Sinclair Inc (SBGI) Reports Decline in Q4 and Full-Year 2023 Revenues Amidst Strategic Adjustments

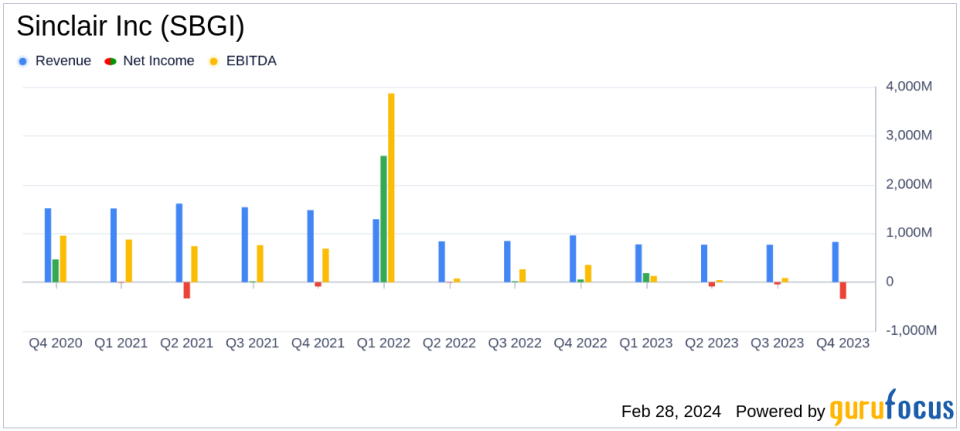

Total Q4 Revenues: Decreased by 14% year-over-year to $826 million.

Media Revenues: Q4 media revenues down 14% to $821 million; full-year media revenues decreased by 20% to $3,106 million.

Advertising Revenues: Q4 advertising revenues fell 28% to $363 million; core advertising revenues up 2%.

Operating Loss: Reported a Q4 operating loss of $386 million, including significant litigation settlement accrual.

Net Loss: Q4 net loss attributable to Sinclair was $341 million; full-year net loss of $291 million.

Adjusted EBITDA: Decreased by 41% in Q4 to $181 million; full-year Adjusted EBITDA down 42% to $549 million.

Debt Repurchase: Repurchased $27 million of debt in January 2024, continuing the deleveraging effort.

On February 28, 2024, Sinclair Inc (NASDAQ:SBGI) released its 8-K filing, detailing financial results for the fourth quarter and full year ended December 31, 2023. The company, a diversified media entity and the second-largest television station operator in the U.S., faced a challenging year with a decline in total and media revenues, alongside a significant operating loss due to non-recurring costs, including a litigation settlement accrual related to Diamond Sports Group (DSG) litigation.

Company Overview

Sinclair Broadcast Group operates 185 stations across 86 markets, with a portfolio that includes the Tennis Channel and four multicast networks. The company's recent developments include the acquisition of WTA rights in India and Spain for the Tennis Channel International, and a settlement with DSG that resolves outstanding litigation claims and reorganizes DSG's assets to better position future RSNs.

Financial Performance and Challenges

For the fourth quarter, Sinclair reported a 14% decrease in total revenues to $826 million, compared to $960 million in the prior year. Media revenues also saw a 14% decline to $821 million. Advertising revenues were hit hard, with a 28% decrease to $363 million, although core advertising revenues showed a slight increase of 2%. The company's operating loss stood at $386 million, including $499 million in Adjustments, primarily due to a litigation settlement accrual. The net loss attributable to Sinclair was $341 million for the quarter.

The full-year results mirrored the quarterly trend, with total revenues down 20% to $3,134 million and media revenues decreasing by the same percentage to $3,106 million. The net loss for the year was reported at $291 million. Adjusted EBITDA for the year decreased by 42% to $549 million, primarily due to lower political advertising revenues in an off-cycle election year.

Strategic Deleveraging and Technological Advancements

Despite the financial setbacks, Sinclair made strategic moves to strengthen its balance sheet and advance its technological capabilities. The company continued its commitment to deleveraging, repurchasing over $91 million in debt principal across all tranches at an average discount to par of 19%. Additionally, the rollout of NextGen Broadcast technology is reaching 75% of the U.S. population, with expectations to deploy 15 million NextGen TV receivers by the end of 2024.

"Sinclair delivered a solid finish to 2023 with our local media segment meeting guidance and Tennis Channel exceeding expectations," said Chris Ripley, Sinclairs President and Chief Executive Officer. "We are focused on continuing to drive industry-leading core advertising revenue growth and net retrans growth, and anticipate another record year for political advertising revenue to generate strong financial results in 2024."

Outlook and Future Developments

Looking ahead, Sinclair anticipates a rebound in political advertising revenue and aims to capitalize on the NextGen Broadcast technology. The company has also renewed key distribution agreements and continues to invest in its diverse portfolio, including minority investments valued at approximately $1.2 billion.

Investors and analysts will be closely monitoring Sinclair's ability to navigate the evolving media landscape, manage its debt levels, and leverage its technological advancements to drive future growth.

For a more detailed breakdown of Sinclair's financials and future outlook, interested parties can access the full earnings report and join the company's conference call scheduled for February 28, 2024.

For further information and analysis on Sinclair Inc (NASDAQ:SBGI) and the media industry, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Sinclair Inc for further details.

This article first appeared on GuruFocus.