Sirius XM (SIRI) Q2 Earnings Match Estimates, Revenues Miss

Sirius XM Holdings SIRI reported second-quarter 2023 earnings of 8 cents per share, which matched the Zacks Consensus Estimate and increased 14.3% year over year.

Total revenues on a reported basis declined 0.1% year over year to $2.25 billion and missed the consensus mark by 0.14%.

Subscriber revenues (76.7% of total revenues) gained 0.3% from the year-ago quarter to $1.72 billion but missed the Zacks consensus estimate by 0.86%.

Meanwhile, advertisement revenues (19.8%) declined 1.5% year over year to $445 million. The figure beat the Zacks consensus estimate by 3.5%.

Equipment revenues (2.1% of total revenues) increased 4.4% year over year to $47 million and beat the Zacks consensus estimate by 2.9%.

Other revenues (1.5% of total revenues) decreased 10.5% from the year-ago quarter to $33 million and missed the Zacks consensus estimate by 6.06%.

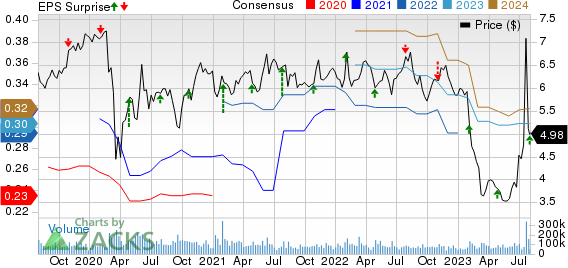

Sirius XM Holdings Inc. Price, Consensus and EPS Surprise

Sirius XM Holdings Inc. price-consensus-eps-surprise-chart | Sirius XM Holdings Inc. Quote

Sirius XM Standalone Details

Sirius XM segment revenues (76.5% of total revenues) were $1.72 billion, up 0.2% year over year. SIRI continued to expand its footprint in the electric vehicle (EV) market, with the service currently widely available in 49 different EV models sold in the U.S. market.

Total subscriber base remained flat year over year at 34.04 million, beating the Zacks consensus estimate by 0.19%.

Revenues witnessed growth due to a 0.3% improvement in average revenue per user, which amounted to $15.66. The figure missed the Zacks consensus estimate by 1.51%.

Subscriber revenues increased 0.6% year over year to $1.59 billion. Advertising revenues were $45 million, down 8.2% year over year. Equipment revenues gained 4.4% year over year to $47 million. Other revenues decreased 10.8% year over year to $33 million.

Self-pay subscribers increased 3% year over year to 31.9 million. Net subscriber additions decreased 70.1% year over year to 23K in the reported quarter. Sirius XM Canada subscribers grew by 54K year over year to 2.62 million.

Pandora & OFF Platform Details

Pandora and OFF platform’s revenues (23.5% of total revenues) declined 1.1% year over year to $528 million owing to a 0.7% decrease in advertising revenues that totaled $400 million and subscriber revenues that declined 2.3% year over year to $128 million.

Self-pay subscribers of the Pandora Plus and Pandora Premium services decreased modestly in the second quarter of 2023 to end the period at 6.2 million.

Total subscribers decreased by 1.4% year-over-year, ending the second quarter at 6.22 million compared to 6.31 million in the 2022 period. The figure beat the Zacks consensus estimate by 0.4%.

Total ad-supported listener hours were 2.73 billion in the second quarter, down 3.9% year over year. Advertising revenue per thousand listener hours were $97.13 in the second quarter, down 2.6% year over year.

Operating Details

In the second quarter, total operating expenses increased 0.8% year over year to $1.77 billion.

Adjusted EBITDA increased 3.4% year over year to $702 million.

Balance Sheet & Cash Flow

As of Jun 30, 2023, cash and cash equivalents were $51 million compared with $53 million as of Mar 31, 2023.

The long-term debt, as of Jun 30, 2023, was $8.9 billion compared with $9.39 billion as of Mar 31, 2023.

For the second quarter, cash flow from operations was $801 million compared with $888 million in the year-ago quarter.

Free cash flow was $323 million for the second quarter of 2023, down from $435 million in the prior-year period.

2023 Guidance

Revenues are expected to be $9 billion. Adjusted EBITDA is expected to be $2.75 billion. Free cash flow is expected to be $1.15 billion.

Zacks Rank & Other Stocks to Consider

Currently, Sirius XM carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the Consumer Discretionary sector are PlayAGS AGS, DraftKings DKNG and Hasbro HAS. AGS currently sports a Zacks Rank #1 (Strong Buy), while DKNG and HAS carry a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

PlayAGS, DraftKings and Hasbro are each scheduled to report the quarterly results on Aug 3.

The Zacks Consensus Estimate for AGS’ second-quarter 2023 loss per share is pegged at 1 cent, which has remained unchanged over the past 30 days.

The Zacks Consensus Estimate for DKNG’s second-quarter 2023 loss is pegged at 25 cents per share, up from a loss of 29 cents per share over the past 30 days.

The Zacks Consensus Estimate for HAS’ second-quarter 2023 earnings is pegged at 58 cents per share, which has increased by a cent over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Sirius XM Holdings Inc. (SIRI) : Free Stock Analysis Report

PlayAGS, Inc. (AGS) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report