SIT Investment Associates Inc Bolsters Portfolio with DWS Strategic Municipal Income Trust Shares

Introduction to the Transaction

SIT Investment Associates Inc, a seasoned investment firm, has recently expanded its investment portfolio by adding shares of DWS Strategic Municipal Income Trust (NYSE:KSM). On November 15, 2023, the firm acquired 231,795 shares of KSM at a trade price of $8.02 per share, marking a significant addition to its holdings. This transaction has a modest impact of 0.05% on the firm's portfolio, bringing the total number of shares held in KSM to 565,322. This represents a 0.12% position in the firm's portfolio and a 5.12% ownership stake in KSM.

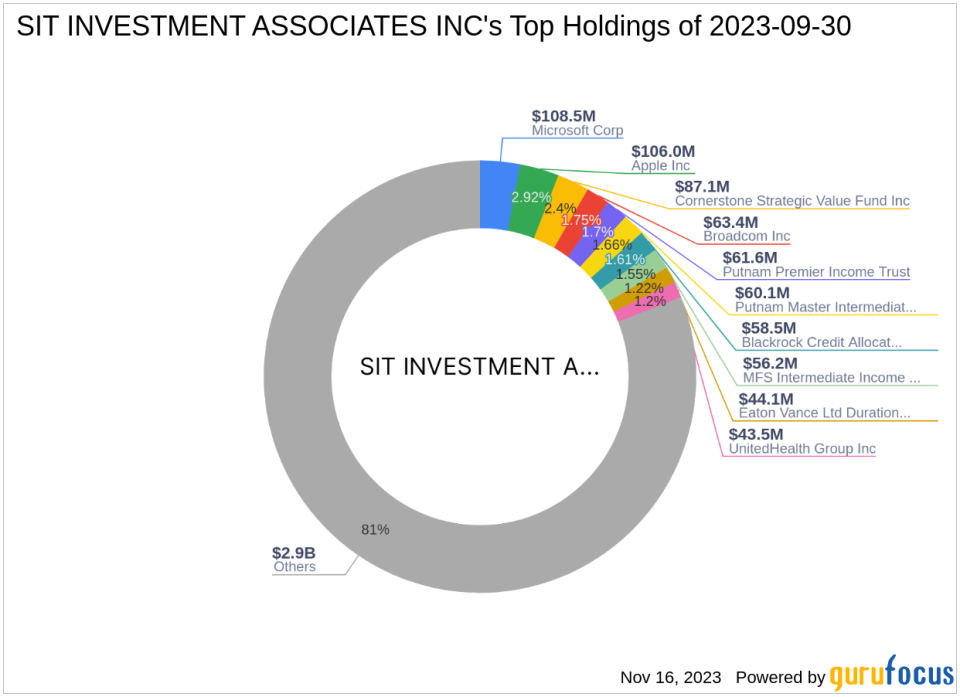

Profile of SIT Investment Associates Inc

Founded in 1981 by Eugene C. Sit, SIT Investment Associates Inc has grown from a small team with $1 million in capital to a prominent investment management company with over $6.6 billion in assets under management. The firm, primarily owned by the Sit family and key executives, employs a combination of quantitative and fundamental methodologies to invest across global fixed income and public equity markets. With a diverse client base, SIT Investment Associates Inc focuses heavily on the financial services sector, followed by technology, healthcare, and other sectors. The firm's top holdings include Cornerstone Strategic Value Fund Inc (CLM), Apple Inc (NASDAQ:AAPL), and Broadcom Inc (NASDAQ:AVGO).

Analysis of DWS Strategic Municipal Income Trust (NYSE:KSM)

DWS Strategic Municipal Income Trust is a closed-end investment company that aims to provide high levels of tax-exempt current income. With a focus on tax-exempt municipal securities, KSM operates within the asset management industry and offers a range of financial products including ETFs, mutual funds, and money market funds. The company's stock, traded under the symbol KSM in the USA, has a market capitalization of approximately $89.689 million.

Financials and Market Performance of KSM

As of the latest data, KSM's stock price stands at $8.09, reflecting a slight gain of 0.87% since the transaction date. However, the stock has experienced a year-to-date decline of 0.98%. KSM's financial metrics present a mixed picture, with a GF Score of 40/100, indicating potential challenges ahead. The company's financial strength and profitability ranks are 5/10 and 2/10, respectively, while growth rank is not applicable. KSM's momentum rank is relatively strong at 7/10, but the lack of GF Value data means that the stock's valuation cannot be evaluated against GuruFocus' intrinsic value estimates.

SIT Investment Associates Inc's Position in KSM

Following the recent transaction, SIT Investment Associates Inc's total holdings in KSM amount to 565,322 shares. This addition has increased the firm's exposure to the asset management sector, with KSM now accounting for 0.12% of its portfolio and the firm holding a 5.12% ownership in KSM.

Sector and Top Holdings of SIT Investment Associates Inc

SIT Investment Associates Inc's portfolio is strategically allocated with a strong emphasis on financial services and technology sectors. The firm's top holdings, which provide context for the recent addition of KSM shares, include prominent companies such as Cornerstone Strategic Value Fund Inc, Apple Inc, and Broadcom Inc.

Market Context and Performance Indicators

KSM's stock has faced a slight downtrend year-to-date, with a decrease of 0.98%. Performance indicators such as the Relative Strength Index (RSI) and Momentum Index rankings provide additional insights into the stock's recent behavior. KSM's RSI over 14 days stands at 73.56, indicating that the stock may be approaching overbought territory. The Momentum Index rankings over the past month show a negative trend, with a 6-month index of -8.25 and a 12-month index of -1.92.

Conclusion

The acquisition of additional shares in DWS Strategic Municipal Income Trust by SIT Investment Associates Inc is a strategic move that aligns with the firm's investment philosophy and sector focus. While the trade has a relatively small impact on the firm's overall portfolio, it reinforces SIT Investment Associates Inc's position in the financial services sector. The potential influence of this transaction on the firm's portfolio will be closely monitored by investors and market analysts alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.