SIT Investment Associates Inc Reduces Stake in First Trust Dynamic Europe Equity Income Fund

On August 9, 2023, SIT Investment Associates Inc, a Minneapolis-based investment management firm, reduced its stake in First Trust Dynamic Europe Equity Income Fund (NYSE:FDEU). This article will provide an in-depth analysis of the transaction, the profiles of the guru and the traded company, and the potential implications for value investors.

Details of the Transaction

The transaction saw SIT Investment Associates Inc reduce its holdings in FDEU by 686,964 shares, a change of -44.73%. The shares were traded at a price of $13.13 each. Following the transaction, the firm holds a total of 848,884 shares in FDEU, representing 0.31% of its portfolio and 4.93% of FDEU's total shares. The transaction had a -0.25% impact on the guru's portfolio.

Profile of the Guru: SIT Investment Associates Inc

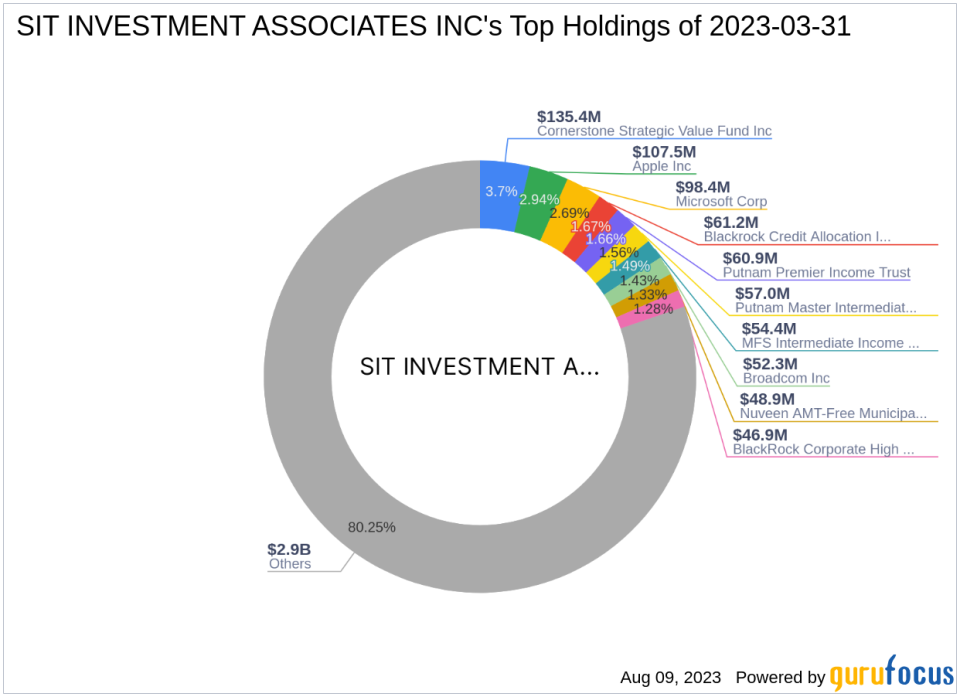

SIT Investment Associates Inc was established in 1981 by Eugene C. Sit with $1 million in capital and 8 people. The firm has since grown to 73 employees, including 36 investment professionals, and is headed by CEO and CIO Roger J. Sit. The firm utilizes quantitative and fundamental methodologies to make its investment decisions, allocating its assets in fixed income and public equity markets on a global scale. As of the date of the transaction, the firm holds over $6.6 billion in total assets under management spread across 67 accounts. Its top holdings include Cornerstone Strategic Value Fund Inc (CLM), Apple Inc (NASDAQ:AAPL), Microsoft Corp (NASDAQ:MSFT), Putnam Premier Income Trust (NYSE:PPT), and Blackrock Credit Allocation Income Trust (NYSE:BTZ). The firm invests most heavily in the financial services and technology sectors.

Overview of the Traded Company: First Trust Dynamic Europe Equity Income Fund

First Trust Dynamic Europe Equity Income Fund is a non-diversified, closed-end management investment company based in the USA. The fund's investment objective is to provide a high level of current income with a secondary focus on capital appreciation. It pursues this objective by investing a majority of its managed assets in a portfolio of equity securities of European companies of any market capitalization. As of the transaction date, the fund has a market capitalization of $226.677 million and a stock price of $13.1545. The fund operates in a single segment, asset management.

Analysis of the Traded Stock

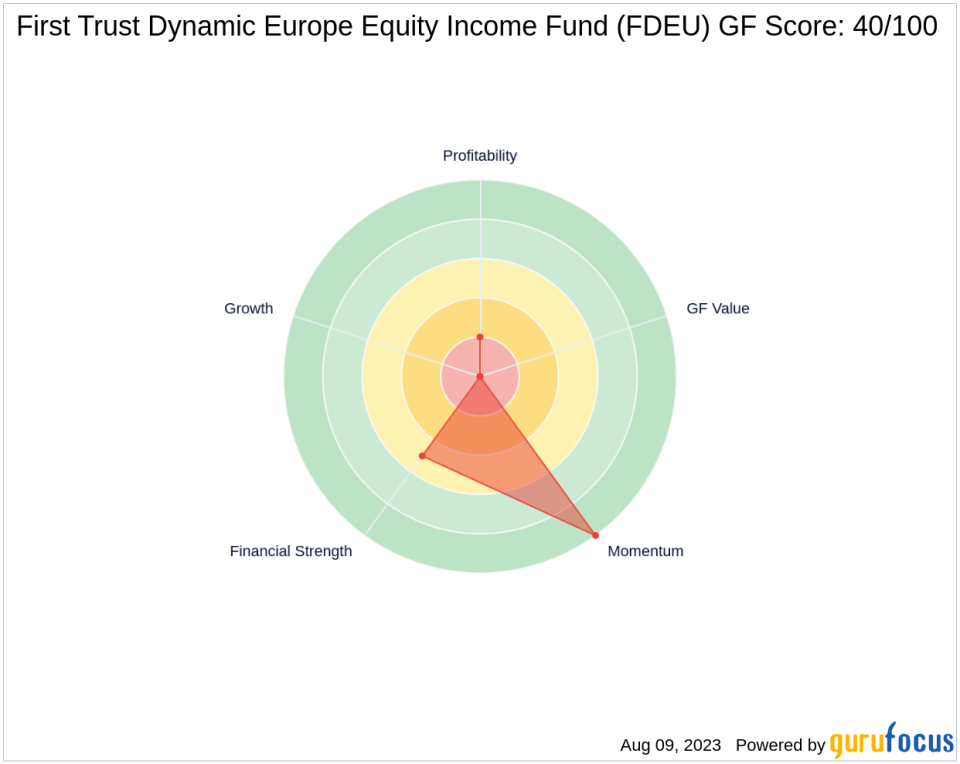

The stock's GF Score is 40/100, indicating poor future performance potential. Its Financial Strength is ranked 5/10, while its Profitability Rank is 2/10. The stock's Growth Rank and GF Value Rank are not available due to lack of data. However, the stock's Momentum Rank is 10/10, indicating strong momentum.

Financial Health of the Traded Company

The company's cash to debt ratio is 0.04, ranking 1338th in the industry. Its return on equity (ROE) is -11.41, ranking 1244th, and its return on assets (ROA) is -8.59, ranking 1257th. The company's interest coverage and Altman Z score are not available due to not enough data to evaluate its financial distress level.

Stock's Performance Indicators

The stock's RSI 5 Day is 32.20, RSI 9 Day is 38.71, and RSI 14 Day is 44.44, ranking 607th. The stock's Momentum Index 6 - 1 Month is 3.35, ranking 313th, and its Momentum Index 12 - 1 Month is 10.57.

Conclusion

In conclusion, SIT Investment Associates Inc's decision to reduce its stake in First Trust Dynamic Europe Equity Income Fund may have been influenced by the stock's poor GF Score and low profitability rank. However, the stock's strong momentum rank suggests potential for future growth. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.