Simpson Manufacturing Co Inc (SSD) Reports Growth in Net Sales and Earnings Per Share for 2023

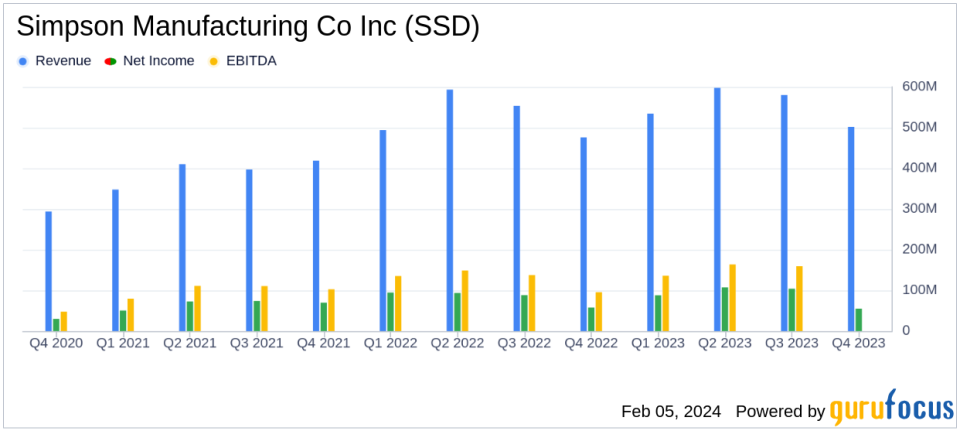

Net Sales: Q4 net sales rose 5.5% to $501.7 million, and annual net sales increased 4.6% to $2.2 billion.

Gross Profit: Q4 gross profit surged 9.9% to $220.5 million, with a gross margin increase to 43.9%.

Net Income: 2023 net income per diluted share grew 6.5% to $8.26.

Dividends and Buybacks: Declared a $0.27 per share dividend and repurchased $50.0 million in common stock in 2023.

Operational Challenges: Higher operating expenses led to a 9.1% decrease in income from operations to $71.6 million in Q4.

Cash Flow: Cash provided by operating activities decreased to $31.7 million in Q4, a $104.7 million decline from the previous year.

Simpson Manufacturing Co Inc (NYSE:SSD), a leading manufacturer of engineered structural connectors and building solutions, released its 8-K filing on February 5, 2024, detailing its financial results for the fourth quarter and full year of 2023. The company, which supplies products to residential, light industrial, and commercial construction markets, as well as the remodeling and do-it-yourself markets, primarily in the United States, reported a year-over-year increase in net sales and net income per diluted share.

Financial Performance and Challenges

The company's performance in the fourth quarter showed a 5.5% increase in consolidated net sales, amounting to $501.7 million. This growth was driven by higher sales volumes in North America and the positive impact of foreign currency translation in Europe. Gross profit for the quarter also saw a significant increase of 9.9%, reaching $220.5 million, with consolidated gross margin improving to 43.9% from 42.2%. The increase in gross margin was attributed to lower raw material and labor costs as a percentage of net sales.

Despite these achievements, Simpson Manufacturing faced challenges in the form of increased operating expenses, which led to a 9.1% decrease in consolidated income from operations, down to $71.6 million. The rise in operating expenses was primarily due to higher personnel costs, professional fees, and variable compensation. This was only partly offset by the higher gross profits.

Annual Highlights and Management Commentary

For the full year, Simpson Manufacturing reported a 4.6% increase in consolidated net sales to $2.2 billion, with net income reaching $354.0 million, or $8.26 per diluted share, a 6.5% increase from the previous year. The company's President and CEO, Mike Olosky, commented on the results:

We achieved above market growth and strong profitability in 2023 with $2.2 billion in annual net sales, a 21.5% operating income margin and $8.26 of earnings per diluted share, said Olosky. Our topline performance was driven by continued share gains across all of our end markets and product lines."

Olosky also noted the challenges faced in North America and Europe, citing economic headwinds and lower construction activity in Europe, while emphasizing the company's strategic investments aimed at accelerating growth.

Financial Tables and Outlook

The company's balance sheet remains robust, with cash and cash equivalents of $429.8 million as of December 31, 2023. The outlook for the fiscal year ending December 31, 2024, includes an operating margin estimated to be in the range of 20.0% to 21.5%, and capital expenditures estimated to be approximately $200.0 million, which includes significant investments in facility expansions.

Simpson Manufacturing's focus on strategic growth and market share gains, despite the operational challenges, positions the company to potentially benefit from the estimated shortage of homes in the U.S. and the improving outlook for the construction industry in 2024. Investors and analysts are invited to join the company's financial results conference call for further details on the performance and outlook.

For more in-depth analysis and up-to-date financial information, visit GuruFocus.com, where value investors and potential members can gain access to valuable insights into Simpson Manufacturing Co Inc (NYSE:SSD) and other companies.

Explore the complete 8-K earnings release (here) from Simpson Manufacturing Co Inc for further details.

This article first appeared on GuruFocus.