SiteOne Landscape Supply Inc (SITE) Reports Mixed Fiscal 2023 Results Amid Market Challenges

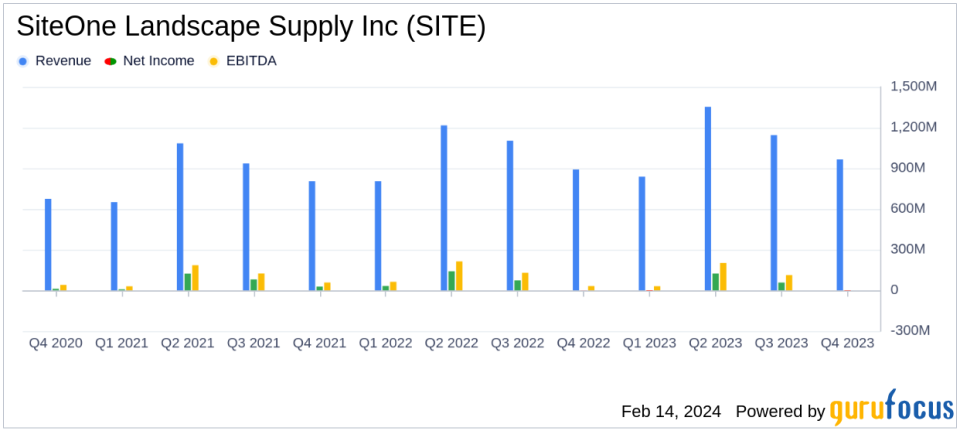

Net Sales: Increased by 7% to $4.30 billion in Fiscal 2023.

Adjusted EBITDA: Decreased by 12% to $410.7 million in Fiscal 2023.

Net Income: Decreased by 29% to $173.4 million in Fiscal 2023.

Operating Cash Flow: Reached a record $297.5 million, up from $217.2 million in Fiscal 2022.

Gross Margin: Decreased by 70 basis points to 34.7% in Fiscal 2023.

SG&A Expenses: Increased to $1.26 billion, or 29.2% of Net sales.

Outlook: Adjusted EBITDA for 2024 projected to be between $420 million and $455 million.

On February 14, 2024, SiteOne Landscape Supply Inc (NYSE:SITE) released its 8-K filing, disclosing its financial results for the fourth quarter and full year of 2023. As the largest wholesale distributor of landscape supplies in the United States and Canada, SiteOne serves a diverse customer base with products ranging from irrigation supplies to outdoor lighting and turf care equipment.

Despite facing a challenging year with softer markets, operating cost inflation, and commodity price deflation, SiteOne reported a 7% increase in Net sales for Fiscal 2023, reaching $4.30 billion. However, the company's Net income saw a significant decline of 29% to $173.4 million compared to the previous fiscal year. Adjusted EBITDA also decreased by 12% to $410.7 million, with a margin decrease of 210 basis points to 9.5%.

Financial Performance Analysis

SiteOne's financial achievements in Fiscal 2023 reflect a resilient business model capable of generating growth in Net sales and operating cash flow despite market headwinds. The company's ability to achieve a record operating cash flow of $297.5 million, up from $217.2 million in Fiscal 2022, underscores effective working capital management.

However, the company's challenges are evident in the decrease in Net income and Adjusted EBITDA. The decline in gross margin by 70 basis points to 34.7% and the increase in SG&A expenses to $1.26 billion, or 29.2% of Net sales, highlight the impact of commodity price deflation and higher operating costs on profitability.

SiteOne's balance sheet as of December 31, 2023, shows a net debt of $382.0 million, with a leverage ratio of 0.9 times Adjusted EBITDA. The company's liquidity remains strong, with $82.5 million in cash and cash equivalents and $578.2 million available under the ABL Facility.

"Overall, 2023 was a tough year where we faced many challenges... Despite these challenges, our teams continued to drive our initiatives and gain market share to deliver mid-single digit growth in Net sales, Adjusted EBITDA that was just above the top end of our guidance range, and record operating cash flow," said Doug Black, SiteOnes Chairman and CEO.

Looking ahead to 2024, SiteOne anticipates commodity price deflation to moderate, with expectations of low single-digit Organic Daily Sales growth for the full year. The company projects Adjusted EBITDA to be in the range of $420 million to $455 million, not accounting for contributions from unannounced acquisitions.

Value investors may find SiteOne's continued market share gains and strategic acquisitions, which represented a record $320 million in trailing twelve-month sales, to be compelling reasons to consider the company's stock. With a focus on operational initiatives and SG&A management, SiteOne is positioning itself for improved performance and growth in the coming years.

For more detailed information on SiteOne Landscape Supply Inc's financial results and management commentary, interested parties can access the full earnings call transcript and slide presentation on the Investor Relations section of the company's website.

Explore the complete 8-K earnings release (here) from SiteOne Landscape Supply Inc for further details.

This article first appeared on GuruFocus.