Sirius XM (SIRI) Q3 Earnings Beat Estimates, Revenues Miss

Sirius XM Holdings SIRI reported third-quarter 2023 earnings of 9 cents per share, which beat the Zacks Consensus Estimate by 12.5% and increased 50% year over year.

Total revenues on a reported basis declined 0.4% year over year to $2.27 billion and missed the consensus mark by 0.71%.

Subscriber revenues (76.1% of total revenues) declined 0.3% from the year-ago quarter to $1.72 billion. The figure missed the Zacks Consensus Estimate by 0.71%.

Meanwhile, advertisement revenues (20.3%) gained 0.7% year over year to $460 million. The figure beat the Zacks Consensus Estimate by 2.21%.

Equipment revenues (2.2% of total revenues) decreased 2% year over year to $49 million. The figure beat the Zacks Consensus Estimate by 3.12%.

Other revenues (1.5% of total revenues) decreased 15.4% from the year-ago quarter to $33 million and missed the Zacks Consensus Estimate by 15.28%.

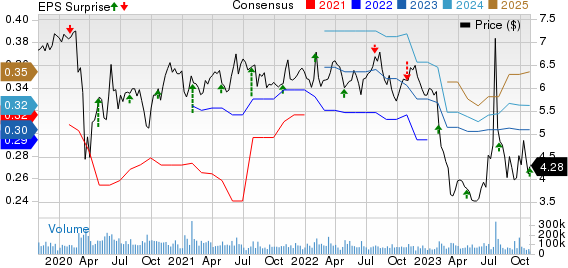

Sirius XM Holdings Inc. Price, Consensus and EPS Surprise

Sirius XM Holdings Inc. price-consensus-eps-surprise-chart | Sirius XM Holdings Inc. Quote

Sirius XM Standalone Details

Sirius XM segment revenues (75.8% of total revenues) were $1.72 billion, down 1.2% year over year.

Total subscriber base declined 0.6% year over year to 33.96 million, missing the Zacks Consensus Estimate by 0.09%.

Revenues witnessed a decline due to a 0.2% drop in average revenue per user, which amounted to $15.69. The figure missed the Zacks Consensus Estimate by 1.73%.

Subscriber revenues decreased 0.4% year over year to $1.59 billion. Advertising revenues were $42 million, down 16% year over year. Equipment revenues declined 2% year over year to $49 million. Other revenues decreased 15.4% year over year to $33 million.

Self-pay subscribers increased 3% year over year to 31.81 million. Net subscriber loss in the reported quarter was 94K compared with net additions of 138K in the year-ago period.

Pandora & OFF Platform Details

Pandora and OFF platform’s revenues (24.2% of total revenues) gained 2.2% year over year to $550 million, owing to a 2.7% increase in advertising revenues that totaled $418 million and subscriber revenues that improved 0.8% year over year to $132 million.

Self-pay subscribers of the Pandora Plus and Pandora Premium services decreased modestly in the third quarter of 2023 to end the period at 6.1 million.

Total subscribers decreased by 2.4% year over year, ending the third quarter at 6.11 million. The figure missed the Zacks Consensus Estimate by 1.45%.

Total ad-supported listener hours were 2.64 billion in the third quarter, down 4% year over year. Advertising revenue per thousand listener hours were $104.33, up 1% year over year.

Operating Details

In the third quarter, total operating expenses decreased 5.8% year over year to $1.7 billion.

Adjusted EBITDA increased 3.8% year over year to $747 million.

Balance Sheet & Cash Flow

As of Sep 30, 2023, cash and cash equivalents were $53 million compared with $51 million as of Jun 30, 2023.

The long-term debt, as of Sep 30, 2023, was $8.82 billion compared with $8.9 billion as of Jun 30, 2023.

For the third quarter, cash flow from operations was $478 million compared with $412 million in the year-ago quarter.

Free cash flow was $291 million for the third quarter of 2023, down from $329 million in the prior-year period.

2023 Guidance

Revenues are expected to be $9 billion. Adjusted EBITDA is expected to be $2.75 billion. Free cash flow is expected to be $1.15 billion.

Zacks Rank & Stocks to Consider

Currently, Sirius XM carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Consumer Discretionary sector are PlayAGS AGS, AMark Precious Metals AMRK and American Public Education APEI. American Public Education sports a Zacks Rank #1 (Strong Buy), while PlayAGS and AMark Precious Metals carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

PlayAGS, AMark Precious Metals and American Public Education are each scheduled to report the quarterly results on Nov 7.

The Zacks Consensus Estimate for AGS’ third-quarter 2023 earnings per share is pegged at 1 cent, up from a loss of 1 cent over the past 30 days.

The Zacks Consensus Estimate for AMRK’s third-quarter 2023 earnings is pegged at $1.88 per share, up 1.1% over the past 30 days.

The Zacks Consensus Estimate for APEI’ third-quarter 2023 loss is pegged at 25 cents per share, which has remained unchanged over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

Sirius XM Holdings Inc. (SIRI) : Free Stock Analysis Report

A-Mark Precious Metals, Inc. (AMRK) : Free Stock Analysis Report

PlayAGS, Inc. (AGS) : Free Stock Analysis Report