Sirius XM Holdings Inc (SIRI) Reports Steady Revenue and Net Income Growth Amidst Increased ...

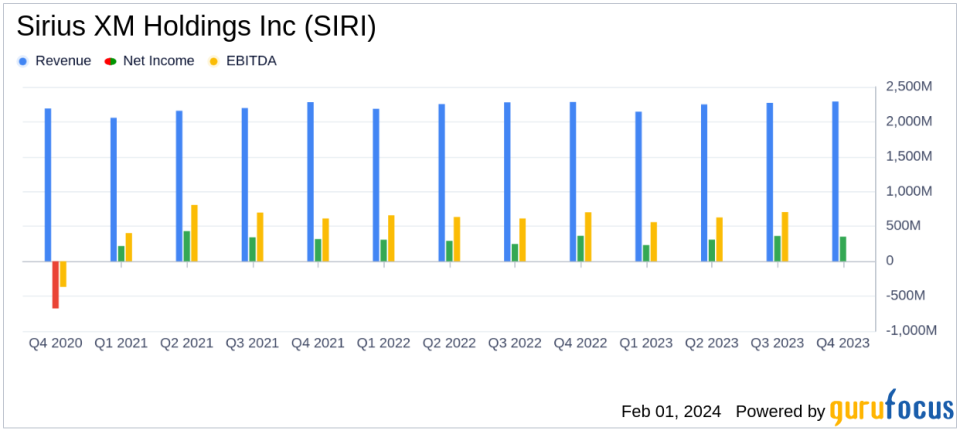

Revenue: Full-year revenue remained relatively flat at $8.95 billion.

Net Income: Full-year net income increased slightly to $1.26 billion, with diluted EPS of $0.32.

Adjusted EBITDA: Full-year adjusted EBITDA saw a slight decline of 2% to $2.79 billion.

Free Cash Flow: Full-year free cash flow decreased to $1.20 billion, attributed to higher capital expenditures and cash taxes.

Subscribers: Total subscribers at year-end stood at approximately 34 million, with a decrease in self-pay subscribers.

2024 Financial Guidance: The company anticipates total revenue of approximately $8.75 billion, adjusted EBITDA of $2.70 billion, and free cash flow of $1.20 billion.

On February 1, 2024, Sirius XM Holdings Inc (NASDAQ:SIRI) released its 8-K filing, detailing its financial performance for the fourth quarter and full-year 2023. The company, which operates two primary businesses, SiriusXM and Pandora, has maintained its revenue year-over-year at $8.95 billion, while net income saw a marginal increase from $1.21 billion in the previous year to $1.26 billion. Despite the challenges posed by increased capital expenditures and higher cash taxes, which led to a decrease in free cash flow, Sirius XM Holdings Inc (NASDAQ:SIRI) has demonstrated resilience in its financial results.

Sirius XM Holdings Inc (NASDAQ:SIRI) is known for its satellite radio and streaming services, offering a wide range of content from music to talk shows, sports, and news. The company's acquisition of Pandora Media has expanded its streaming music platform, which includes an ad-supported radio option and a paid on-demand service. Liberty Media, holding an 81% stake in Sirius XM, underscores the company's significant position in the Media - Diversified industry.

Performance and Challenges

The company's performance in 2023 was marked by strategic content investments and the launch of a next-generation platform, which CEO Jennifer Witz highlighted as laying the groundwork for future growth. CFO Tom Barry emphasized the company's resilient performance and the potential for further cost efficiencies. Despite these positive developments, Sirius XM Holdings Inc (NASDAQ:SIRI) faced challenges, including a decrease in self-pay subscribers and a decline in advertising revenue, which could pose risks to future revenue streams.

Financial Achievements and Importance

One of the key financial achievements for Sirius XM Holdings Inc (NASDAQ:SIRI) in 2023 was the ability to maintain a steady revenue stream in a challenging economic environment. The company's ability to slightly increase its net income and manage a high gross margin of 61% for SiriusXM and 30% for Pandora and Off-Platform segments is indicative of its effective cost management and strong market position. These achievements are particularly important for a subscription-based company, as they reflect the company's ability to retain and monetize its customer base effectively.

Key Financial Details

From the income statement, the company reported a total revenue of $2.29 billion for the fourth quarter and $8.95 billion for the full year, with a gross profit of $4.2 billion for SiriusXM. The balance sheet shows a healthy position with $216 million in cash and cash equivalents. The cash flow statement indicates a robust operating cash flow of $1.85 billion for the year, despite the increased capital expenditures that impacted free cash flow.

"In 2023, SiriusXM laid the groundwork for future growth through the successful launch of our next-generation platform and the new SiriusXM app, said Jennifer Witz, Chief Executive Officer.

Our fourth quarter financial results speak volumes about our resilient performance, said Tom Barry, Chief Financial Officer.

Analysis of Company's Performance

While Sirius XM Holdings Inc (NASDAQ:SIRI) has managed to maintain its revenue and increase net income, the slight decrease in adjusted EBITDA and the significant drop in free cash flow highlight the company's investment phase, which could yield future benefits but also requires careful management of expenses and subscriber growth. The company's guidance for 2024 suggests a cautious outlook, with revenue expected to decline slightly but with a stable projection for adjusted EBITDA and free cash flow.

The company's strategic investments in content and technology, along with its focus on cost optimization, are expected to strengthen its long-term growth profile. However, the decrease in self-pay subscribers and the challenges in the advertising market will be areas to watch in the coming year.

For a detailed analysis of Sirius XM Holdings Inc (NASDAQ:SIRI)'s financial results and future outlook, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Sirius XM Holdings Inc for further details.

This article first appeared on GuruFocus.