This Simple but Effective Fund Is 2023’s Most Popular ETF

One ETF has taken in more money than all others so far in 2023, with a massive $11.3 billion in inflows as of June 6th, according to FactSet. But it’s not a hot new AI fund or an ETF capitalizing on other en-vogue tech trends, although it will give you some exposure to them. Instead, it’s arguably one of the most boring, vanilla ETFs out there, but this doesn’t mean it can’t help you to grow your portfolio. It’s the Vanguard S&P 500 ETF (NYSEARCA:VOO). In fact, whether you are just beginning your investing journey or if you are already a veteran trader who has spent years in the investing game, this unassuming but massive ETF can serve as a sound building block for your portfolio. Here’s why.

Harness the Power of the Entire S&P 500 in Your Portfolio

The Vanguard S&P 500 ETF boasts over $300 billion in assets under management (AUM), making it the third-largest ETF in the market today. While there are many complex investing strategies and products out there that claim to offer investors a leg up on the market, VOO keeps it simple. It invests in the S&P 500, the index that consists of about 500 of the largest 500 U.S. stocks and arguably the most important and influential index in the investing world.

The S&P 500 covers all sectors of the U.S. economy, so rather than having to bet on individual sectors, an ETF like VOO gives you exposure to them all — from tech leaders like Apple and Microsoft to old economy industrial giants like Caterpillar and Deere and everything in between.

The great thing about VOO is that it allows investors to harness the power and innovation of a large swath of the U.S. economy in one investment vehicle without having to pick favorite sectors or stocks. An investment in VOO is essentially a bet on around 500 of the top publicly-listed companies in the United States continuing to innovate and profit over time, which has historically been a winning proposition.

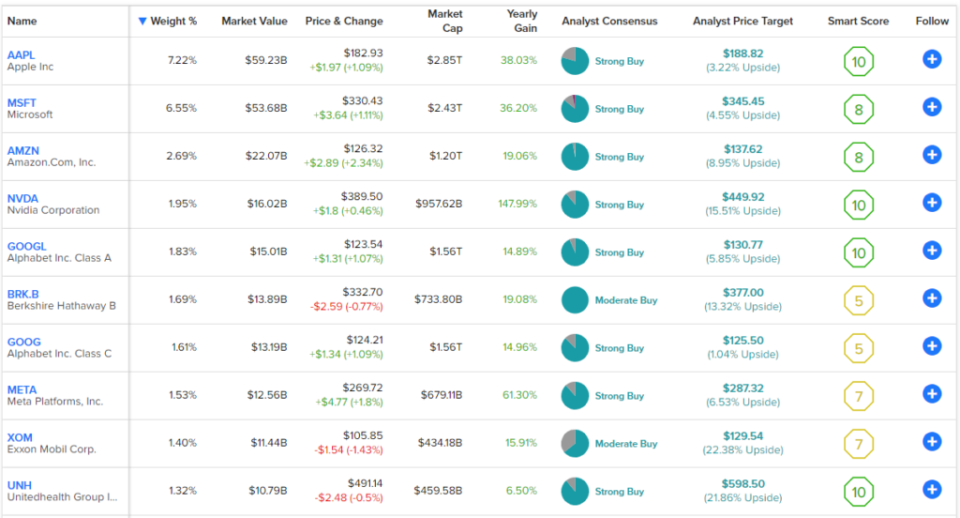

Below, you’ll find an overview of VOO’s top 10 holdings, created using TipRanks’ holdings tool.

Because it tracks the S&P 500 index itself, the fund is extraordinarily diversified, holding 504 stocks, and its top 10 positions make up just 27.8% of assets. As you can see, top holding Apple accounts for a 7.2% position in the fund, followed by Microsoft, which has a 6.6% weighting, with Amazon, Nvidia and Alphabet (Class A) rounding out the top five holdings. However, it’s not just tech stocks, Warren Buffett’s Berkshire Hathaway and energy giant ExxonMobil follow closely behind.

As you can see in the table, VOO’s top holdings feature a pretty solid collection of Smart Scores. In fact, four of its top 10 holdings, Apple, Nvidia, Alphabet, and UnitedHealth Group, feature ‘Perfect 10’ Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating, and VOO itself has a strong ETF Smart Score of 8 out of 10.

Is VOO Stock a Buy, According to Analysts?

So the quantitative factors rate VOO favorably, but what do Wall Street analysts think? VOO earns a Moderate Buy consensus rating on TipRanks based on analysts’ ratings, and the average VOO stock price target of $445.50 implies upside potential of 11.9%. Of the 6,212 analyst ratings on the name, 59.13% are Buys, 35.33% are Holds, and just 5.54% are Sells.

Investor-Friendly Fees

In addition to this ample diversification and broad exposure, another attractive feature of VOO is its low expense ratio. It’s hard to beat VOO’s minuscule expense ratio of just 0.03%. An investor putting $10,000 into VOO would pay just $3 in fees in year one. This type of investor-friendly expense structure helps investors defend the principal of their portfolios over time without coughing up too much in fees. For example, assuming this fee remains constant and that the fund returns 5% a year for the next 10 years, an investor will pay just $39 in fees over the course of the decade. Compare this to the multitude of ETFs on the market with expense ratios of 0.75%, where investors are paying $75 in fees on a $10,000 investment in just year one, and you really see the value proposition of an ETF like VOO.

Solid Long-Term Performance

With this diversification and investor-friendly expense ratio, it’s easy to see why this massive ETF is the most popular ETF in terms of inflows so far this year. Still, there’s also another factor leading to its popularity — its long-term performance track record. VOO has consistently produced double-digit annualized total returns for its investors for a long time. No matter what time horizon you are looking over, VOO has delivered. As of the end of May, VOO had an annualized total return of 12.8% over a three-year time frame. Over a five-year time horizon, the massive ETF has delivered 11% total returns annually. Further, over the past 10 years, VOO returned 11.9% annually. VOO has been around since 2010, and since its inception that year, it has returned a stellar 13.3% on an annualized basis.

Keeping Things Simple Can Pay Off

It doesn’t hurt to keep it simple. While there are plenty of exotic investment strategies out there, few beat an ETF like VOO over the long term. While this S&P 500 ETF isn’t the type of investment that is going to give you a multi-bag return in a year, the reality is that few investments are. However, the good news is that investing in a broad-market ETF like this and allowing these gains to compound over the years is a time-tested way to build long-term wealth. Investors can dollar-cost average over time when they have a surplus of cash and/or when the S&P 500 falls while reinvesting dividends to amplify these results even more.

VOO’s strong performance track record, investor-friendly expense ratio, and portfolio of around 500 of the top U.S. stocks have made it a winner for a long time, and it’s likely to remain a winner for the foreseeable future.