This Is the Single Best Artificial Intelligence (AI) Stock to Buy, According to a Wall Street Analyst

Wedbush Securities analyst Dan Ives has said Palantir Technologies (NYSE: PLTR) is probably the best pure-play artificial intelligence (AI) stock on the market. He also called the company an "undiscovered gem" following its fourth-quarter earnings report, which highlighted unprecedented demand for its new platform.

Ives has referred to AI as the fourth industrial revolution, likening its potential impact to the advent of the internet and the invention of the smartphone. Those technologies created significant wealth for investors, and the AI boom could be just as lucrative.

Here's what investors should know about Palantir.

Palantir impressed the market with its fourth-quarter report

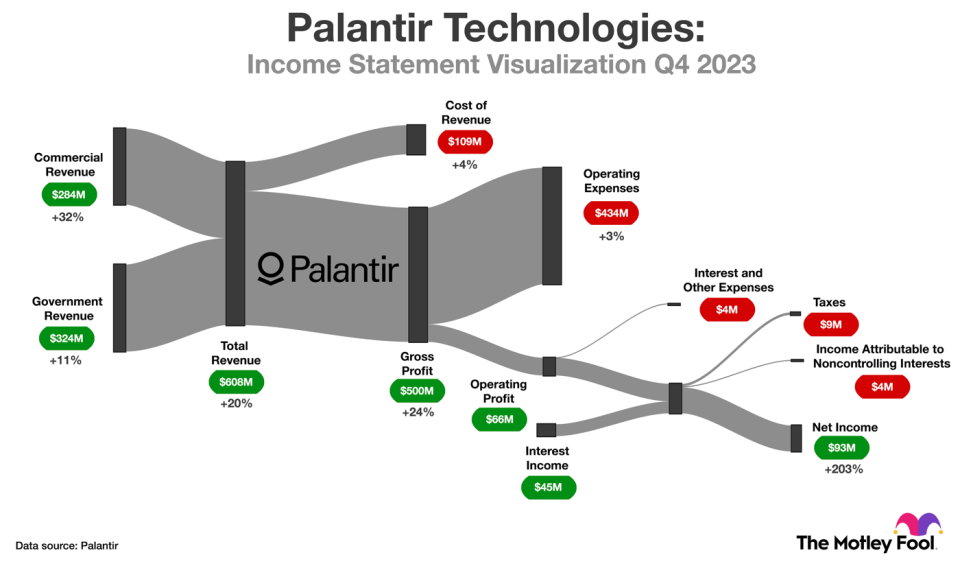

Palantir stock soared 19% after the company reported encouraging financial results in the fourth quarter. Revenue rose 20% to $608 million due to strong demand for AIP (Artificial Intelligence Platform) among commercial customers, though growth in the government segment remained muted. On the bottom line, generally accepted accounting principles (GAAP) net income tripled to reach $93 million as Palantir leaned into cost control.

The flow diagram below provides more detail on the company's performance in Q4.

Another noteworthy development in Q4 was the 35% year-over-year customer growth driven by especially strong momentum in the commercial segment. Palantir still has a relatively small clientele, with just 497 customers, so expansion is encouraging because it diversifies revenue across a larger base. In other words, the risk associated with highly concentrated revenue is slowly diminishing.

Palantir is a leader in artificial intelligence and machine learning platforms

Artificial intelligence (AI) and analytics are the IT categories likely to see the largest spending increases in 2024, according to a survey from Morgan Stanley. Palantir is well positioned to benefit, given that its business sits between those technologies.

Specifically, its platforms integrate data and machine learning (ML) models to build ontologies, which are maps defining the relationship between digital information and physical assets. Users can run ontology data through prebuilt analytics tools and custom applications, thereby gleaning insights that improve decision-making and operating efficiency. In short, Palantir provides frameworks that help businesses use AI to create real value.

Industry analysts have recognized Palantir as a leader in AI/ML platforms and ModelOps, a discipline concerned with the development, evaluation, and deployment of models. The company is leaning into demand for generative AI with AIP, a new product that brings support for large language models to its existing analytics platforms. AIP has so far been a resounding success.

To quote CEO Alex Karp's shareholder letter: "It once took weeks and months, if not longer, for data integration and analytical software platforms to be set up and integrated with a customer's existing systems. AIP can now be up and running in as little as a few hours." He also commented that demand for AIP is unlike anything the company has seen in its two-decade history.

Palantir has restructured its go-to-market strategy around AIP boot camps -- five-day events in which current and prospective customers learn to apply AIP to real-use cases involving data from their businesses. Chief Revenue Officer Ryan Taylor says boot camps are compressing sales cycles and accelerating commercial-customer acquisition, and that efficiency leaves room for continued margin expansion over time.

Palantir stock looks a bit expensive at its current valuation

Palantir helps clients build data-driven intelligence applications that solve complex, high-value use cases, according to Forrester Research. Its platform is ideal for businesses with heavy data requirements that want to deploy AI quickly. The market has realized that to some extent. Palantir ranked second (behind Microsoft) in AI software market share in 2022, according to the International Data Corp. And AIP should help the company maintain its momentum.

With that in mind, Straits Research expects the big-data analytics market to expand at 14% annually through 2031. Meanwhile, Grand View Research believes the artificial intelligence market will compound at 37% annually through 2030. Palantir should benefit from both tailwinds, and its top-line growth should land somewhere in the middle of those projections.

Wall Street expects the company to grow revenue at 21% annually over the next five years. In that context, the current valuation of 24.3 times sales looks pricey, especially when the two-year average is 12.9 times sales. Investors eager to own this stock can buy a very small position today, but it would be prudent to wait for a cheaper price before building out a large position.

As a final thought, Wall Street analysts may identify certain companies as the best AI stocks, but I doubt any analyst would advise concentrating money in a single brand. It would be far more prudent to spread capital across a basket of AI stocks. Investors should keep that in mind as they position their portfolios to capitalize on the AI boom.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 5, 2024

Trevor Jennewine has positions in Palantir Technologies. The Motley Fool has positions in and recommends Microsoft and Palantir Technologies. The Motley Fool has a disclosure policy.

This Is the Single Best Artificial Intelligence (AI) Stock to Buy, According to a Wall Street Analyst was originally published by The Motley Fool