SIT Investment Associates Inc Acquires New Stake in Neuberger Berman High Yield Strategies Fund

On November 15, 2023, SIT Investment Associates Inc made a significant addition to its investment portfolio by purchasing 1,145,417 shares of Neuberger Berman High Yield Strategies Fund (NHS). This transaction marked a new holding for the firm, with a trade impact of 0.23% on the portfolio. The shares were acquired at a price of $7.45 each, making the total holding in NHS account for 4.42% of the traded stock's outstanding shares.

Background of SIT Investment Associates Inc

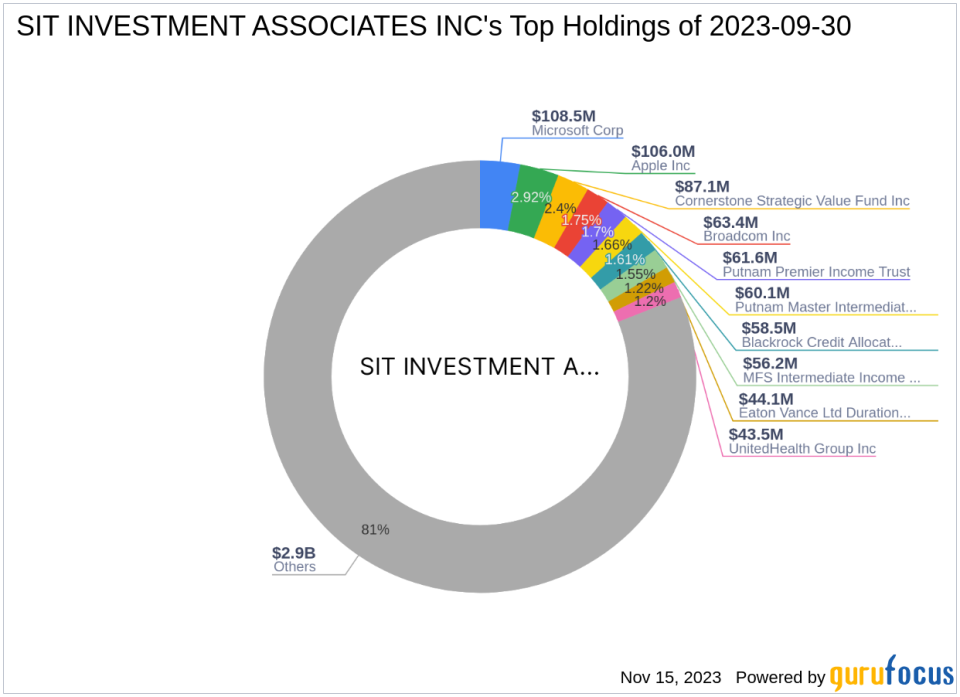

SIT Investment Associates Inc, a prominent investment management firm established in 1981, has a rich history of growth and diversification. With a team of 36 investment professionals, the firm manages over $6.6 billion in assets, focusing on a variety of sectors with a strong emphasis on financial services and technology. The firm's investment approach combines quantitative and fundamental analysis, catering to a diverse clientele that includes high net worth individuals and various institutional investors. SIT Investment Associates Inc's top holdings include notable names such as Cornerstone Strategic Value Fund Inc (CLM) and tech giants like Apple Inc (NASDAQ:AAPL) and Microsoft Corp (NASDAQ:MSFT).

Neuberger Berman High Yield Strategies Fund at a Glance

Neuberger Berman High Yield Strategies Fund operates as a closed-end management investment company, focusing on equity, fixed income, and alternative investment strategies. With a market capitalization of $193.17 million, NHS has been serving investors since its IPO on July 29, 2003. Despite its current status as significantly overvalued according to GuruFocus metrics, the fund remains an active player in the asset management industry.

Impact of the Transaction on SIT Investment Associates Inc's Portfolio

The acquisition of NHS shares by SIT Investment Associates Inc represents a strategic move, as the firm diversifies its portfolio with a new asset class. The trade price of $7.45 aligns with the current stock price, indicating a potentially calculated entry point for the investment firm. With a trade impact of 0.23%, this new holding could signal confidence in the high yield strategies that NHS offers, despite the fund's current financial metrics.

Financial Metrics and Performance Indicators of NHS

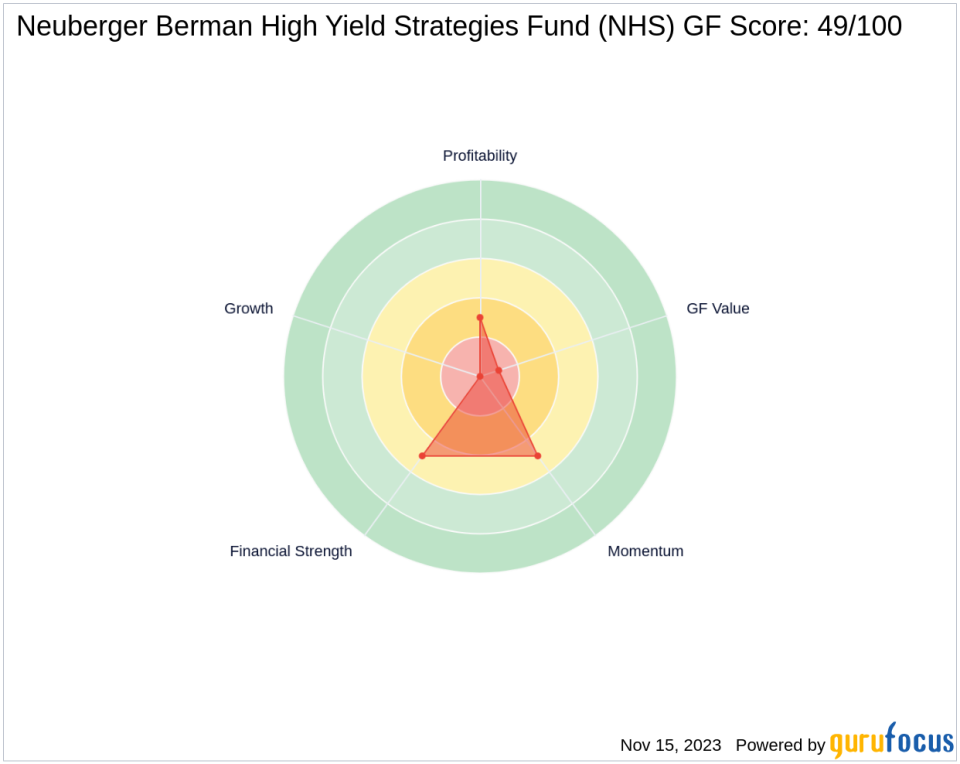

NHS's financial health presents a mixed picture. With a market capitalization of $193.17 million and a PE percentage of 0.00, indicating no earnings, the fund is currently deemed significantly overvalued with a GF Value of $2.20. The stock's performance indicators, such as a GF Score of 49/100, a Financial Strength rank of 5/10, and a Profitability Rank of 3/10, suggest cautious potential for future performance. Additionally, the lack of growth, as indicated by a Growth Rank of 0/10, and a low GF Value Rank of 1/10, further underscore the challenges NHS faces.

Market Performance and Valuation of NHS

The market performance of NHS has seen a year-to-date decline of 12.66%, with a significant drop of 50.33% since its IPO. The valuation metrics provided by GuruFocus highlight the stock's current overvaluation, with a price to GF Value ratio of 3.39. Despite these figures, SIT Investment Associates Inc's recent purchase could be based on a long-term strategy or an assessment of underlying value not reflected in the current metrics.

Strategic Positioning of SIT Investment Associates Inc

SIT Investment Associates Inc's portfolio is well-diversified, with top holdings in both the financial services and technology sectors. The addition of NHS to its portfolio may represent a strategic move to capitalize on high yield opportunities within the asset management industry. This new holding could play a significant role in the firm's overall market positioning, depending on the future performance of the fund.

Conclusion

The recent acquisition of Neuberger Berman High Yield Strategies Fund shares by SIT Investment Associates Inc is a noteworthy development for value investors. While the financial health and market performance of NHS present certain risks, the firm's decision to invest may be driven by a broader investment strategy that sees potential in the high yield segment. As the market continues to evolve, the implications of this trade will become clearer, potentially offering insights into the firm's investment acumen and the future trajectory of NHS.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.