Simulations Plus (SLP) Ties With IMB PAS for New Compounds

Simulations Plus SLP recently announced that it has partnered with the Institute of Medical Biology of the Polish Academy of Sciences (IMB PAS) to design new compounds for the RORγ/RORγT nuclear receptors. As a part of the agreement, Simulations Plus will be leveraging artificial intelligence (AI) / machine learning (ML) technologies in the ADMET Predictor platform for development of new compounds.

ADMET Predictor is the company’s flagship software platform for ADMET (chemical absorption, distribution, metabolism, excretion and toxicity) modeling, and features data analysis, metabolism prediction and AI-driven drug design fucntionalities.

By using the AI-Driven Drug Design or AIDD Module in ADMET Predictor, Simulations Plus will be able to create predictive models of inhibition and activation for the human RORγ/RORγT nuclear receptors. The company added that any intellectual property (such as encouraging lead compounds) arising from the collaboration, will be jointly owned by Simulations Plus and IMB PAS for further development.

Simulations Plus, Inc. Price and Consensus

Simulations Plus, Inc. price-consensus-chart | Simulations Plus, Inc. Quote

SLP further stated that the generative chemistry approaches within the AIDD Module will yield novel virtual compounds with desired blends of the properties as chosen which will then be used by IMB PAS to synthesize and test analogs.

Headquartered in Lancaster, CA, Simulations Plus develops drug discovery and development simulation software, which is licensed to and used in the conduct of drug research by major pharmaceutical and biotechnology companies worldwide.

The company’s performance is being driven by strength in its services revenues which increased 17% to $5.9 million in the last reported quarter. Software segment revenues were affected due to changes in renewal pattern and shift in revenue seasonality.

For fiscal 2023, SLP expects revenue growth of 10-15% year over year and in the range of $59.3-$62 million. For the fiscal year, the company expects Software and Services to consist 60-65% and 35-40% of revenues, respectively.

In January 2023, Simulations Plus rolled out the latest version of DILIsym — DILIsym version X (DSX) Beta — with redesigned software infrastructure. The new redesigned software infrastructure also includes command line and graphical interface options along with server/cloud computing functionalities. The latest version improves speed in obtaining results and is expected to boost its adoption among pharmaceuticals companies, regulators and academics.

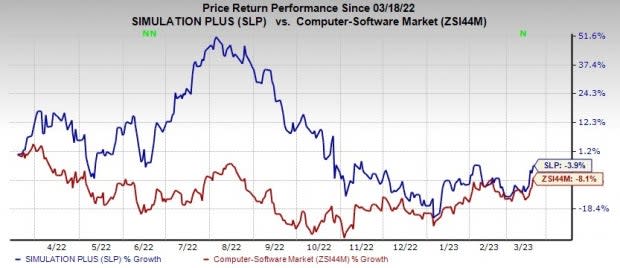

Currently, SLP carries a Zacks Rank #3 (Hold). Shares of the company have lost 3.9% compared with sub-industry’s decline of 8.1% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Arista Networks ANET, Perion Network PERI and Pegasystems PEGA, each presently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2023 earnings is pegged at $5.79 per share, rising 11.6% in the past 60 days. The long-term earnings growth rate is anticipated to be 14.2%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 14.2%. Shares of ANET have increased 24% in the past year.

The Zacks Consensus Estimate for Perion’s 2023 earnings is pegged at $2.69 per share, rising 16% in the past 60 days. The long-term earnings growth rate is anticipated to be 25%.

Perion’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 31.7%. Shares of PERI have increased 63.5% in the past year.

The Zacks Consensus Estimate for Pegasystem’s 2023 earnings is pegged at $1.35 per share, rising 61% in the past 60 days.

Pegasystem’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, the average surprise being 11.2%. Shares of PEGA have declined 40.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simulations Plus, Inc. (SLP) : Free Stock Analysis Report

Perion Network Ltd (PERI) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report