SiteOne (SITE) Stock Up 34% YTD: More Room for Growth?

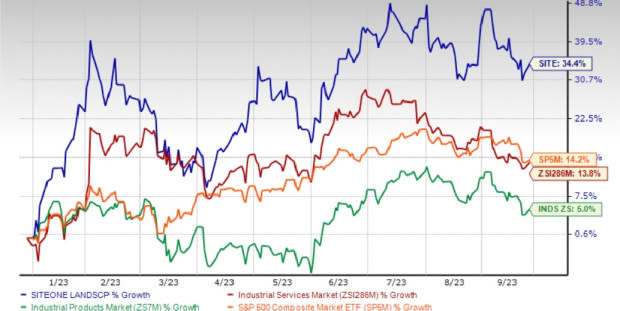

Shares of SiteOne Landscape Supply SITE have gained 34.3% in this year so far, faring better than the industry, which witnessed 13.7% growth. The Industrial Products sector and the S&P 500 composite have gained 5% and 14.2%, respectively, in the same time frame.

SITE has a market capitalization of $7 billion. The average volume of shares traded in the last three months was 223.85K.

SiteOne Landscape currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

SiteOne Landscape’s shares have gained since it reported upbeat second-quarter 2023 results on Aug 2, 2023. Sales improved 11% year over year to $1.35 billion. Organic daily sales increased 4% as aided by volume growth, reflecting solid end-market demand. Acquisitions contributed 7% to net sales growth in the quarter.

The company however saw a 170-basis point contraction in the gross margin to 36.2% in the quarter. This was mainly due to the absence of the large price realization benefit in the prior-year period, partially offset by lower freight costs and the positive impact of acquisitions. Adjusted earnings per share declined 12% year over year to $2.71 in the second quarter as higher net sales were more than offset by lower gross margin and increased SG&A expense (due to acquisitions). The company however beat the Zacks Consensus Estimate on both revenues and earnings.

Also, compared with a loss of 10 cents per share reported in the first quarter of 2023, the earnings of $2.71 per share in the second quarter marked a substantial improvement. Moderating cost inflation, demand in end markets as well as contribution from acquisitions are expected to boost earnings.

Following the second-quarter release, the company raised its adjusted EBITDA guidance to the range of $400 million to $425 million, up from the prior stated range of $395-$425 million.

SiteOne Landscape has been active on the acquisition front this year. It has invested in 10 acquisitions so far in 2023 as it continues to expand its lines of business and presence in markets in which it offers the full range of landscape supplies and services to landscape professionals.

The recent trend of consumers spending more time at home and investing in their outdoor living spaces is expected to continue, which bodes well for SiteOne Landscape. Homeowners are now preferring to stay at homes and upgrade their properties due to the sharp increases in home values, lack of affordable new homes, as well as elevated mortgage interest rates.

The long-term outlook for the landscape supply industry remains strong driven by favorable population trends, housing demand, and the increased interest in outdoor living. SiteOne thus remains focused on driving growth organically and through acquisitions as well as margin expansion by leveraging scale, resources, and capabilities.

Favorable Estimate Revisions

The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. Over the past 60 days, the Zacks Consensus Estimate for SiteOne Landscape’s 2023 earnings has increased 9%. The estimate for 2024 has been revised upward by 8%.

Key Picks

Some better-ranked stocks from the Industrial Products sector are Caterpillar Inc. CAT, Astec Industries, Inc. ASTE and Eaton Corporation plc. ETN. CAT and ASTE sport a Zacks Rank #1 (Strong Buy), and ETN has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has an average trailing four-quarter earnings surprise of 18.5%. The Zacks Consensus Estimate for CAT’s 2023 earnings is pegged at $19.81 per share. The consensus estimate for 2023 earnings has moved 11.4% north in the past 60 days. Its shares have gained 14.5% so far this year.

Astec has an average trailing four-quarter earnings surprise of 20%. The Zacks Consensus Estimate for ASTE’s 2023 earnings is pegged at $2.81 per share. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. ASTE’s shares have gained 16% year to date.

The Zacks Consensus Estimate for Eaton’s 2023 earnings per share is pegged at $8.80. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. It has a trailing four-quarter average earnings surprise of 3%. Shares of ETN have rallied 38% in the current year so far.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

SiteOne Landscape Supply, Inc. (SITE) : Free Stock Analysis Report