2023, a decrease from $47.2 million in the previous quarter and $83.3 million in the same quarter of the previous year. Diluted earnings per share (EPS) were $0.19, compared to $0.37 in Q3 2023 and $0.65 in Q4 2022. Adjusted for certain items, earnings were $50.2 million and adjusted diluted EPS were $0.40.

Despite the challenging economic environment, the company experienced positive trends in net interest income and net interest margin, reflecting disciplined loan and deposit pricing. Deposit growth was primarily driven by an increase in customer deposits, particularly money market and savings accounts.

Simmons maintained a strong risk profile with net charge-offs at 11 basis points for the quarter. The allowance for credit losses on loans to total loans ended the quarter at 1.34%, as provision expense exceeded net charge-offs. Expense growth was contained, excluding the impact of a FDIC special assessment.

Strategic Actions and Financial Achievements

Simmons took strategic actions to position itself favorably for 2024, including the sale of certain lower-yielding bonds from its securities portfolio, which resulted in a pre-tax loss but is expected to pay off in approximately 2.5 years. The company also recorded a noninterest expense for a FDIC special assessment due to the failure of certain banks in 2023.

The company's balance sheet showed growth in total loans, reaching $16.846 billion, up from $16.142 billion in Q4 2022. Total deposits remained stable at $22.245 billion. The equity to assets ratio improved to 12.53%, and the tangible common equity ratio increased to 7.69%. Book value per share and tangible book value per share also saw increases of 4% and 8%, respectively.

Simmons' board of directors authorized a new $175 million share repurchase program and approved a 5% increase in the quarterly cash dividend, signaling confidence in the company's financial strength and commitment to delivering shareholder value.

Income Statement and Balance Sheet Highlights

Net interest income for Q4 2023 totaled $155.6 million, with interest income at $323.5 million and interest expense at $167.9 million. The yield on loans was 6.20%, and the yield on investment securities was 3.67%. Noninterest income, excluding the loss on the sale of AFS investment securities, was $42.2 million.

Noninterest expense for the quarter was $148.1 million, which included $15.4 million related to branch right-sizing, early retirement program costs, and a FDIC special assessment. Adjusted noninterest expense was $132.7 million.

Provision for income taxes for Q4 2023 was $(4.5) million, reflecting an effective tax rate adjustment based on the level of taxable income, primarily due to the FDIC special assessment and loss on the sale of securities.

Analysis and Outlook

Simmons' Q4 2023 performance reflects a resilient business model amid economic uncertainty. The company's strategic sale of AFS securities and disciplined expense management demonstrate a proactive approach to navigating market conditions. The increase in the quarterly cash dividend and the new share repurchase program underscore the company's commitment to shareholder returns.

As Simmons enters 2024, the company's strategic actions taken in the past year, including the Better Bank Initiative, are expected to provide a solid foundation for capitalizing on opportunities and addressing challenges ahead.

For more detailed information on Simmons First National Corp's Q4 2023 earnings, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Simmons First National Corp for further details.

This article first appeared on GuruFocus.